A credit limit is the maximum amount a lender allows a borrower to charge on a credit card, while a spending limit is a self-imposed cap set by the cardholder to control expenses. Learn how understanding the difference between credit limits and spending limits can improve your financial management in this article.

Table of Comparison

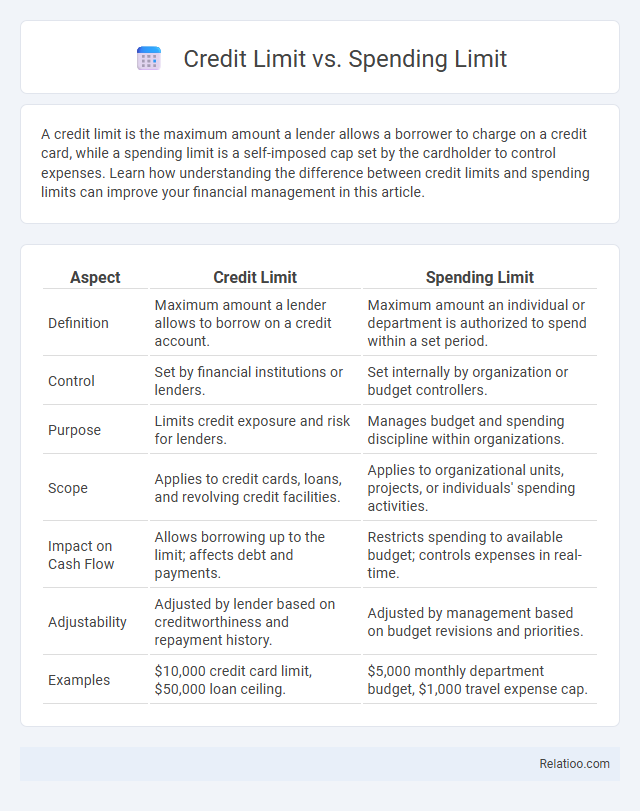

| Aspect | Credit Limit | Spending Limit |

|---|---|---|

| Definition | Maximum amount a lender allows to borrow on a credit account. | Maximum amount an individual or department is authorized to spend within a set period. |

| Control | Set by financial institutions or lenders. | Set internally by organization or budget controllers. |

| Purpose | Limits credit exposure and risk for lenders. | Manages budget and spending discipline within organizations. |

| Scope | Applies to credit cards, loans, and revolving credit facilities. | Applies to organizational units, projects, or individuals' spending activities. |

| Impact on Cash Flow | Allows borrowing up to the limit; affects debt and payments. | Restricts spending to available budget; controls expenses in real-time. |

| Adjustability | Adjusted by lender based on creditworthiness and repayment history. | Adjusted by management based on budget revisions and priorities. |

| Examples | $10,000 credit card limit, $50,000 loan ceiling. | $5,000 monthly department budget, $1,000 travel expense cap. |

Introduction to Credit Limit and Spending Limit

Credit Limit refers to the maximum amount of credit a lender allows you to borrow on a credit card or line of credit, serving as a cap on your total outstanding balance. Spending Limit is the predefined amount you can use for daily or specific transactions, often set by the issuer to control or monitor your spending behavior and manage risk. Understanding both limits helps you maintain healthy credit utilization and avoid exceeding your authorized borrowing capacity.

Defining Credit Limit

Credit Limit defines the maximum amount a lender allows you to borrow on a credit account, serving as a cap on your total outstanding balance. Spending Limit refers to restrictions on individual transactions or categories, controlling how much you can spend within a given timeframe. Understanding your Credit Limit is crucial for managing debt responsibly and maintaining a healthy credit score.

Understanding Spending Limit

Understanding spending limit is crucial for managing personal finances, as it defines the maximum amount a cardholder can spend within a billing cycle or transaction period. Unlike credit limit, which represents the total available credit extended by the issuer, the spending limit can be more restrictive based on preset rules or budget controls. Monitoring spending limits helps prevent overspending and maintain healthy credit utilization ratios, essential for credit score optimization.

Key Differences Between Credit Limit and Spending Limit

Credit limit refers to the maximum amount a lender allows a borrower to owe on a credit account, impacting overall credit utilization and credit score. Spending limit typically denotes a preset cap on expenditures within a billing cycle, often set by the cardholder or financial institution to control daily or monthly outflows. The key difference lies in credit limit defining total borrowing capacity, while spending limit enforces controlled usage within that capacity.

How Credit Limit Affects Your Finances

Credit limit represents the maximum amount a credit issuer allows you to borrow on a credit card or loan, directly impacting your credit utilization ratio, a key factor in credit score calculations. A higher credit limit can improve your credit score by lowering utilization, while overspending near or beyond the limit can lead to fees, higher interest rates, and damage to credit health. Managing your credit limit wisely helps maintain financial flexibility, avoids debt traps, and supports long-term financial stability.

The Importance of Managing Your Spending Limit

Managing your spending limit is crucial for maintaining financial health and avoiding debt accumulation. Your spending limit represents the maximum amount you can safely use within a specific period, while the credit limit is the maximum borrowing capacity granted by your credit card issuer. By monitoring and adhering to your spending limit, you ensure responsible credit usage, protect your credit score, and control your budget effectively.

Factors Influencing Your Credit Limit

Credit limit is the maximum amount a creditor allows on your credit account, while spending limit refers to the maximum you can spend within a specific period or category, often set by budgeting tools or card features. Factors influencing your credit limit include your credit score, income, debt-to-income ratio, credit utilization, and payment history, all of which reflect your ability to manage credit responsibly. Understanding these elements helps you manage your spending limit effectively and maintain a healthy credit profile.

How Spending Limits Impact Credit Scores

Spending limits control your daily or monthly expenses on credit accounts, directly affecting your credit utilization ratio, a key factor in credit score calculations. Unlike credit limits, which define the maximum borrowing capacity set by the lender, spending limits help you manage debt responsibly without exceeding your credit line, thereby preventing potential score damage from high utilization. By maintaining spending limits below 30% of your total credit limit, you demonstrate financial discipline that positively influences your credit score and overall creditworthiness.

Tips for Maximizing Credit and Spending Limits Responsibly

Understanding the differences between credit limit, spending limit, and daily spending limit is crucial for managing your finances effectively. Your credit limit represents the maximum amount you can borrow on your credit card, while spending limits often refer to restrictions set on transactions or categories, helping control your expenditure. To maximize these limits responsibly, monitor your spending regularly, set personalized alerts, and avoid reaching your credit limit to maintain a healthy credit score and financial stability.

Frequently Asked Questions about Credit and Spending Limits

Credit limits define the maximum amount you can borrow on your credit card or loan, directly affecting your available credit and credit score. Spending limits, often set by banks or apps, restrict the amount you can spend within a specific period for budgeting or security purposes. Your understanding of these limits helps manage credit responsibly, avoid overspending, and maintain a positive financial profile.

Infographic: Credit Limit vs Spending Limit

relatioo.com

relatioo.com