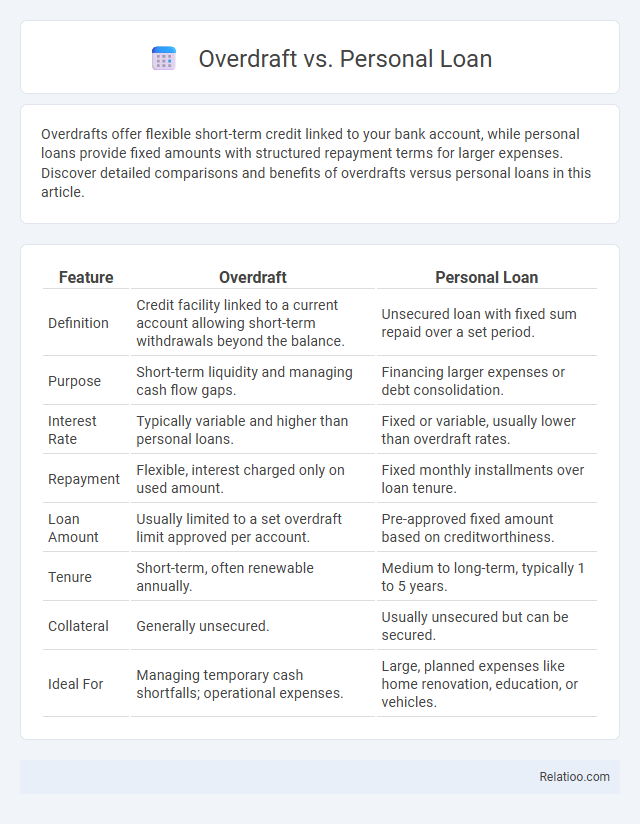

Overdrafts offer flexible short-term credit linked to your bank account, while personal loans provide fixed amounts with structured repayment terms for larger expenses. Discover detailed comparisons and benefits of overdrafts versus personal loans in this article.

Table of Comparison

| Feature | Overdraft | Personal Loan |

|---|---|---|

| Definition | Credit facility linked to a current account allowing short-term withdrawals beyond the balance. | Unsecured loan with fixed sum repaid over a set period. |

| Purpose | Short-term liquidity and managing cash flow gaps. | Financing larger expenses or debt consolidation. |

| Interest Rate | Typically variable and higher than personal loans. | Fixed or variable, usually lower than overdraft rates. |

| Repayment | Flexible, interest charged only on used amount. | Fixed monthly installments over loan tenure. |

| Loan Amount | Usually limited to a set overdraft limit approved per account. | Pre-approved fixed amount based on creditworthiness. |

| Tenure | Short-term, often renewable annually. | Medium to long-term, typically 1 to 5 years. |

| Collateral | Generally unsecured. | Usually unsecured but can be secured. |

| Ideal For | Managing temporary cash shortfalls; operational expenses. | Large, planned expenses like home renovation, education, or vehicles. |

Understanding Overdrafts and Personal Loans

Overdrafts provide short-term credit by allowing account holders to withdraw more than their current balance, typically with higher interest rates and immediate access to funds. Personal loans offer a fixed amount with a set repayment schedule and lower interest rates, ideal for planned expenses or debt consolidation. Understanding the differences in cost, flexibility, and repayment terms helps in choosing the most suitable credit option for financial needs.

Key Differences Between Overdraft and Personal Loan

An overdraft provides short-term credit linked to a current account, allowing withdrawals beyond the account balance up to an approved limit with interest charged only on the overdrawn amount. A personal loan offers a fixed sum with a set repayment schedule and interest, suitable for larger, planned expenses. Key differences include flexibility in repayment, interest calculation, and usage purpose, where overdrafts offer revolving credit with variable interest, while personal loans have fixed terms and amounts.

When to Choose an Overdraft Facility

Choose an overdraft facility when you need flexible short-term access to funds with the ability to withdraw more than your account balance up to a set limit. Overdrafts are ideal for managing occasional cash flow gaps or unexpected expenses without committing to a fixed repayment schedule. This option contrasts with personal loans, which are better suited for larger, planned expenses requiring structured, fixed repayments over time.

When a Personal Loan Makes Sense

A personal loan makes sense when you need a fixed amount of money for a specific purpose, such as debt consolidation, home improvement, or a major purchase, offering predictable monthly payments and a fixed interest rate. Unlike overdrafts, which provide flexible short-term credit with potentially higher interest rates, personal loans typically have lower rates and a clear repayment schedule that helps you manage your finances more effectively. You should consider a personal loan when your financial goal requires stability and a structured repayment plan rather than the variable costs and short-term relief that overdrafts provide.

Eligibility Criteria: Overdraft vs Personal Loan

Eligibility criteria for overdrafts typically require a valid current account with the bank and a steady income to ensure repayment ability, often with flexible credit limits based on account history. Personal loans usually demand a higher credit score, stable employment, proof of income, and sometimes collateral, reflecting their fixed terms and repayment schedules. While overdrafts offer quick credit access with minimal paperwork, personal loans require a thorough credit assessment and stricter eligibility conditions.

Interest Rates and Charges Comparison

Overdrafts typically have higher interest rates compared to personal loans, which often offer fixed, lower rates making them more cost-effective for larger or longer-term borrowing. Charges on overdrafts usually include daily interest on the outstanding amount and possible fees for exceeding limits, while personal loans may have upfront processing fees but predictable monthly repayments. Understanding your borrowing needs and comparing these costs helps you manage finances efficiently and avoid costly debt.

Repayment Flexibility and Terms

Overdrafts offer flexible repayment with no fixed schedule, allowing You to repay borrowed funds as your account is credited, but may carry higher interest rates on outstanding balances. Personal loans have structured repayment terms, typically fixed monthly payments over a set period, providing predictability but less flexibility. Comparing these options, overdrafts maximize short-term convenience, while personal loans suit longer-term borrowing with clearly defined repayment timelines.

How Overdraft and Personal Loan Impact Credit Score

Overdrafts typically have a minimal impact on credit scores unless they are frequently used or exceed the agreed limit, which can indicate financial stress to lenders. Personal loans, when managed responsibly with timely payments, generally improve credit scores by demonstrating the borrower's ability to handle installment debt. Both financial products influence credit utilization and payment history, key factors in credit scoring models like FICO and VantageScore.

Pros and Cons: Overdraft vs Personal Loan

Overdrafts offer flexible access to additional funds linked to your current account with interest charged only on the amount used, making them ideal for short-term cash flow needs but often come with higher interest rates compared to personal loans. Personal loans provide a fixed sum with set repayment schedules and typically lower interest rates, suitable for larger expenses or debt consolidation but can involve fees and less flexibility in borrowing beyond the approved limit. While overdrafts allow quick access without formal approval for each use, they can lead to higher costs if overused, whereas personal loans require application processes but offer predictable payments and potentially lower overall borrowing costs.

Choosing the Right Option for Your Financial Needs

Choosing the right financial option depends on your cash flow and repayment capacity; overdrafts offer flexible short-term access to funds with interest charged only on the amount used, ideal for managing temporary liquidity issues. Personal loans provide lump-sum amounts with fixed interest rates and repayment schedules, suitable for larger, planned expenses or debt consolidation. Understanding your financial situation and comparing interest rates, fees, and repayment terms ensures selecting the best option between overdraft and personal loan for your needs.

Infographic: Overdraft vs Personal Loan

relatioo.com

relatioo.com