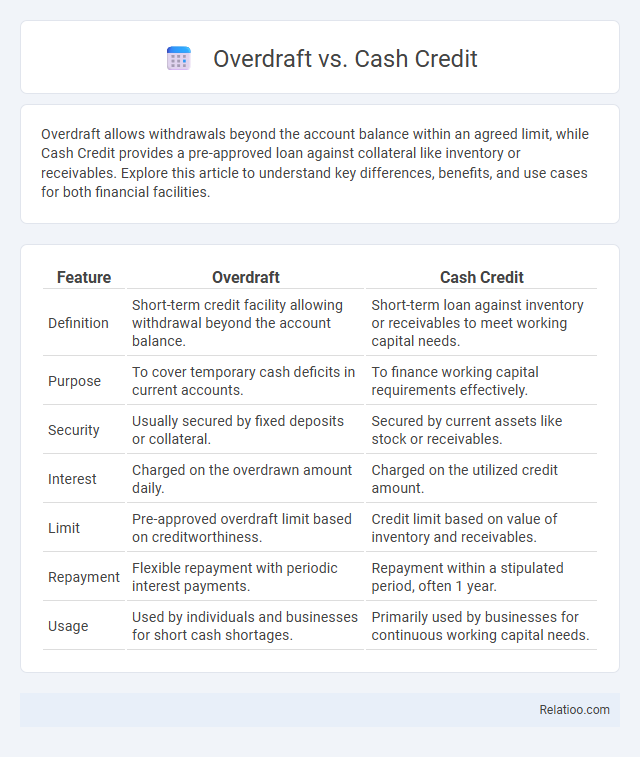

Overdraft allows withdrawals beyond the account balance within an agreed limit, while Cash Credit provides a pre-approved loan against collateral like inventory or receivables. Explore this article to understand key differences, benefits, and use cases for both financial facilities.

Table of Comparison

| Feature | Overdraft | Cash Credit |

|---|---|---|

| Definition | Short-term credit facility allowing withdrawal beyond the account balance. | Short-term loan against inventory or receivables to meet working capital needs. |

| Purpose | To cover temporary cash deficits in current accounts. | To finance working capital requirements effectively. |

| Security | Usually secured by fixed deposits or collateral. | Secured by current assets like stock or receivables. |

| Interest | Charged on the overdrawn amount daily. | Charged on the utilized credit amount. |

| Limit | Pre-approved overdraft limit based on creditworthiness. | Credit limit based on value of inventory and receivables. |

| Repayment | Flexible repayment with periodic interest payments. | Repayment within a stipulated period, often 1 year. |

| Usage | Used by individuals and businesses for short cash shortages. | Primarily used by businesses for continuous working capital needs. |

Introduction to Overdraft and Cash Credit

Overdraft and Cash Credit are financial facilities offered by banks to manage short-term working capital requirements. Overdraft allows account holders to withdraw funds beyond their available balance up to an approved limit, providing flexibility for temporary cash shortfalls. Cash Credit, on the other hand, is a revolving credit facility where businesses can draw funds against the security of goods or receivables, facilitating ongoing operational expenses.

Definition of Overdraft

An overdraft is a financial arrangement that allows an individual or business to withdraw more money than what is available in their current account, up to an approved limit, providing short-term liquidity. Cash credit is a short-term loan facility where the borrower can withdraw funds against inventory or receivables, generally used by businesses for working capital needs. The primary difference lies in overdraft being linked to a current account with flexible repayment, while cash credit is a formal loan backed by collateral.

Definition of Cash Credit

Cash Credit is a short-term financing facility provided by banks that allows businesses to withdraw funds beyond their account balance up to an agreed limit, secured against inventory or receivables. Overdraft is a facility where you can withdraw more than your bank balance in a current account, usually without specific collateral but within a pre-approved limit. Both Cash Credit and Overdraft help manage liquidity, but Cash Credit is typically used for business working capital needs, while Overdraft suits occasional shortfalls.

Key Differences Between Overdraft and Cash Credit

Overdraft allows a customer to withdraw money beyond their current account balance up to an approved limit, primarily for short-term liquidity needs, whereas Cash Credit provides working capital by enabling businesses to withdraw funds against inventory or receivables. Overdraft is usually linked to current accounts without fixed collateral, while Cash Credit often requires hypothecation of stock or debtors as security. Interest on overdraft is charged only on the utilized amount, whereas in Cash Credit, interest applies on the amount withdrawn within the sanctioned limit.

Eligibility Criteria for Overdraft and Cash Credit

Eligibility criteria for Overdraft typically require a good credit history, a stable income source, and an existing current or savings account with the bank. Cash Credit eligibility demands a secured asset or stock as collateral, a strong credit profile, and often a minimum business turnover threshold. Both facilities aim to provide short-term working capital but differ in collateral requirements and target users.

Documentation Required for Each Facility

Documentation required for overdraft facilities typically includes identity proof, address proof, income statements, and business financials to verify creditworthiness. Cash credit demands similar documents but also requires detailed business financial statements, stock and debtor analysis, and sometimes collateral documents to secure the credit limit. Your application for any of these facilities will be streamlined if you prepare accurate financial records and relevant identification papers as per the lender's criteria.

Interest Rates and Charges Comparison

Overdrafts typically have higher interest rates compared to cash credit, with interest charged only on the amount utilized rather than the entire sanctioned limit. Cash credit interest rates tend to be lower and involve additional charges such as processing fees and renewal fees, making it more cost-effective for longer-term working capital needs. Overdrafts often incur transaction charges and penal interest on exceeding limits, impacting the overall cost of borrowing.

Benefits of Overdraft

Overdraft provides flexible short-term financing by allowing you to withdraw funds beyond your account balance up to a pre-approved limit, helping manage cash flow gaps effectively. Unlike cash credit, which is typically linked to inventory or receivables and includes periodic interest charges, overdraft interest is charged only on the amount utilized, reducing overall borrowing costs. This financial tool offers immediate access to funds without the need for collateral, enhancing liquidity and operational efficiency for your business.

Advantages of Cash Credit

Cash Credit offers the advantage of flexible working capital financing, allowing your business to withdraw funds up to an approved limit whenever needed, which helps maintain smooth operations without frequent loan applications. It often comes with lower interest rates compared to overdraft facilities, as interest is charged only on the amount utilized rather than the entire credit limit. This cost-effective credit option enhances liquidity management and supports short-term financial stability for businesses.

Choosing the Right Facility for Your Business

Choosing between overdraft and cash credit depends on your business's cash flow needs and repayment capacity. Overdraft is ideal for short-term, flexible borrowing against a current account, suitable for managing temporary cash shortages, while cash credit provides a revolving credit line against inventory or receivables, better for ongoing working capital requirements. Evaluating interest rates, collateral requirements, and withdrawal limits helps determine the most cost-effective and convenient facility to support your business operations.

Infographic: Overdraft vs Cash Credit

relatioo.com

relatioo.com