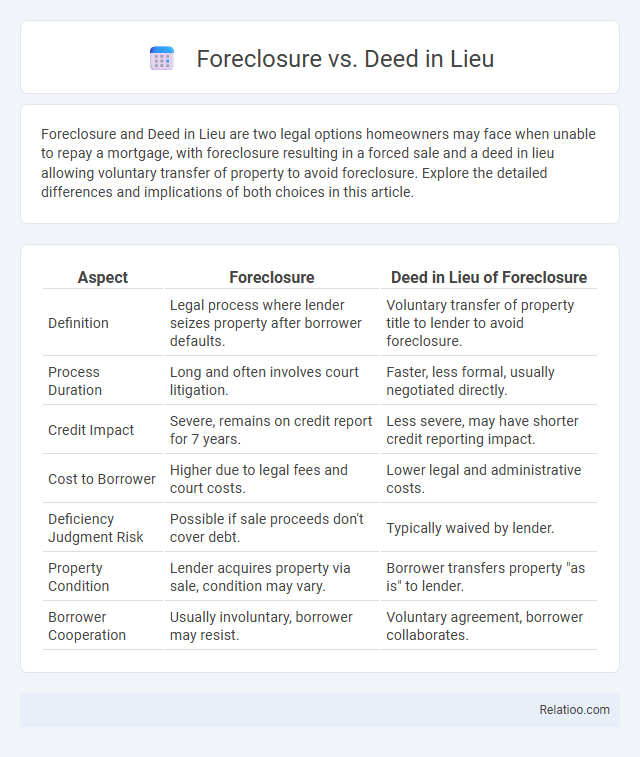

Foreclosure and Deed in Lieu are two legal options homeowners may face when unable to repay a mortgage, with foreclosure resulting in a forced sale and a deed in lieu allowing voluntary transfer of property to avoid foreclosure. Explore the detailed differences and implications of both choices in this article.

Table of Comparison

| Aspect | Foreclosure | Deed in Lieu of Foreclosure |

|---|---|---|

| Definition | Legal process where lender seizes property after borrower defaults. | Voluntary transfer of property title to lender to avoid foreclosure. |

| Process Duration | Long and often involves court litigation. | Faster, less formal, usually negotiated directly. |

| Credit Impact | Severe, remains on credit report for 7 years. | Less severe, may have shorter credit reporting impact. |

| Cost to Borrower | Higher due to legal fees and court costs. | Lower legal and administrative costs. |

| Deficiency Judgment Risk | Possible if sale proceeds don't cover debt. | Typically waived by lender. |

| Property Condition | Lender acquires property via sale, condition may vary. | Borrower transfers property "as is" to lender. |

| Borrower Cooperation | Usually involuntary, borrower may resist. | Voluntary agreement, borrower collaborates. |

Understanding Foreclosure: Key Concepts

Foreclosure involves a lender seizing and selling your property when you fail to meet mortgage payments, negatively impacting your credit score. A deed in lieu of foreclosure allows you to voluntarily transfer ownership to the lender, avoiding the lengthy foreclosure process but still affecting your credit. Understanding these options helps you weigh the financial consequences and choose the best path to manage your mortgage default effectively.

What Is a Deed in Lieu of Foreclosure?

A deed in lieu of foreclosure is a legal agreement where a borrower voluntarily transfers property ownership to the lender to avoid the lengthy foreclosure process. This alternative can reduce foreclosure costs and mitigate credit damage compared to traditional foreclosure. It requires lender approval and typically benefits homeowners seeking a simplified exit from mortgage default.

Major Differences Between Foreclosure and Deed in Lieu

Foreclosure is a legal process where the lender seizes and sells the property to recover loan balance after borrower default, often impacting credit scores significantly. A Deed in Lieu of Foreclosure involves the borrower voluntarily transferring property ownership to the lender to avoid foreclosure, typically resulting in less credit damage and a quicker resolution. The major difference lies in the process control; foreclosure is a lender-initiated public auction, while deed in lieu is mutually agreed upon, usually sparing the borrower from lengthy legal proceedings.

Pros and Cons of Foreclosure for Homeowners

Foreclosure allows lenders to regain property when homeowners default on mortgage payments but significantly damages Your credit score and can lead to the loss of the home with little control over the sale process. Unlike a deed in lieu, foreclosure may take longer and involve costly legal proceedings, which can create prolonged financial and emotional stress for homeowners. Despite its drawbacks, foreclosure sometimes results in fewer immediate price reductions for the property compared to a deed in lieu, providing lenders with a chance to recover more of the loan balance.

Pros and Cons of Deed in Lieu for Homeowners

Deed in Lieu offers homeowners a way to avoid the lengthy foreclosure process by voluntarily transferring property ownership to the lender, which often results in less credit damage compared to foreclosure. However, this option requires lender approval and may not release all mortgage obligations, potentially leaving you liable for deficiencies. While foreclosure can severely impact your credit score and remain on your record for seven years, Deed in Lieu provides a more amicable resolution but may limit your eligibility for future loans due to its impact on your credit history.

Credit Impact: Foreclosure vs Deed in Lieu

Foreclosure typically has a more severe negative impact on credit scores, often remaining on a credit report for up to seven years and significantly lowering creditworthiness. A deed in lieu of foreclosure generally results in less damage to credit, as it is viewed as a cooperative resolution between borrower and lender, potentially allowing for quicker credit recovery. Both options affect credit, but the deed in lieu usually reflects a less drastic credit event compared to foreclosure.

Qualification Requirements for a Deed in Lieu

Qualification requirements for a deed in lieu of foreclosure typically include lender approval, the property being free of junior liens, and the borrower demonstrating financial hardship or inability to continue mortgage payments. This alternative to foreclosure often requires the borrower to voluntarily surrender the property title to avoid the lengthy foreclosure process and minimize credit damage. Foreclosure, on the other hand, occurs when the lender forcibly takes possession due to missed payments, while a deed in lieu offers a negotiated resolution with specific eligibility criteria.

Legal and Financial Consequences Compared

Foreclosure results in legal proceedings where the lender repossesses the property due to default, often severely damaging the borrower's credit score for 7-10 years and potentially leading to deficiency judgments. A deed in lieu of foreclosure allows the borrower to voluntarily transfer the property's title to the lender, avoiding the lengthy foreclosure process and slightly mitigating credit damage but still impacting credit reports for several years. Both options have distinct financial consequences; foreclosure typically incurs higher costs including legal fees and potential deficiency payments, whereas a deed in lieu usually involves less financial liability and faster resolution.

Which Option Is Right for Struggling Homeowners?

Struggling homeowners facing mortgage default must carefully evaluate foreclosure, deed in lieu, and short sale options to minimize financial damage and credit impact. Foreclosure typically results in the most severe credit consequences and prolonged legal proceedings, while a deed in lieu offers a quicker resolution by voluntarily transferring property ownership to the lender, potentially preserving credit scores and avoiding public foreclosure records. Short sales can also be viable, allowing sale of the home for less than the owed mortgage balance with lender approval, often minimizing credit damage and providing more control over the outcome.

Frequently Asked Questions on Foreclosure and Deed in Lieu

Foreclosure involves a lender legally repossessing a property due to the borrower's failure to meet mortgage obligations, typically resulting in a public auction, while a deed in lieu of foreclosure allows the borrower to voluntarily transfer ownership to the lender to avoid foreclosure proceedings. Frequently asked questions on foreclosure cover timelines, impacts on credit scores, and options to avoid it, whereas inquiries on deed in lieu focus on eligibility, how it affects credit compared to foreclosure, and potential tax consequences. Understanding these differences helps homeowners make informed decisions to mitigate financial damage during mortgage default situations.

Infographic: Foreclosure vs Deed in Lieu

relatioo.com

relatioo.com