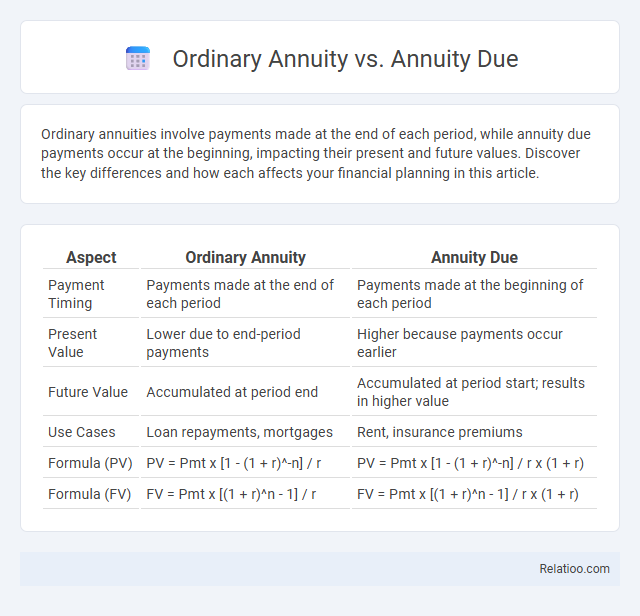

Ordinary annuities involve payments made at the end of each period, while annuity due payments occur at the beginning, impacting their present and future values. Discover the key differences and how each affects your financial planning in this article.

Table of Comparison

| Aspect | Ordinary Annuity | Annuity Due |

|---|---|---|

| Payment Timing | Payments made at the end of each period | Payments made at the beginning of each period |

| Present Value | Lower due to end-period payments | Higher because payments occur earlier |

| Future Value | Accumulated at period end | Accumulated at period start; results in higher value |

| Use Cases | Loan repayments, mortgages | Rent, insurance premiums |

| Formula (PV) | PV = Pmt x [1 - (1 + r)^-n] / r | PV = Pmt x [1 - (1 + r)^-n] / r x (1 + r) |

| Formula (FV) | FV = Pmt x [(1 + r)^n - 1] / r | FV = Pmt x [(1 + r)^n - 1] / r x (1 + r) |

Introduction to Ordinary Annuity and Annuity Due

An ordinary annuity involves fixed payments made at the end of each period, commonly used in loans and mortgages for consistent cash flow management. An annuity due requires payments at the beginning of each period, offering advantages in investment growth due to earlier payment timing. Understanding the timing differences between ordinary annuities and annuity due is crucial for accurate financial planning and valuation.

Key Definitions: Ordinary Annuity vs Annuity Due

An Ordinary Annuity involves equal payments made at the end of each period, commonly used in loans and mortgages, whereas an Annuity Due requires payments at the beginning of each period, often utilized in rent or insurance premiums. The primary distinction affects the present and future value calculations, with Annuity Due generally having higher values due to earlier payments. Understanding these key definitions helps in accurately evaluating cash flow timing and financial planning strategies.

Payment Timing Differences

Ordinary annuities require payments at the end of each period, while annuity dues mandate payments at the beginning, impacting the present and future value calculations. You benefit from annuity due payments occurring earlier, which increases the investment's growth potential due to additional compounding time. Understanding these payment timing differences is crucial for accurate financial planning and optimizing returns.

Calculation Methods Explained

Ordinary annuities involve payments made at the end of each period, calculated using the present value of an annuity formula PV = Pmt x [1 - (1 + r)^-n] / r, where Pmt is the payment amount, r is the interest rate per period, and n is the number of periods. Annuity due requires adjusting the ordinary annuity formula by multiplying by (1 + r) to account for payments occurring at the beginning of each period, reflecting a higher present value. General annuity calculations depend on the timing of payments, interest rate, and number of periods, differentiating between ordinary annuities and annuities due to determine accurate valuation in financial analysis.

Present Value Comparison

The present value of an annuity due is higher than that of an ordinary annuity because payments are made at the beginning of each period, allowing each payment to be discounted for one less period. Ordinary annuities involve payments at the end of each period, resulting in a lower present value compared to annuities due given the same payment amount, interest rate, and number of periods. Comparing both to a general annuity, the timing of payments is crucial in calculating present value, with the annuity due offering greater value due to earlier cash flows.

Future Value Analysis

Future value analysis of an ordinary annuity calculates the compound amount of equal payments made at the end of each period, while an annuity due assumes payments occur at the beginning, resulting in a higher future value due to one extra compounding period per payment. The general term annuity encompasses both types and refers to a series of equal cash flows over time. Understanding the timing of payments is crucial for accurate future value computations, impacting investment growth and retirement planning strategies.

Common Examples and Applications

Ordinary annuities, commonly used in mortgage payments and car loans, involve payments made at the end of each period, while annuity due schedules payments at the beginning, frequently applied in rent and insurance premiums. General annuities encompass both types and are utilized in pension plans and structured settlements, offering predictable income streams for retirees. Recognizing the timing difference in payment applications helps optimize cash flow management in financial planning.

Advantages and Disadvantages

Ordinary annuities require payments at the end of each period, offering simplicity and easier calculation but may delay your access to funds compared to annuity due, which demands payments at the beginning of each period, providing quicker accumulation of interest yet often higher initial costs. Annuity due's advantage lies in faster growth potential due to early payments, but it may reduce flexibility in cash flow management. Your choice depends on cash flow preferences and financial goals, balancing the trade-offs between immediate payment timing and overall return.

Choosing the Right Annuity Type

Choosing the right annuity type depends on your payment schedule and financial goals. An ordinary annuities involve payments at the end of each period, ideal for consistent cash flow needs, while annuity due requires payments at the beginning, benefiting those who prefer upfront income. Understanding these differences ensures your annuity matches your retirement strategy and maximizes your financial security.

Frequently Asked Questions (FAQs)

An ordinary annuity requires payments at the end of each period, while an annuity due involves payments at the beginning, affecting the total value of your investment over time. Frequently asked questions often address how the timing of payments differs and how this impacts the present and future value calculations of each annuity type. Understanding these distinctions helps you choose the right annuity plan based on cash flow needs and financial goals.

Infographic: Ordinary Annuity vs Annuity Due

relatioo.com

relatioo.com