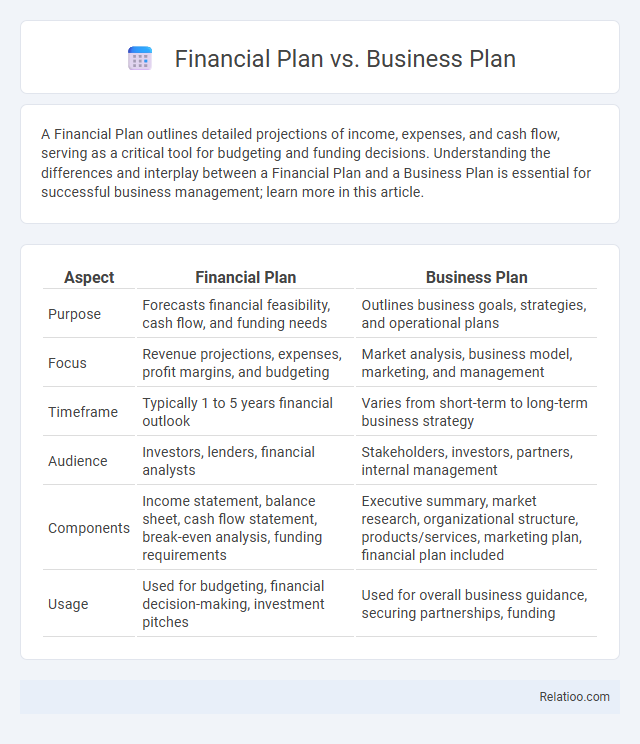

A Financial Plan outlines detailed projections of income, expenses, and cash flow, serving as a critical tool for budgeting and funding decisions. Understanding the differences and interplay between a Financial Plan and a Business Plan is essential for successful business management; learn more in this article.

Table of Comparison

| Aspect | Financial Plan | Business Plan |

|---|---|---|

| Purpose | Forecasts financial feasibility, cash flow, and funding needs | Outlines business goals, strategies, and operational plans |

| Focus | Revenue projections, expenses, profit margins, and budgeting | Market analysis, business model, marketing, and management |

| Timeframe | Typically 1 to 5 years financial outlook | Varies from short-term to long-term business strategy |

| Audience | Investors, lenders, financial analysts | Stakeholders, investors, partners, internal management |

| Components |

Income statement, balance sheet, cash flow statement, break-even analysis, funding requirements |

Executive summary, market research, organizational structure, products/services, marketing plan, financial plan included |

| Usage | Used for budgeting, financial decision-making, investment pitches | Used for overall business guidance, securing partnerships, funding |

Introduction to Financial Plan vs Business Plan

A financial plan outlines an organization's strategies for managing its finances, including budgeting, forecasting, and investment decisions, focusing primarily on cash flow, profitability, and financial stability. In contrast, a business plan provides a comprehensive overview of the company's vision, market analysis, operational structure, product or service offerings, and growth strategies. Understanding the distinction between these documents is critical for entrepreneurs and managers to effectively allocate resources and attract investors.

Definition of a Financial Plan

A financial plan is a detailed strategy outlining an individual's or organization's current financial situation, long-term goals, and actionable steps to achieve financial stability and growth. Unlike a business plan, which covers the overall vision, market analysis, and operational strategy of a company, a financial plan specifically focuses on budgeting, forecasting, investment planning, risk management, and cash flow management. It serves as a roadmap for managing assets, liabilities, income, and expenses to ensure sustainable financial health.

What is a Business Plan?

A business plan outlines your company's goals, strategies, target market, and operational structure, serving as a roadmap for your business's growth and success. It includes detailed sections such as an executive summary, market analysis, marketing plan, financial projections, and management structure. Unlike a financial plan that focuses solely on budgeting and funding, your business plan integrates financial information within a broader framework to guide decision-making and attract investors.

Core Components of a Financial Plan

A Financial Plan centers on budgeting, forecasting, cash flow management, and risk assessment, ensuring your business maintains financial health and meets long-term goals. In contrast, a Business Plan includes broader elements like market analysis, organizational structure, and marketing strategies alongside financial projections. Understanding the core components of a Financial Plan helps you make informed decisions, allocate resources wisely, and secure funding effectively.

Key Elements of a Business Plan

A business plan outlines key elements such as market analysis, organizational structure, product or service offerings, marketing strategy, and detailed financial projections. Unlike a financial plan that concentrates solely on budgeting, cash flow, and investment strategies, a business plan integrates both financial and operational aspects to guide overall business growth. Understanding these components helps entrepreneurs secure funding, align resources, and evaluate business viability effectively.

Purpose and Goals: Financial vs. Business Plans

Financial plans focus on detailed projections of income, expenses, cash flow, and funding requirements to ensure your business's fiscal health and secure investment or loans. Business plans provide a broader strategic overview, including market analysis, operational strategy, and long-term vision to attract stakeholders and guide overall company development. Understanding the distinct purpose and goals of each plan helps you tailor efforts to financial management versus comprehensive business growth.

Differences Between Financial Plans and Business Plans

Financial plans focus specifically on managing your company's financial resources, including budgeting, forecasting, and investment strategies, while business plans provide a comprehensive overview of your entire business model, including market analysis, operational plans, and goals. The financial plan is a subset of the business plan, giving detailed insights into revenue projections, cash flow, and funding needs. Understanding these differences helps you align financial strategies with broader business objectives for effective decision-making.

How Financial Plans Support Business Plans

Financial plans support business plans by providing detailed projections of revenue, expenses, cash flow, and funding requirements that clarify the financial feasibility and sustainability of your business goals. They enable you to allocate resources effectively, assess risks, and attract investors by demonstrating a clear path to profitability. Integrating financial plans with business plans ensures strategic alignment and measurable performance benchmarks to guide decision-making.

When to Use Each Plan

Use a financial plan to manage your personal or business finances through budgeting, forecasting, and investment strategies, essential during financial goal setting or when seeking loans. A business plan outlines your company's mission, market analysis, operational structure, and growth strategy, crucial when starting a new business or attracting investors. A strategic plan focuses on long-term objectives, resource allocation, and competitive positioning, guiding your company's direction during major transitions or market expansions.

Integrating Financial and Business Planning for Success

Integrating your financial plan with your business plan ensures a cohesive strategy that aligns financial goals with operational objectives, maximizing your company's growth potential. A financial plan focuses on budgeting, forecasting, and managing resources, while a business plan outlines your business model, market strategy, and organizational structure. Combining both frameworks provides a comprehensive roadmap, enabling better decision-making and increased investor confidence.

Infographic: Financial Plan vs Business Plan

relatioo.com

relatioo.com