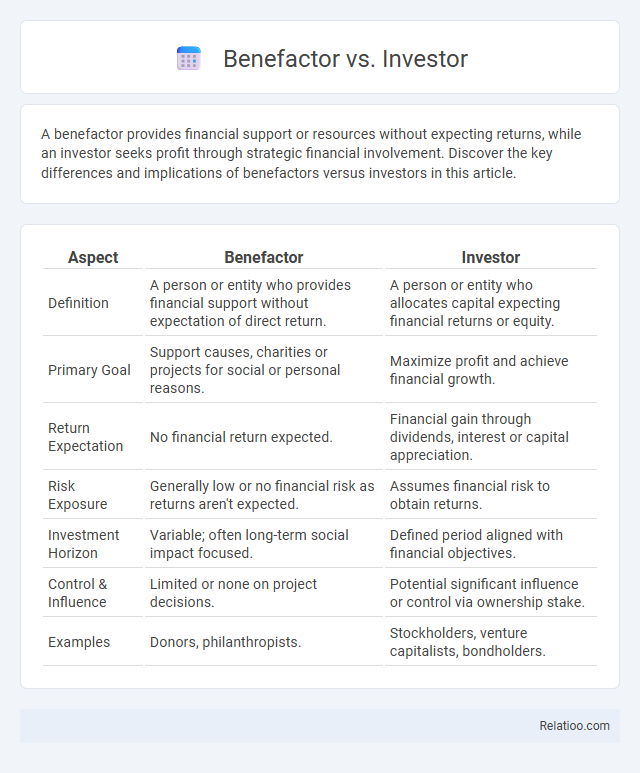

A benefactor provides financial support or resources without expecting returns, while an investor seeks profit through strategic financial involvement. Discover the key differences and implications of benefactors versus investors in this article.

Table of Comparison

| Aspect | Benefactor | Investor |

|---|---|---|

| Definition | A person or entity who provides financial support without expectation of direct return. | A person or entity who allocates capital expecting financial returns or equity. |

| Primary Goal | Support causes, charities or projects for social or personal reasons. | Maximize profit and achieve financial growth. |

| Return Expectation | No financial return expected. | Financial gain through dividends, interest or capital appreciation. |

| Risk Exposure | Generally low or no financial risk as returns aren't expected. | Assumes financial risk to obtain returns. |

| Investment Horizon | Variable; often long-term social impact focused. | Defined period aligned with financial objectives. |

| Control & Influence | Limited or none on project decisions. | Potential significant influence or control via ownership stake. |

| Examples | Donors, philanthropists. | Stockholders, venture capitalists, bondholders. |

Understanding the Roles: Benefactor vs Investor

A benefactor provides financial support or gifts without expecting direct financial returns, often driven by philanthropy or personal motives. An investor commits capital to a business or project with the expectation of earning profits or equity over time. Understanding these roles highlights the key difference: benefactors aim to support and enable causes, while investors seek financial growth and return on investment.

Defining a Benefactor: Key Characteristics

A benefactor is an individual or entity who provides financial support, donations, or gifts without expecting a financial return, typically aiming to support charitable causes or personal beneficiaries. Unlike investors, benefactors prioritize altruism and philanthropy over profit, often contributing to nonprofits, educational institutions, or community projects. Key characteristics of a benefactor include generosity, a focus on impact rather than financial gain, and a commitment to advancing social, cultural, or personal causes.

What Makes an Investor? Core Attributes

An investor is defined by key attributes such as risk tolerance, a comprehensive understanding of market dynamics, and a strategic approach to capital allocation aimed at generating financial returns. Unlike a benefactor who donates without a direct expectation of profit, your role as an investor requires a disciplined analysis of potential growth opportunities and a commitment to monitoring asset performance over time. Core investor qualities also include patience, adaptability to market changes, and a focus on maximizing value through informed decision-making.

Motivations Behind Giving: Altruism vs Profit

Benefactors give primarily out of altruism, motivated by a desire to support causes or individuals without expecting financial returns, focusing on social impact and community benefit. Investors seek profit by allocating capital to ventures or assets with the expectation of financial gain and growth, prioritizing return on investment and market performance. Benefactors differ from investors fundamentally in their motivation, emphasizing philanthropy and charitable giving rather than monetary rewards.

Funding Approaches: Donations vs Investments

Benefactors provide funding primarily through donations, offering financial support without expecting financial returns, thus focusing on philanthropy and social impact. Investors supply capital with the expectation of financial gains, using investments that are strategically aimed at business growth and profitability. Your choice between benefactor and investor funding depends on whether you prioritize altruistic contributions or financial returns in your funding approach.

Impact Expectations: Social Good vs ROI

Investors prioritize financial returns, expecting measurable ROI from their capital while balancing acceptable risk levels. Benefactors focus on social good, providing funds or resources without expecting financial gain, aiming to create a positive impact on communities or causes. Your choice between these roles shapes the impact expectations, whether seeking profit-driven outcomes or prioritizing philanthropic contributions for societal benefit.

Types of Relationships: Personal vs Professional

A benefactor typically forms a personal relationship by providing support, often financial, out of goodwill without expecting returns, whereas an investor enters a professional relationship aiming for financial gain and measurable outcomes. Your involvement with a benefactor emphasizes trust and gratitude, contrasting with the transactional nature of investor relationships focused on profitability and contracts. Understanding these dynamics helps tailor interactions and expectations based on whether the connection is personal or professional.

Risk Tolerance: Philanthropy vs Financial Return

Benefactors prioritize philanthropy, focusing on supporting causes aligned with their values and exhibiting low risk tolerance since their returns are primarily social or emotional rather than financial. Investors seek financial return, typically accepting higher risk tolerance to maximize profits and growth potential. Your choice between benefactor and investor depends on whether your goal is impact-driven giving or wealth accumulation through strategic risk management.

Long-Term Involvement and Support

A benefactor provides ongoing financial or moral support without expecting returns, emphasizing a long-term commitment to your cause or project. An investor, however, seeks financial gain and typically assesses involvement based on profitability and time-bound objectives. Understanding these distinctions helps you align your partnership goals with the appropriate type of support for sustained growth and success.

Choosing Between Benefactor and Investor: Which Is Right for You?

Choosing between a benefactor and an investor depends on your financial goals and desired level of involvement; benefactors typically provide funds without expecting repayment or control, while investors seek returns and often want influence in decision-making. Benefactors are ideal for projects needing support without profit pressure, whereas investors suit ventures aiming for growth and profitability. Understanding these distinctions helps align funding sources with your business objectives and risk tolerance.

Infographic: Benefactor vs Investor

relatioo.com

relatioo.com