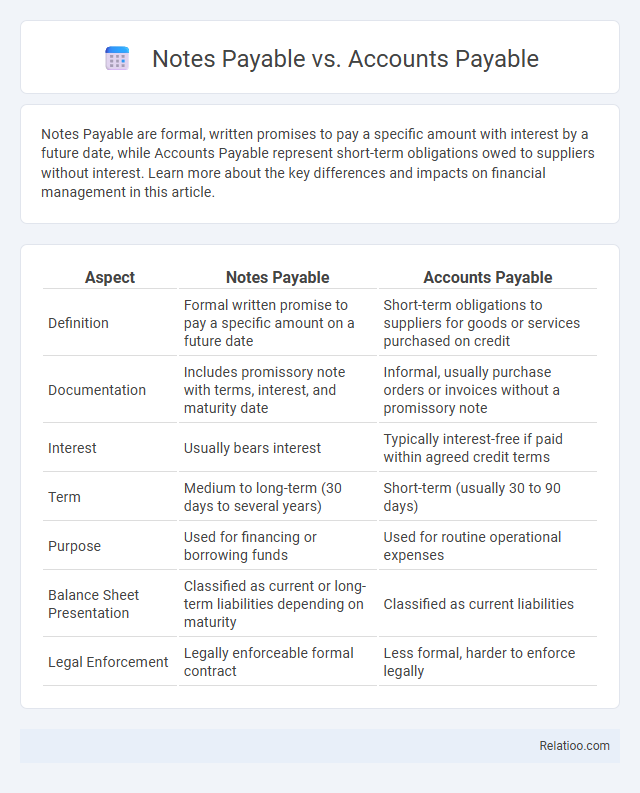

Notes Payable are formal, written promises to pay a specific amount with interest by a future date, while Accounts Payable represent short-term obligations owed to suppliers without interest. Learn more about the key differences and impacts on financial management in this article.

Table of Comparison

| Aspect | Notes Payable | Accounts Payable |

|---|---|---|

| Definition | Formal written promise to pay a specific amount on a future date | Short-term obligations to suppliers for goods or services purchased on credit |

| Documentation | Includes promissory note with terms, interest, and maturity date | Informal, usually purchase orders or invoices without a promissory note |

| Interest | Usually bears interest | Typically interest-free if paid within agreed credit terms |

| Term | Medium to long-term (30 days to several years) | Short-term (usually 30 to 90 days) |

| Purpose | Used for financing or borrowing funds | Used for routine operational expenses |

| Balance Sheet Presentation | Classified as current or long-term liabilities depending on maturity | Classified as current liabilities |

| Legal Enforcement | Legally enforceable formal contract | Less formal, harder to enforce legally |

Introduction to Notes Payable and Accounts Payable

Notes Payable represents a formal written promise to pay a specific amount of money on a future date, often involving interest, while Accounts Payable refers to short-term obligations to suppliers or vendors for goods and services received on credit. Both are key components of Your company's current liabilities but differ in formality, terms, and interest implications. Understanding these distinctions helps manage cash flow, credit terms, and overall financial health effectively.

Definition of Notes Payable

Notes Payable refers to written promissory notes where a company commits to pay a specific amount of money at a future date, often including interest, distinguishing it from Accounts Payable, which represents short-term obligations for goods or services received but not yet paid. It is a subset of Liabilities on the balance sheet, representing formal debt instruments as opposed to informal credit arrangements captured by Accounts Payable. Understanding Notes Payable is crucial for accurate financial reporting and managing long-term debt obligations.

Definition of Accounts Payable

Accounts Payable refers to the short-term obligations a company owes to its suppliers for goods and services received but not yet paid for, typically due within 30 to 90 days. Notes Payable represents written promissory notes with specific terms for repayment, often involving interest, while Liability is a broader accounting term encompassing all financial debts and obligations, including both Accounts Payable and Notes Payable. Understanding your Accounts Payable helps manage cash flow and maintain healthy supplier relationships.

Key Differences Between Notes Payable and Accounts Payable

Notes payable are written agreements detailing specific repayment terms and interest rates, while accounts payable represent short-term obligations to suppliers without formal promissory notes or interest. Notes payable generally involve formal loans or financing arrangements, making them longer-term liabilities compared to accounts payable, which arise from standard credit purchases. The main difference lies in the documentation and financial impact, as notes payable affect cash flow through scheduled payments and interest expenses, whereas accounts payable impact operational liquidity without interest charges.

Terms and Conditions Comparison

Notes payable are formal, written agreements specifying fixed repayment terms, interest rates, and maturity dates, often used for borrowing significant sums. Accounts payable represent short-term obligations to suppliers for goods or services received, typically requiring payment within 30 to 90 days without interest. Liabilities encompass both notes and accounts payable, reflecting overall financial obligations, but differ primarily in documentation, payment terms, and whether interest accrues.

Recording Notes Payable in Financial Statements

Notes Payable represents formal written promises to repay a specific amount with interest, recorded as a liability on the balance sheet under current or long-term liabilities depending on the maturity date. Accounts Payable reflects short-term obligations for goods or services received, typically recorded as a current liability without interest. Your accurate recording of Notes Payable requires including principal amounts, accrued interest, and distinguishing between short-term notes payable and long-term debt for clearer financial statement presentation.

Recording Accounts Payable in Financial Statements

Accounts Payable represents short-term obligations your business owes to suppliers for goods and services, recorded as current liabilities on the balance sheet. Notes Payable involves formal, written promises to pay a specific amount at a future date, often including interest, and can be classified as current or long-term liabilities depending on the maturity. Proper recording of Accounts Payable in financial statements reflects your company's outstanding payments accurately, ensuring clear liability tracking and helping maintain balanced cash flow management.

Impact on Business Cash Flow

Notes payable represent formal debt agreements with specific repayment terms and interest, directly affecting your business cash flow through scheduled principal and interest payments. Accounts payable consist of short-term obligations to suppliers, influencing cash flow management by requiring timely payments to maintain vendor relationships and creditworthiness. Both fall under liabilities on the balance sheet, but understanding their distinct impact on your cash flow is crucial for effective liquidity planning and financial stability.

Examples of Notes Payable and Accounts Payable Transactions

Notes payable transactions include borrowing money from a bank with a formal promissory note payable within a specified term, such as a business loan for purchasing equipment. Accounts payable transactions involve short-term obligations like purchasing inventory on credit from suppliers, where payment is due within a standard billing cycle, commonly 30 to 60 days. Both notes payable and accounts payable represent liabilities on the balance sheet, but notes payable often have interest terms and longer repayment periods compared to the typically interest-free accounts payable.

Choosing the Right Liability Management Strategy

Effective liability management requires distinguishing between notes payable, accounts payable, and other liabilities to optimize cash flow and credit terms. Notes payable involve formal debt instruments with fixed repayment schedules and interest, making them suitable for long-term financing, while accounts payable consist of short-term obligations to suppliers, critical for maintaining operational liquidity. Selecting the right strategy involves balancing payment prioritization, negotiating terms, and leveraging liabilities to support business growth and financial stability.

Infographic: Notes Payable vs Accounts Payable

relatioo.com

relatioo.com