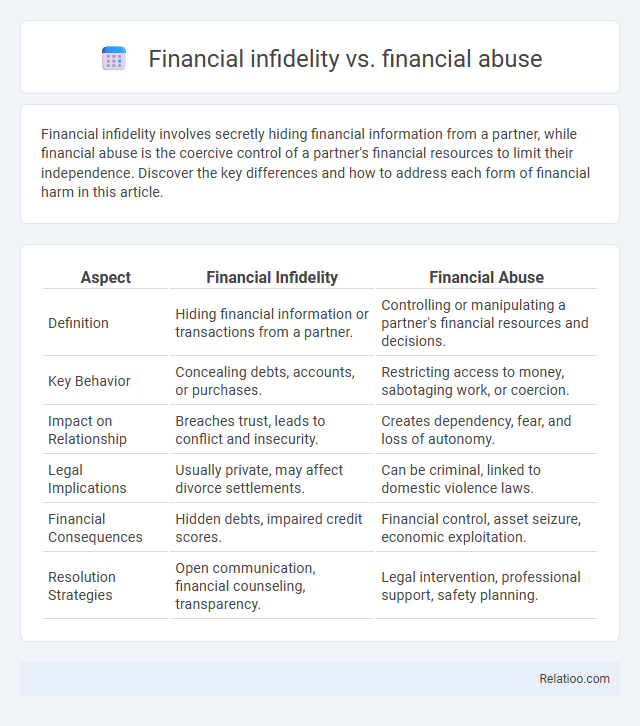

Financial infidelity involves secretly hiding financial information from a partner, while financial abuse is the coercive control of a partner's financial resources to limit their independence. Discover the key differences and how to address each form of financial harm in this article.

Table of Comparison

| Aspect | Financial Infidelity | Financial Abuse |

|---|---|---|

| Definition | Hiding financial information or transactions from a partner. | Controlling or manipulating a partner's financial resources and decisions. |

| Key Behavior | Concealing debts, accounts, or purchases. | Restricting access to money, sabotaging work, or coercion. |

| Impact on Relationship | Breaches trust, leads to conflict and insecurity. | Creates dependency, fear, and loss of autonomy. |

| Legal Implications | Usually private, may affect divorce settlements. | Can be criminal, linked to domestic violence laws. |

| Financial Consequences | Hidden debts, impaired credit scores. | Financial control, asset seizure, economic exploitation. |

| Resolution Strategies | Open communication, financial counseling, transparency. | Legal intervention, professional support, safety planning. |

Understanding Financial Infidelity

Understanding financial infidelity involves recognizing secretive behaviors about money, such as hiding debts, undisclosed spending, or misleading a partner about income and financial decisions. Unlike financial abuse, which involves controlling or coercive tactics to dominate a partner's financial resources, financial infidelity centers on breaches of trust through deception. Distinguishing these behaviors helps in addressing relationship issues and promoting transparency for healthier financial partnerships.

Defining Financial Abuse

Financial abuse involves controlling a partner's access to financial resources, using money to manipulate or exploit, and restricting their economic independence. It differs from financial infidelity, which entails secretive financial actions like hiding debts or assets without consent. Understanding your situation requires recognizing these distinctions to protect your financial well-being and establish healthy boundaries.

Key Differences Between Financial Infidelity and Financial Abuse

Financial infidelity involves secretly hiding financial information or transactions from a partner, undermining trust, whereas financial abuse is a deliberate pattern of controlling or exploiting a partner's access to money and resources, often as a form of control or manipulation. You should recognize that financial infidelity typically revolves around dishonesty and secrecy, while financial abuse includes coercion, intimidation, and restriction of financial autonomy. Understanding these distinctions is crucial for identifying the impact on your financial well-being and relationship health.

Signs of Financial Infidelity in Relationships

Signs of financial infidelity in relationships include hidden bank accounts, secret credit card charges, unexplained withdrawals, or undisclosed debts that can erode trust and create emotional distance. Unlike financial abuse, which involves controlling or restricting access to money to manipulate or dominate a partner, financial infidelity centers on deception about financial matters without necessarily inflicting control or harm. Recognizing these signs early helps you protect your financial well-being and maintain transparency with your partner.

Recognizing Financial Abuse Tactics

Recognizing financial abuse tactics involves identifying behaviors such as controlling access to money, withholding financial information, and sabotaging your employment or finances. Unlike financial infidelity, which centers on secretive financial actions like hidden debts or accounts, financial abuse is a deliberate pattern aimed at exerting power and control over your economic resources. Understanding these distinctions helps protect your financial autonomy and ensures your well-being in financial relationships.

Emotional and Financial Impact on Victims

Financial infidelity involves secretive behaviors like hiding expenses or debts, causing trust issues that can deeply affect Your emotional well-being with feelings of betrayal and insecurity. Financial abuse takes a more severe toll by controlling or restricting Your access to money, leading to emotional distress and significant financial vulnerability. The emotional impact of both financial infidelity and abuse often results in anxiety, depression, and long-term difficulties in rebuilding financial stability and personal trust.

Root Causes: Why Financial Deception Occurs

Financial infidelity typically stems from fear of judgment, dissatisfaction, or power imbalances in relationships, leading to hidden expenditures or secret accounts. Financial abuse arises from control dynamics where one partner manipulates money to exert dominance, often rooted in emotional or psychological vulnerabilities. These distinct forms of financial deception share underlying causes such as mistrust, lack of communication, and unresolved personal or relational insecurities.

How to Address Financial Infidelity with Your Partner

Addressing financial infidelity with your partner requires open communication, transparency about finances, and setting clear boundaries for money management. Establish regular check-ins to review shared expenses, debts, and savings goals, fostering trust and accountability. Seeking couples therapy or financial counseling can also help repair the relationship and develop healthier financial habits together.

Seeking Help and Protection from Financial Abuse

Recognizing financial abuse is crucial when safeguarding your assets and well-being, as it often involves control, manipulation, and exploitation within relationships. Seeking help from financial advisors, legal professionals, or support organizations can provide protection strategies and legal recourse to prevent further abuse. You must document all financial transactions and communicate openly with trusted experts to regain control and secure your financial future.

Building Trust and Transparency in Financial Relationships

Financial infidelity involves secretly hiding financial information or transactions from a partner, undermining trust and causing emotional distress. Financial abuse is a more severe form where one partner controls or manipulates the other's access to money, leading to power imbalances and dependency. Building trust and transparency in financial relationships requires open communication, joint financial planning, and mutual agreement on budgeting and spending to prevent secrecy and promote equality.

Infographic: Financial Infidelity vs Financial Abuse

relatioo.com

relatioo.com