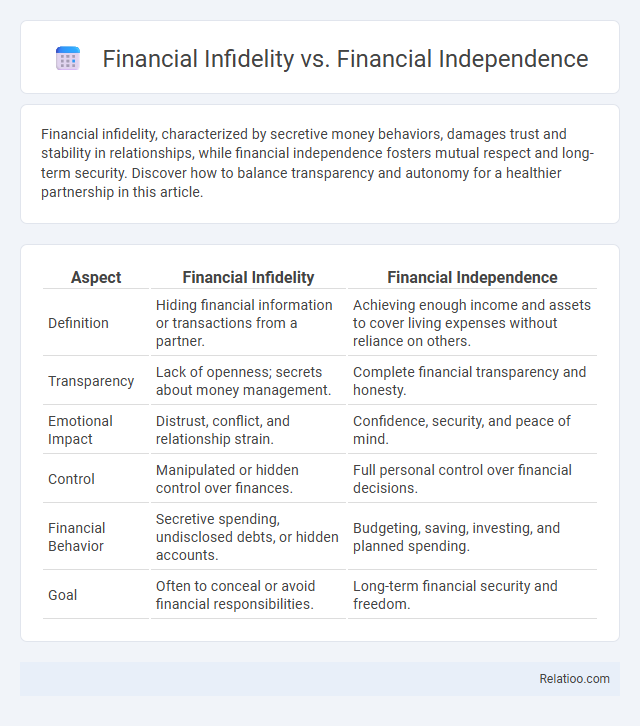

Financial infidelity, characterized by secretive money behaviors, damages trust and stability in relationships, while financial independence fosters mutual respect and long-term security. Discover how to balance transparency and autonomy for a healthier partnership in this article.

Table of Comparison

| Aspect | Financial Infidelity | Financial Independence |

|---|---|---|

| Definition | Hiding financial information or transactions from a partner. | Achieving enough income and assets to cover living expenses without reliance on others. |

| Transparency | Lack of openness; secrets about money management. | Complete financial transparency and honesty. |

| Emotional Impact | Distrust, conflict, and relationship strain. | Confidence, security, and peace of mind. |

| Control | Manipulated or hidden control over finances. | Full personal control over financial decisions. |

| Financial Behavior | Secretive spending, undisclosed debts, or hidden accounts. | Budgeting, saving, investing, and planned spending. |

| Goal | Often to conceal or avoid financial responsibilities. | Long-term financial security and freedom. |

Defining Financial Infidelity

Financial infidelity refers to the act of hiding financial information, such as secret spending, undisclosed debts, or hidden accounts, from a partner, leading to mistrust and relationship strain. This behavior contrasts with financial independence, which is the ability to manage personal finances autonomously and make informed financial decisions without reliance on others. Understanding and addressing financial infidelity is crucial for fostering transparency and trust in shared financial management.

Understanding Financial Independence

Financial independence represents the ability to cover living expenses without relying on external income, often achieved through savings, investments, and passive income sources. Understanding financial independence involves recognizing the importance of budgeting, debt management, and building diverse revenue streams to secure long-term financial stability. Unlike financial infidelity, which involves secrecy in money matters and damages trust, financial independence promotes transparency and control over personal finances for sustained empowerment.

Key Differences Between Financial Infidelity and Independence

Financial infidelity involves hiding financial information or lying about money matters, which erodes trust and damages relationships. Financial independence signifies having sufficient income or assets to support one's lifestyle without relying on others, promoting personal freedom and security. The key difference lies in transparency and control: financial infidelity is marked by secrecy and conflict, while financial independence is characterized by openness and self-sufficiency.

Common Signs of Financial Infidelity

Common signs of financial infidelity include secretive spending, hidden accounts, and lying about debts or assets, which can undermine trust and financial security. Recognizing these behaviors early is crucial for maintaining financial independence and fostering transparency in your financial relationship. Addressing financial infidelity promptly helps protect your financial goals and ensures mutual accountability.

Building Healthy Financial Boundaries

Building healthy financial boundaries involves distinguishing between financial infidelity, where secretive money behaviors undermine trust, and financial independence, which empowers you with control and transparency over your finances. Clear communication and agreed-upon financial goals help prevent financial infidelity by fostering mutual respect and accountability. Establishing these boundaries creates a foundation for financial independence while protecting relationships from the harm caused by secrecy and mistrust.

Impact of Financial Infidelity on Relationships

Financial infidelity, characterized by secretive financial behaviors like hidden debts or undisclosed spending, severely undermines trust and communication within relationships. Unlike financial independence, which empowers you to manage your finances openly and confidently, financial infidelity breeds resentment, anxiety, and emotional distance, often leading to conflict or separation. Understanding the profound impact of financial infidelity on relationship dynamics is crucial for building financial transparency and fostering long-term emotional security.

Benefits of Achieving Financial Independence

Achieving financial independence empowers you to make confident decisions without relying on others, reducing stress and potential conflicts often seen in financial infidelity. It provides control over your resources, enabling long-term stability and freedom from debt or paycheck-to-paycheck living. By prioritizing financial independence, your overall well-being improves through enhanced security, better planning for retirement, and increased opportunities for personal growth.

Strategies for Rebuilding Trust After Financial Betrayal

Rebuilding trust after financial betrayal requires transparent communication, comprehensive financial planning, and shared goal-setting to restore confidence between partners. Establishing regular financial check-ins and utilizing tools such as joint budgeting apps promotes accountability and mutual understanding. Engaging in professional counseling or financial coaching further supports the healing process and helps prevent future breaches of trust.

Joint Financial Goals vs Individual Autonomy

Financial infidelity undermines joint financial goals by hiding spending or debts, causing mistrust that disrupts shared plans for savings, investments, and future security. Financial independence empowers you to maintain individual autonomy, ensuring personal control over your finances while still contributing transparently to joint goals. Balancing these aspects requires open communication and mutual respect to align your financial priorities without compromising personal freedom.

Tips for Promoting Financial Transparency and Independence

Promoting financial transparency and independence requires open communication between partners about income, expenses, and financial goals to build trust and prevent financial infidelity. Setting shared budgets, regularly reviewing financial statements together, and establishing individual spending limits can empower you to maintain financial independence while fostering honesty. Encouraging joint decision-making and financial education further strengthens clarity and collaboration in relationships.

Infographic: Financial Infidelity vs Financial Independence

relatioo.com

relatioo.com