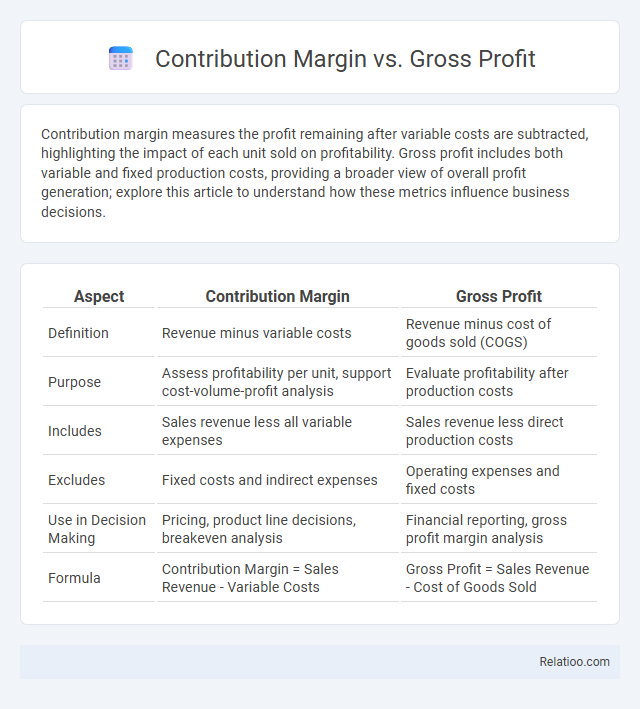

Contribution margin measures the profit remaining after variable costs are subtracted, highlighting the impact of each unit sold on profitability. Gross profit includes both variable and fixed production costs, providing a broader view of overall profit generation; explore this article to understand how these metrics influence business decisions.

Table of Comparison

| Aspect | Contribution Margin | Gross Profit |

|---|---|---|

| Definition | Revenue minus variable costs | Revenue minus cost of goods sold (COGS) |

| Purpose | Assess profitability per unit, support cost-volume-profit analysis | Evaluate profitability after production costs |

| Includes | Sales revenue less all variable expenses | Sales revenue less direct production costs |

| Excludes | Fixed costs and indirect expenses | Operating expenses and fixed costs |

| Use in Decision Making | Pricing, product line decisions, breakeven analysis | Financial reporting, gross profit margin analysis |

| Formula | Contribution Margin = Sales Revenue - Variable Costs | Gross Profit = Sales Revenue - Cost of Goods Sold |

Understanding Contribution Margin: Definition and Importance

Contribution margin represents the amount remaining from sales revenue after variable costs are deducted, highlighting how much money is available to cover fixed costs and generate profit. Unlike gross profit, which subtracts only the cost of goods sold, contribution margin considers all variable expenses, making it crucial for analyzing product profitability and making informed business decisions. Understanding your contribution margin enables you to optimize pricing strategies and improve overall financial performance.

What is Gross Profit? Key Concepts Explained

Gross profit represents the revenue remaining after subtracting the cost of goods sold (COGS), highlighting the core profitability of your products before accounting for operating expenses. It serves as a crucial indicator of production efficiency and pricing strategy effectiveness. Understanding gross profit helps you evaluate how well your business generates profit from sales alone, separate from other operational costs.

Calculation Methods: Contribution Margin vs Gross Profit

Contribution margin is calculated by subtracting variable costs from total sales revenue, highlighting the amount available to cover fixed costs and generate profit. Gross profit is derived by subtracting the cost of goods sold (COGS), which includes both variable and some fixed production costs, from total sales revenue, reflecting the profitability of core business activities before operating expenses. Focusing on calculation, contribution margin exclusively deducts variable expenses, while gross profit accounts for all production costs embedded in COGS.

Components Included in Contribution Margin

Contribution margin primarily includes sales revenue minus variable costs such as direct materials, direct labor, and variable overhead, highlighting the funds available to cover fixed costs and generate profit. Gross profit differs by subtracting only the cost of goods sold (COGS), which typically includes both fixed and variable production costs, from sales revenue. Contribution margin provides clearer insight into cost behavior by isolating variable expenses, making it essential for break-even analysis and decision-making processes.

Elements Considered in Gross Profit

Gross profit primarily considers net sales revenue minus the cost of goods sold (COGS), including direct materials, direct labor, and manufacturing overhead. Unlike contribution margin, gross profit excludes variable selling and administrative expenses, focusing strictly on production costs. This distinction highlights gross profit's role in assessing production efficiency before accounting for operating expenses.

Role in Financial Analysis: Comparative Overview

Contribution Margin represents the revenue remaining after variable costs, crucial for assessing product-level profitability and guiding pricing decisions. Gross Profit accounts for total revenue minus the cost of goods sold, providing insights into overall production efficiency and business scalability. Contribution as a broader term emphasizes the impact of specific products or segments on covering fixed costs and generating profit, serving as a key metric for strategic financial analysis and resource allocation.

Impact on Business Decisions and Pricing Strategies

Contribution Margin measures the profitability of individual products by subtracting variable costs from sales revenue, directly impacting your pricing strategies to cover fixed costs and achieve target profits. Gross Profit includes all revenue minus the cost of goods sold, providing a broader view of overall business profitability that guides strategic decisions on product mix and cost control. Understanding the distinct roles of Contribution Margin and Gross Profit enables more precise decision-making, optimizing pricing and resource allocation for sustainable business growth.

Common Mistakes When Comparing Contribution Margin and Gross Profit

Confusing contribution margin with gross profit often leads to inaccurate financial analysis and decision-making errors since contribution margin specifically deducts variable costs while gross profit subtracts only cost of goods sold. You must clearly distinguish that contribution margin highlights the amount available to cover fixed costs and generate profit, whereas gross profit reflects overall profitability after direct production costs. Misinterpreting these metrics can result in misguided pricing strategies and poor cost control.

Industry Examples: Practical Applications and Insights

Contribution margin, gross profit, and contribution serve distinct roles in financial analysis across industries; for instance, in manufacturing, contribution margin highlights variable costs subtracted from sales to assess product profitability, while gross profit deducts all cost of goods sold reflecting overall production efficiency. Retail businesses leverage gross profit to evaluate inventory performance and pricing strategies, whereas contribution margin aids in determining break-even points and guiding promotional efforts. Service industries focus on contribution to analyze direct labor and materials costs, optimizing resource allocation for enhanced operational decisions and profitability insights.

Choosing the Right Metric for Your Business Goals

Contribution Margin reveals how much revenue remains after variable costs, directly influencing pricing and sales strategies. Gross Profit shows total revenue minus cost of goods sold, offering a broader view of profitability essential for understanding product efficiency. Choosing the right metric depends on your business goals: use Contribution Margin for operational decisions and Gross Profit for overall financial health analysis.

Infographic: Contribution Margin vs Gross Profit

relatioo.com

relatioo.com