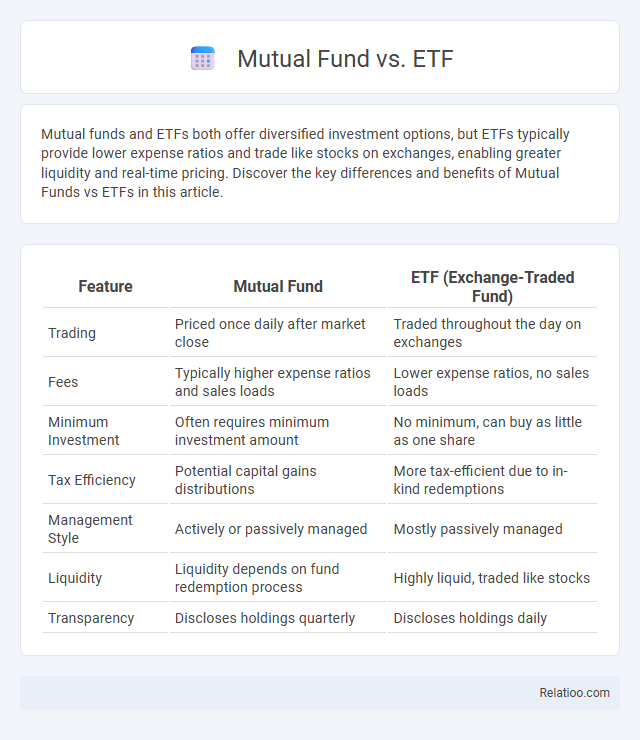

Mutual funds and ETFs both offer diversified investment options, but ETFs typically provide lower expense ratios and trade like stocks on exchanges, enabling greater liquidity and real-time pricing. Discover the key differences and benefits of Mutual Funds vs ETFs in this article.

Table of Comparison

| Feature | Mutual Fund | ETF (Exchange-Traded Fund) |

|---|---|---|

| Trading | Priced once daily after market close | Traded throughout the day on exchanges |

| Fees | Typically higher expense ratios and sales loads | Lower expense ratios, no sales loads |

| Minimum Investment | Often requires minimum investment amount | No minimum, can buy as little as one share |

| Tax Efficiency | Potential capital gains distributions | More tax-efficient due to in-kind redemptions |

| Management Style | Actively or passively managed | Mostly passively managed |

| Liquidity | Liquidity depends on fund redemption process | Highly liquid, traded like stocks |

| Transparency | Discloses holdings quarterly | Discloses holdings daily |

Introduction to Mutual Funds and ETFs

Mutual funds pool money from multiple investors to invest in a diversified portfolio managed by professional fund managers, offering accessibility and variety. Exchange-Traded Funds (ETFs) combine features of mutual funds and stocks, trading on exchanges throughout the day with generally lower expense ratios and tax efficiency. Both investment vehicles provide diversification, but ETFs offer intra-day liquidity and often lower fees, while mutual funds support automatic investment plans and professional oversight.

Key Differences Between Mutual Funds and ETFs

Mutual funds pool money from investors to buy a diversified portfolio managed by professionals, typically priced once daily at the end of trading. ETFs trade on stock exchanges throughout the day like individual stocks, offering intraday liquidity and often lower expense ratios due to passive management. Your choice depends on trading flexibility, cost sensitivity, and management style, as mutual funds may involve minimum investments and potential sales charges, whereas ETFs provide real-time pricing and greater cost efficiency.

Investment Structure: Mutual Funds vs ETFs

Mutual funds pool investor capital to create a diversified portfolio managed by professional fund managers, with shares bought and redeemed at the fund's net asset value (NAV) at the end of each trading day. ETFs, or exchange-traded funds, combine features of mutual funds and individual stocks by holding a basket of assets traded on an exchange throughout the day at market prices, offering intraday liquidity and typically lower expense ratios. The investment structure of mutual funds prioritizes end-of-day transactions and active management, while ETFs emphasize intraday trading flexibility and often employ passive management strategies through indexing.

How Mutual Funds and ETFs Are Traded

Mutual funds are traded only once per day after the market closes at their net asset value (NAV), while ETFs are traded throughout the day on stock exchanges like individual stocks, allowing investors to buy and sell shares at market prices. This intraday trading feature of ETFs offers greater flexibility and real-time pricing compared to mutual funds. Mutual funds' transactions occur directly through the fund company or a broker, whereas ETFs can be bought and sold through any brokerage account.

Management Styles: Active vs Passive

Mutual funds typically employ active management, where professional fund managers make investment decisions to outperform market benchmarks, while ETFs generally follow passive management, tracking specific indices to replicate market performance with lower fees. Your choice between mutual funds and ETFs depends on your preference for active oversight versus cost-efficient, passive investment strategies. Understanding these management styles helps optimize your portfolio based on risk tolerance and financial goals.

Costs and Fees Comparison

Mutual funds typically charge higher management fees and may include sales loads, while ETFs generally offer lower expense ratios and avoid loads due to their passive management style. Transaction costs for ETFs can vary depending on brokerage fees and trading frequency, whereas mutual fund costs are embedded in the expense ratio and sometimes include redemption fees. Understanding these cost structures helps you minimize expenses and maximize returns based on your investment strategy.

Tax Efficiency: Mutual Funds vs ETFs

ETFs generally offer greater tax efficiency compared to mutual funds due to their unique in-kind redemption process, which helps minimize capital gains distributions. Mutual funds frequently generate capital gains when portfolio managers buy and sell securities within the fund, resulting in taxable events for investors. Investors seeking to reduce tax liabilities may prefer ETFs, especially those structured as index funds with lower turnover rates, over actively managed mutual funds.

Liquidity and Accessibility

Exchange-Traded Funds (ETFs) offer higher liquidity compared to Mutual Funds, as ETFs trade on stock exchanges throughout the trading day, allowing you to buy or sell shares anytime during market hours. Mutual Funds, while accessible through investment accounts, only process trades at the end of the trading day, which may delay your ability to react to market changes. ETFs typically have lower minimum investment requirements and can be purchased in smaller increments, enhancing accessibility for individual investors.

Suitability for Different Investors

Mutual funds, ETFs, and index funds each cater to different investor needs based on risk tolerance, investment goals, and trading preferences. Mutual funds offer professional management and are ideal for investors seeking a hands-off approach and regular contributions, while ETFs provide flexibility with intraday trading and lower expense ratios, appealing to cost-conscious and active investors. Your choice should align with your investment horizon, desired control over trades, and sensitivity to fees to optimize portfolio performance.

Final Verdict: Choosing Between Mutual Funds and ETFs

Mutual funds and ETFs both offer diversified investment options with distinct features: mutual funds provide professional management and ease of automatic investing while ETFs offer lower expense ratios and intraday trading flexibility. Your choice depends on factors like investment goals, trading preferences, and cost sensitivity. For long-term investors prioritizing simplicity and active management, mutual funds may be ideal, whereas ETFs suit those seeking lower fees and greater control over trades.

Infographic: Mutual Fund vs ETF

relatioo.com

relatioo.com