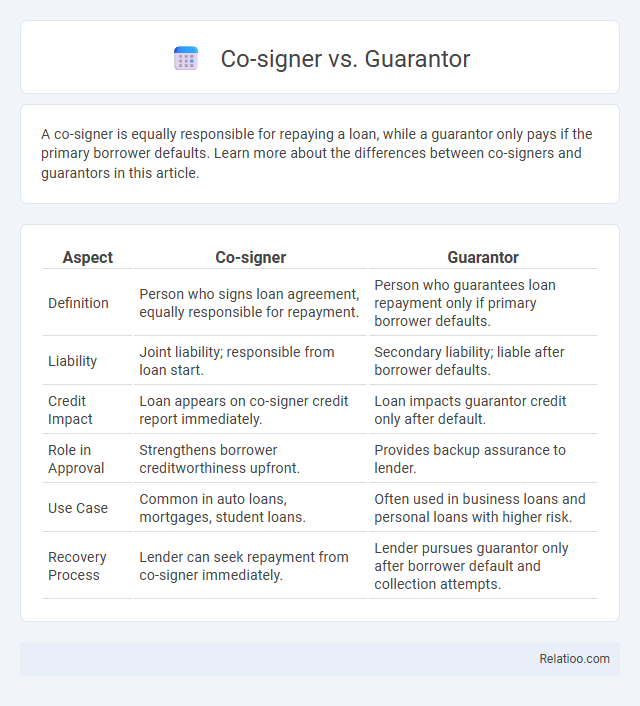

A co-signer is equally responsible for repaying a loan, while a guarantor only pays if the primary borrower defaults. Learn more about the differences between co-signers and guarantors in this article.

Table of Comparison

| Aspect | Co-signer | Guarantor |

|---|---|---|

| Definition | Person who signs loan agreement, equally responsible for repayment. | Person who guarantees loan repayment only if primary borrower defaults. |

| Liability | Joint liability; responsible from loan start. | Secondary liability; liable after borrower defaults. |

| Credit Impact | Loan appears on co-signer credit report immediately. | Loan impacts guarantor credit only after default. |

| Role in Approval | Strengthens borrower creditworthiness upfront. | Provides backup assurance to lender. |

| Use Case | Common in auto loans, mortgages, student loans. | Often used in business loans and personal loans with higher risk. |

| Recovery Process | Lender can seek repayment from co-signer immediately. | Lender pursues guarantor only after borrower default and collection attempts. |

Introduction to Co-Signer vs Guarantor

A co-signer is an individual who signs a loan alongside the primary borrower, sharing equal responsibility for repayment and ensuring the lender has a backup source of payment. A guarantor only promises to pay the loan if the borrower defaults, making their obligation conditional rather than joint. Understanding the difference between co-signer and guarantor helps you determine the level of risk and commitment involved in your financial agreements.

Definition of a Co-Signer

A co-signer is an individual who signs a loan agreement alongside the primary borrower, sharing equal responsibility for repayment in the lender's eyes. Unlike a guarantor, who only pays if the borrower defaults, the co-signer is immediately liable from the loan inception. This role is crucial in securing loans for borrowers with insufficient credit history or income, as the co-signer's creditworthiness supports the loan approval process.

Definition of a Guarantor

A guarantor is a third party who agrees to fulfill a borrower's debt obligation if the borrower defaults, providing lenders with additional security for loan approval. Unlike a co-signer, who shares equal responsibility from the outset, the guarantor is only liable after the primary borrower fails to pay. This distinction highlights the guarantor's role as a backup financial safeguard in loan agreements.

Key Differences Between Co-Signer and Guarantor

A co-signer and a guarantor both provide financial assurance on a loan, but a co-signer shares equal responsibility for repayment and their credit is directly affected by the loan, whereas a guarantor only steps in if the primary borrower defaults. Co-signers typically have an immediate obligation to the lender, while guarantors hold a secondary, conditional liability. Understanding these distinctions is crucial for borrowers seeking credit and lenders mitigating risk.

Legal Obligations of Co-Signers

Co-signers hold joint legal responsibility for the loan repayment, making them equally liable alongside the primary borrower if payments are missed, unlike guarantors who only pay after the borrower defaults. The co-signer's obligation is immediate and unconditional, often reflected in the loan agreement signed prior to funding. Courts typically enforce these obligations strictly, requiring co-signers to fulfill debt payments without the need for lenders to pursue the borrower first.

Legal Responsibilities of Guarantors

Guarantors bear a distinct legal responsibility compared to co-signers, as they guarantee loan repayment only after the primary borrower defaults, whereas co-signers share equal liability from the loan's inception. The guarantor's obligation is secondary and contingent, often requiring a formal demand for payment before they are held accountable in court. Understanding these nuanced legal distinctions is crucial for parties considering guarantor roles in loan agreements to mitigate financial risks effectively.

Risks Involved for Co-Signers and Guarantors

Co-signers and guarantors face significant financial risks including full liability for loan repayment if the primary borrower defaults, which can severely impact their credit scores and financial stability. Unlike co-signers who share equal responsibility from the outset, guarantors typically assume responsibility only after the borrower fails to pay, but both may face legal actions and asset seizure. Understanding these risks is crucial to avoid unexpected financial burdens and long-term credit damage.

When to Choose a Co-Signer

A co-signer is typically required when your credit history or income is insufficient to qualify for a loan independently, providing the lender extra assurance of repayment. Choose a co-signer if you need to strengthen your loan application and improve approval chances, as they share equal responsibility for the debt alongside you. Unlike a guarantor who only pays if you default, a co-signer is immediately liable, making their creditworthiness crucial in your borrowing process.

When to Opt for a Guarantor

Opt for a guarantor when your credit history is limited or your income does not meet the lender's criteria, as guarantors provide a secondary promise to repay without immediate liability. Guarantors typically become responsible only after the primary borrower defaults, offering a safety net that protects both you and the lender. Choosing a guarantor can improve loan approval chances and secure better terms when a co-signer might be less suitable due to their direct obligation from the loan's outset.

Co-Signer vs Guarantor: Which is Right for You?

A co-signer takes equal responsibility for repaying a loan, directly impacting your credit and finances if you default, while a guarantor agrees to pay only if the primary borrower fails to do so, providing a secondary layer of security to the lender. Your choice between a co-signer and a guarantor depends on your creditworthiness and the level of risk you and the lender are willing to accept. Understanding these differences ensures you select the option that best supports your financial goals and borrowing capacity.

Infographic: Co-signer vs Guarantor

relatioo.com

relatioo.com