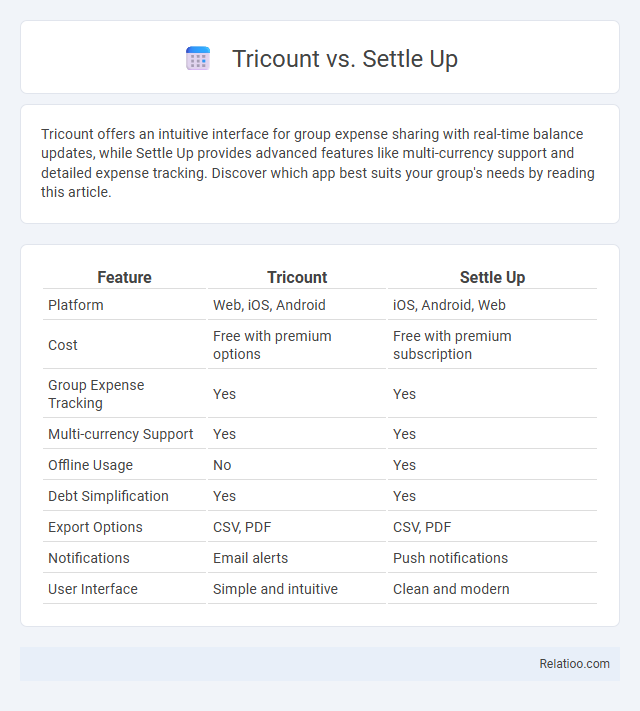

Tricount offers an intuitive interface for group expense sharing with real-time balance updates, while Settle Up provides advanced features like multi-currency support and detailed expense tracking. Discover which app best suits your group's needs by reading this article.

Table of Comparison

| Feature | Tricount | Settle Up |

|---|---|---|

| Platform | Web, iOS, Android | iOS, Android, Web |

| Cost | Free with premium options | Free with premium subscription |

| Group Expense Tracking | Yes | Yes |

| Multi-currency Support | Yes | Yes |

| Offline Usage | No | Yes |

| Debt Simplification | Yes | Yes |

| Export Options | CSV, PDF | CSV, PDF |

| Notifications | Email alerts | Push notifications |

| User Interface | Simple and intuitive | Clean and modern |

Introduction to Tricount and Settle Up

Tricount simplifies group expense management by allowing users to create shared expenses, track individual contributions, and automatically calculate who owes whom. Settle Up offers a similar platform with real-time syncing across devices and multi-currency support, making it ideal for international trips or shared household costs. Your choice between Tricount and Settle Up ultimately depends on the specific features that best match your group's financial tracking needs.

Key Features Comparison

Tricount offers seamless bill splitting with currency conversion and detailed expense categorization, ideal for group travel or shared living. Settle Up provides real-time expense tracking, multi-currency support, and customizable repayments, enhancing transparency for your shared costs. Shared Expense simplifies group expense management with offline mode and debt simplification algorithms, making it efficient for frequent use and diverse scenarios.

User Interface and Experience

Tricount offers an intuitive and clean user interface that simplifies group expense management, making it easy for you to track and split costs seamlessly. Settle Up features a visually engaging layout with clear categorization and detailed balance sheets, enhancing user experience during complex expense sharing. Shared Expense prioritizes straightforward navigation and minimalistic design, ensuring quick access to transaction inputs and summaries for efficient group budgeting.

Expense Tracking Capabilities

Tricount offers intuitive expense tracking with real-time balance updates and multi-currency support, making it ideal for group travel and shared budgets. Settle Up excels in detailed expense categorization and split options, providing seamless reconciliation for complex shared expenses. Shared Expense emphasizes user-friendly interfaces with automatic expense syncing and clear summary reports, simplifying ongoing cost management among roommates or friends.

Group Management Functions

Tricount offers intuitive group expense tracking with real-time updates and customizable categories, making it easier for your group to manage shared costs transparently. Settle Up provides comprehensive group management tools including detailed payment history, multi-currency support, and automatic debt simplification to minimize transactions. Shared Expense excels in allowing users to create multiple groups, assign roles, and generate clear summaries, enhancing your group's ability to coordinate and settle expenses efficiently.

Cross-Platform Availability

Tricount offers extensive cross-platform availability with seamless access via web, iOS, and Android apps, ensuring users can manage expenses on any device. Settle Up supports multiple platforms including iOS, Android, and an intuitive web interface, allowing effortless synchronization across smartphones and desktops. Shared Expense primarily focuses on mobile apps for iOS and Android, with limited web functionality, making it slightly less versatile for desktop users compared to its competitors.

Data Security and Privacy

Tricount, Settle Up, and Shared Expense all prioritize data security, using encryption protocols to protect your financial information from unauthorized access. Tricount employs SSL encryption and complies with GDPR regulations to ensure user privacy, while Settle Up offers end-to-end encryption for secure data transfers. Shared Expense maintains strict privacy policies, regularly updating its security measures to safeguard sensitive user data against breaches.

Pricing and Subscription Plans

Tricount offers a free basic plan with limited features and a premium subscription at EUR4.99/month providing advanced expense management tools. Settle Up provides a free tier with ads and a one-time payment option of $4.99 for ad-free usage and enhanced functionalities. Shared Expense follows a freemium model with in-app purchases to unlock premium features, ensuring Your expense tracking is customizable based on budget and feature needs.

User Reviews and Feedback

User reviews highlight Tricount's intuitive interface and seamless expense tracking for group trips, praised for its clear balance calculations and multi-currency support. Settle Up receives positive feedback for detailed transaction history and offline functionality, appreciated by users managing complex group expenses. Shared Expense stands out for its simple design and easy receipt scanning, though some users report limited customization options compared to competitors.

Which Is Better: Tricount or Settle Up?

Tricount excels with its intuitive interface and seamless multi-currency support, making it ideal for international trips and group expenses. Settle Up offers detailed expense tracking and customizable settling options, providing greater flexibility for complex group finances. Your choice depends on whether you prioritize simplicity and ease of use (Tricount) or advanced customization and detailed reporting (Settle Up).

Infographic: Tricount vs Settle Up

relatioo.com

relatioo.com