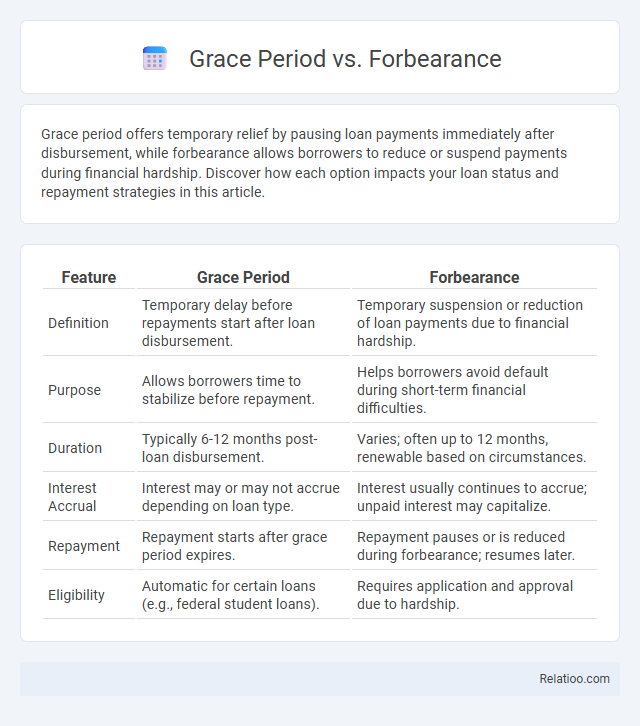

Grace period offers temporary relief by pausing loan payments immediately after disbursement, while forbearance allows borrowers to reduce or suspend payments during financial hardship. Discover how each option impacts your loan status and repayment strategies in this article.

Table of Comparison

| Feature | Grace Period | Forbearance |

|---|---|---|

| Definition | Temporary delay before repayments start after loan disbursement. | Temporary suspension or reduction of loan payments due to financial hardship. |

| Purpose | Allows borrowers time to stabilize before repayment. | Helps borrowers avoid default during short-term financial difficulties. |

| Duration | Typically 6-12 months post-loan disbursement. | Varies; often up to 12 months, renewable based on circumstances. |

| Interest Accrual | Interest may or may not accrue depending on loan type. | Interest usually continues to accrue; unpaid interest may capitalize. |

| Repayment | Repayment starts after grace period expires. | Repayment pauses or is reduced during forbearance; resumes later. |

| Eligibility | Automatic for certain loans (e.g., federal student loans). | Requires application and approval due to hardship. |

Understanding Grace Periods

Grace periods provide a set timeframe after a loan's due date during which no late fees or penalties are applied, allowing borrowers temporary relief without impacting credit scores. Forbearance extends this concept by permitting reduced or paused payments for a limited period due to financial hardship, though interest often continues to accrue. Understanding grace periods is crucial for managing loan repayments effectively, as they offer a buffer to avoid default while maintaining borrower eligibility for future credit.

What Is Loan Forbearance?

Loan forbearance is a temporary postponement or reduction of loan payments, typically granted during financial hardship to help you avoid default. Unlike a grace period that offers a short-term pause after a loan disbursement or graduation before payments begin, forbearance extends relief by allowing lower or suspended payments for a specific period. Your interest may continue to accrue during forbearance, potentially increasing the total loan balance once regular payments resume.

Key Differences Between Grace Periods and Forbearance

Grace periods allow borrowers a set time after a loan's due date to make payments without penalties or interest accrual, typically lasting six months for student loans. Forbearance temporarily suspends or reduces loan payments due to financial hardship but may result in interest accumulation, extending the repayment period. Key differences include grace periods being automatic and interest-free delays, while forbearance requires approval and can increase the loan balance over time.

How Grace Periods Work in Different Loans

Grace periods in student loans typically allow borrowers six to nine months after graduation before repayments begin, providing time to seek employment and financial stability. Mortgage loans often include a grace period of 10 to 15 days past the due date, preventing late fees if payments are made within this timeframe. In contrast, forbearance temporarily pauses or reduces loan payments during financial hardship but generally does not forgive interest, making it a distinct option separate from grace periods.

Eligibility Requirements for Forbearance

Forbearance eligibility requires You to demonstrate financial hardship, such as unemployment, illness, or a natural disaster, and typically involves a request approved by your loan servicer. Unlike grace periods that automatically apply after graduation or loan disbursement, forbearance requires proactive communication and documentation to pause or reduce payments. Understanding the specific eligibility criteria for federal and private student loans can help you navigate options during financial difficulties.

Pros and Cons of Grace Periods

Grace periods offer borrowers temporary relief by allowing payments to be postponed without penalty, providing flexibility after loan origination or deferment. Your monthly budget benefits from this pause, but interest may continue accruing, increasing the overall loan balance and cost over time. While forbearance and deferment provide similar payment relief, the grace period uniquely supports immediate post-graduation transitions without requiring formal hardship documentation.

Pros and Cons of Forbearance

Forbearance offers temporary relief by pausing or reducing your loan payments, helping prevent default during financial hardship, but it accrues interest, increasing overall loan cost. Unlike grace periods, which provide interest-free time after graduation before payments start, forbearance extends the repayment timeline but can lead to higher long-term expenses due to unpaid interest capitalization. Understanding these distinctions helps you choose the best option to manage your loan effectively.

Impact on Credit Score: Grace Period vs Forbearance

Grace periods typically do not impact your credit score as they allow you extra time to make payments without being reported late to credit bureaus. Forbearance, while preventing immediate default, can still negatively affect your credit if payments are missed or reported as deferred, potentially lowering your credit score. Understanding the distinctions helps you manage your financial obligations without unnecessarily harming your credit profile.

Choosing Between Grace Period and Forbearance

Choosing between a grace period and forbearance depends on financial stability and repayment goals; a grace period offers temporary relief immediately after loan disbursement or graduation, allowing payments to be deferred without penalty, while forbearance permits pausing or reducing payments during financial hardship but may accrue interest on certain loans. Borrowers facing short-term financial challenges often prefer grace periods to avoid interest buildup, whereas extended difficulties might necessitate forbearance to prevent default and maintain loan status. Evaluating loan terms, interest accumulation, and long-term financial impact is crucial for optimal decision-making between these options.

Frequently Asked Questions: Grace Period vs Forbearance

A grace period refers to a set timeframe after a loan's due date during which no late fees or penalties are applied, typically lasting 6 to 12 months for student loans, whereas forbearance allows temporary suspension or reduction of loan payments due to financial hardship, often lasting up to 12 months but with interest continuing to accrue. Borrowers frequently ask if payments are required during these times; during a grace period, payments are usually deferred without interest on subsidized loans, but in forbearance, interest accumulates and is added to the loan balance. Understanding the distinctions helps borrowers make informed decisions about managing student loan repayment during financial challenges.

Infographic: Grace Period vs Forbearance

relatioo.com

relatioo.com