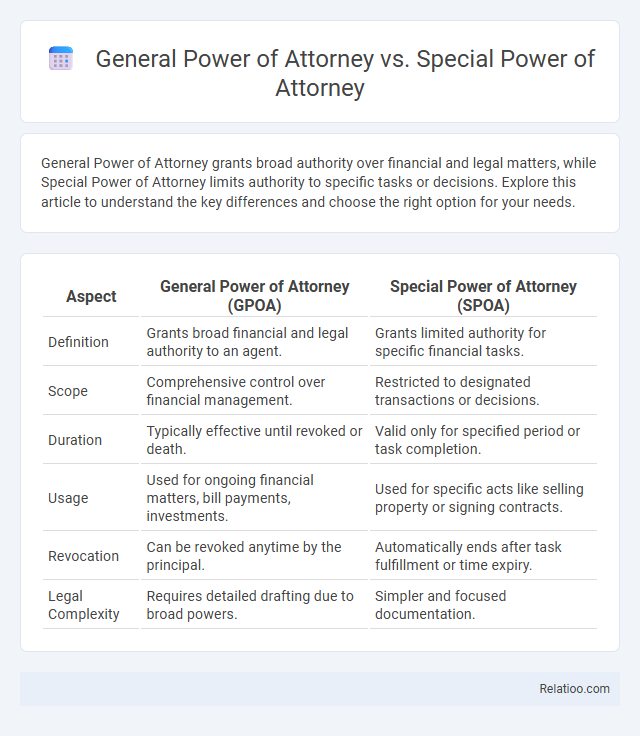

General Power of Attorney grants broad authority over financial and legal matters, while Special Power of Attorney limits authority to specific tasks or decisions. Explore this article to understand the key differences and choose the right option for your needs.

Table of Comparison

| Aspect | General Power of Attorney (GPOA) | Special Power of Attorney (SPOA) |

|---|---|---|

| Definition | Grants broad financial and legal authority to an agent. | Grants limited authority for specific financial tasks. |

| Scope | Comprehensive control over financial management. | Restricted to designated transactions or decisions. |

| Duration | Typically effective until revoked or death. | Valid only for specified period or task completion. |

| Usage | Used for ongoing financial matters, bill payments, investments. | Used for specific acts like selling property or signing contracts. |

| Revocation | Can be revoked anytime by the principal. | Automatically ends after task fulfillment or time expiry. |

| Legal Complexity | Requires detailed drafting due to broad powers. | Simpler and focused documentation. |

Introduction to Power of Attorney

Power of Attorney (POA) is a legal document granting an individual the authority to act on behalf of another in financial, legal, or medical matters. General Power of Attorney provides broad powers over the principal's affairs, while Special Power of Attorney limits authority to specific tasks or decisions. Understanding the distinctions between General, Special, and the overall concept of POA is crucial for effective delegation and legal protection.

Understanding General Power of Attorney

A General Power of Attorney grants broad legal authority to an agent to act on behalf of the principal in multiple financial and legal matters, unlike a Special Power of Attorney, which limits the agent's powers to specific tasks or transactions. Understanding the scope of a General Power of Attorney is crucial as it enables comprehensive decision-making, including managing bank accounts, signing contracts, and conducting business operations. The Power of Attorney document must be carefully drafted to reflect the principal's intentions, ensuring legal validity and protection against misuse.

Key Features of General Power of Attorney

General Power of Attorney grants broad authority to an agent to act on behalf of the principal in various financial, legal, and business matters, without restrictions on specific transactions. Unlike Special Power of Attorney, which limits the agent's powers to particular acts or decisions, the General Power of Attorney covers a wide range of duties and is typically used for comprehensive management of affairs. Power of Attorney is the overarching legal document that allows one person to grant decision-making powers to another, with General and Special Power of Attorney representing specific types distinguished by the scope of authority.

Understanding Special Power of Attorney

A Special Power of Attorney grants you authority to act on someone's behalf for specific tasks, such as managing property or conducting business transactions, distinct from the broader General Power of Attorney that covers a wide range of decisions. While a General Power of Attorney allows comprehensive control, the Special Power of Attorney is limited to specified powers defined in the document, providing precise legal boundaries. Understanding Special Power of Attorney helps ensure your authorization is clear, focused, and legally enforceable for particular purposes.

Key Features of Special Power of Attorney

A Special Power of Attorney grants Your appointed agent authority to perform specific tasks or make decisions on Your behalf, limited to clearly defined activities such as property transactions or legal matters, unlike the broader General Power of Attorney which covers all actions. The specificity of the Special Power of Attorney ensures precise control over the scope of authority, reducing the risk of misuse. Understanding the distinctions helps tailor the legal instrument to Your particular needs, ensuring effective and secure representation.

Major Differences Between General and Special Power of Attorney

General Power of Attorney grants comprehensive authority to an agent to act on behalf of the principal in a broad range of legal and financial matters, while Special Power of Attorney limits the agent's powers to specific tasks or decisions only. The major difference lies in the scope; General POA provides wide-ranging control, including managing bank accounts, signing documents, and handling investments, whereas Special POA authorizes actions such as selling a property or making medical decisions for a defined period or purpose. Power of Attorney, as a general term, encompasses both types but must be clearly specified to avoid ambiguity in the extent of the agent's powers.

Situations Best Suited for General Power of Attorney

General Power of Attorney is best suited for situations where You need someone to manage your financial, legal, or business affairs comprehensively during your absence or incapacity. Special Power of Attorney limits the agent's authority to specific tasks like selling property or handling a single transaction, providing focused control without broad powers. Power of Attorney, encompassing both general and special types, allows tailored delegation to fit Your unique legal or financial needs.

Situations Best Suited for Special Power of Attorney

Special Power of Attorney is best suited for specific, clearly defined tasks such as managing real estate transactions, handling tax matters, or making decisions about a particular business deal. Unlike a General Power of Attorney, which grants broad authority over multiple aspects of your affairs, the Special Power of Attorney limits the agent's power to a particular situation, reducing risk. For your needs, choosing a Special Power of Attorney ensures precise control over who can act on your behalf and for what purpose, enhancing security and clarity in legal matters.

Legal Implications and Limitations

A General Power of Attorney grants broad legal authority to an agent to act on Your behalf in multiple matters, but it typically becomes invalid if You become incapacitated, posing significant legal risks. A Special Power of Attorney limits the agent's powers to specific tasks or decisions, providing clearer boundaries and reducing potential misuse while ensuring legal actions are confined to designated areas. The Power of Attorney, as a broad term, encompasses both general and special forms, with critical legal implications depending on its scope and the jurisdiction's specific statutes governing authority and liability.

How to Choose the Right Power of Attorney

Choosing the right power of attorney depends on the scope and duration of authority needed. A General Power of Attorney grants broad, comprehensive decision-making powers suitable for ongoing financial or legal matters, while a Special Power of Attorney limits authority to specific tasks or transactions, ideal for short-term or defined responsibilities. Assess the complexity and time frame of the matters involved to determine whether a general, special, or a tailored power of attorney best aligns with your legal and personal needs.

Infographic: General Power of Attorney vs Special Power of Attorney

relatioo.com

relatioo.com