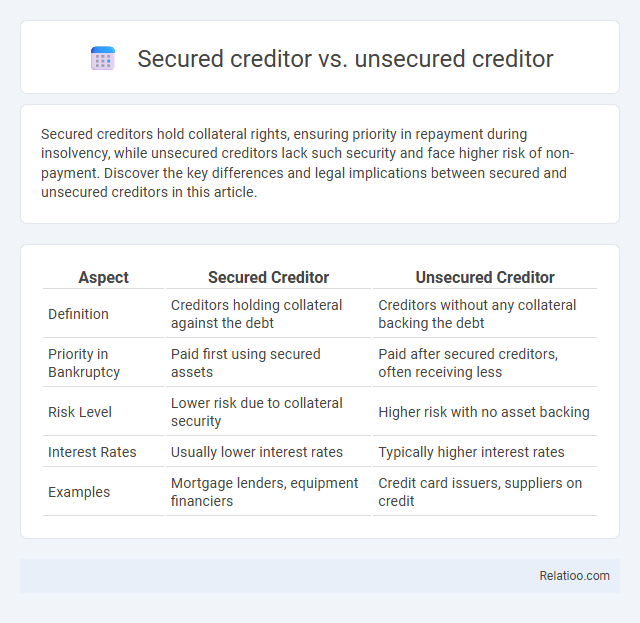

Secured creditors hold collateral rights, ensuring priority in repayment during insolvency, while unsecured creditors lack such security and face higher risk of non-payment. Discover the key differences and legal implications between secured and unsecured creditors in this article.

Table of Comparison

| Aspect | Secured Creditor | Unsecured Creditor |

|---|---|---|

| Definition | Creditors holding collateral against the debt | Creditors without any collateral backing the debt |

| Priority in Bankruptcy | Paid first using secured assets | Paid after secured creditors, often receiving less |

| Risk Level | Lower risk due to collateral security | Higher risk with no asset backing |

| Interest Rates | Usually lower interest rates | Typically higher interest rates |

| Examples | Mortgage lenders, equipment financiers | Credit card issuers, suppliers on credit |

Introduction to Secured and Unsecured Creditors

Secured creditors hold a legal claim or lien on specific assets of the debtor, providing them priority in repayment during bankruptcy proceedings. Unsecured creditors lack collateral backing and face higher risk, often recovering less if the debtor declares bankruptcy. Understanding your position as a secured or unsecured creditor is crucial in assessing potential recovery outcomes in bankruptcy cases.

Defining Secured Creditors

Secured creditors hold a legal claim or lien on specific assets or collateral pledged by the debtor, ensuring priority in repayment if the debtor defaults. Unsecured creditors lack such collateral, relying solely on the debtor's general creditworthiness, making their claims subordinate to secured creditors during bankruptcy proceedings. In bankruptcy, secured creditors are prioritized for asset recovery, whereas unsecured creditors typically receive payment only after secured claims are satisfied.

Understanding Unsecured Creditors

Unsecured creditors are lenders or suppliers who extend credit without collateral, placing them at higher risk during bankruptcy proceedings. Their claims are subordinate to secured creditors, meaning repayment depends on remaining assets after secured debts are satisfied. Understanding your status as an unsecured creditor is crucial because it impacts your chances of recovering debts when a debtor files for bankruptcy.

Key Differences Between Secured and Unsecured Creditors

Secured creditors hold claims backed by collateral, granting them priority in repayment during bankruptcy, while unsecured creditors lack such security and face higher risk of loss. In bankruptcy proceedings, secured creditors are paid from the liquidation of specific assets tied to their loans, whereas unsecured creditors are paid from remaining assets after secured claims are satisfied, often resulting in partial or no recovery. Understanding these distinctions is crucial for assessing creditor rights and debt recovery potential in insolvency cases.

Examples of Secured and Unsecured Credit

Secured creditors hold collateral-backed claims, such as mortgage lenders with property liens or auto financiers with car titles securing the loan. Unsecured creditors, like credit card companies or medical service providers, extend credit without specific asset guarantees, relying on general debtor creditworthiness. In a bankruptcy, your secured creditors typically have priority in claims repayment through asset liquidation, while unsecured creditors may recover only a fraction of owed amounts.

Rights and Priorities During Bankruptcy

Secured creditors hold priority rights during bankruptcy because their claims are backed by specific collateral, allowing them to recover debts from secured assets before others. Unsecured creditors have lower priority and may receive partial payments only after secured creditors are fully paid, often resulting in minimal recovery. Your rights as a creditor depend on whether your claim is secured or unsecured, directly influencing the likelihood and amount of repayment during bankruptcy proceedings.

Legal Protections for Secured and Unsecured Creditors

Secured creditors benefit from legal protections such as priority claims on collateral, allowing them to recover debts directly from specific assets if the borrower defaults, enhancing their chances of repayment. Unsecured creditors lack collateral-backed claims and rely on general assets during bankruptcy proceedings, often leading to lower recovery rates as they are paid after secured creditors. Understanding these distinctions helps you assess risk and potential recovery in bankruptcy cases, emphasizing the stronger legal safeguards afforded to secured creditors.

Risks Associated with Secured and Unsecured Lending

Secured creditors face lower risks due to collateral backing their loans, enabling priority claims during bankruptcy proceedings and greater recovery potential. Unsecured creditors assume higher risk as they lack asset security, often resulting in significant losses or partial repayment if the debtor defaults or declares bankruptcy. Bankruptcy amplifies risks for unsecured lenders by triggering the orderly liquidation or restructuring of assets, typically favoring secured creditors and leaving unsecured creditors with diminished or no recovery.

Implications for Borrowers and Businesses

Secured creditors hold collateral rights, providing them priority in claims during bankruptcy, which reduces risk for lenders but increases potential loss for borrowers. Unsecured creditors lack collateral, resulting in lower recovery rates and higher risk, impacting businesses' credit terms and financial stability. Your ability to manage debt effectively influences bankruptcy outcomes and creditor negotiations, affecting long-term business viability and access to future financing.

Conclusion: Choosing Between Secured and Unsecured Credit

Choosing between secured and unsecured credit depends on risk tolerance and asset availability; secured creditors hold collateral, reducing lender risk and often resulting in lower interest rates. Unsecured creditors face higher risk due to lack of collateral, leading to higher interest rates and lower priority in bankruptcy proceedings. Understanding these differences is crucial for lenders and borrowers to manage financial stability and repayment obligations effectively.

Infographic: Secured creditor vs Unsecured creditor

relatioo.com

relatioo.com