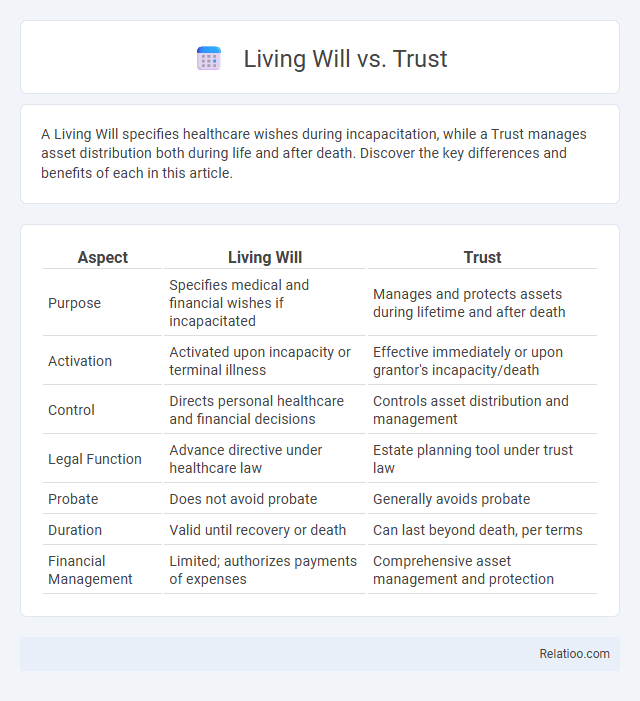

A Living Will specifies healthcare wishes during incapacitation, while a Trust manages asset distribution both during life and after death. Discover the key differences and benefits of each in this article.

Table of Comparison

| Aspect | Living Will | Trust |

|---|---|---|

| Purpose | Specifies medical and financial wishes if incapacitated | Manages and protects assets during lifetime and after death |

| Activation | Activated upon incapacity or terminal illness | Effective immediately or upon grantor's incapacity/death |

| Control | Directs personal healthcare and financial decisions | Controls asset distribution and management |

| Legal Function | Advance directive under healthcare law | Estate planning tool under trust law |

| Probate | Does not avoid probate | Generally avoids probate |

| Duration | Valid until recovery or death | Can last beyond death, per terms |

| Financial Management | Limited; authorizes payments of expenses | Comprehensive asset management and protection |

Understanding Living Wills and Trusts

Living wills and trusts serve distinct purposes in estate planning; a living will outlines medical care preferences if incapacitated, ensuring health care directives are followed, while a trust manages asset distribution during and after life, offering control over financial affairs. Understanding the legal frameworks of living wills and trusts is crucial for effective personal planning, as living wills address end-of-life decisions and trusts provide mechanisms to avoid probate and protect beneficiaries. Choosing between or combining these tools depends on individual needs, with living wills prioritizing health care autonomy and trusts emphasizing asset management and legacy preservation.

Key Differences Between Living Will and Trust

A Living Will outlines your healthcare preferences in case you become incapacitated, ensuring your medical decisions are respected, while a Trust primarily manages and protects your assets during your lifetime and after death. Your Living Will becomes effective only when you cannot communicate, whereas a Trust operates continuously and can help avoid probate, providing financial security and asset management. Understanding these key differences equips you to plan both your healthcare and estate effectively.

Purpose and Functionality of a Living Will

A Living Will serves as a legal document that outlines Your healthcare preferences if You become incapacitated and unable to communicate, focusing primarily on medical treatment decisions. Unlike a Trust, which manages Your assets and their distribution during and after Your lifetime, a Living Will specifically addresses the purpose of guiding medical professionals and family members on end-of-life care. This ensures Your treatment aligns with Your wishes, avoiding unnecessary interventions or prolonged suffering.

Main Features of a Trust

A trust is a legal arrangement where a grantor transfers assets to a trustee to manage for the benefit of beneficiaries, offering flexibility in asset distribution and probate avoidance. Unlike a living will, which details healthcare preferences, or a living trust that can serve estate planning purposes, a standard trust primarily focuses on protecting and managing your assets during your lifetime and after death. Your trust can specify conditions for asset use, ensuring your wishes are followed while providing potential tax advantages and privacy.

Legal Requirements for Living Wills and Trusts

Living wills and trusts serve distinct legal purposes, with living wills primarily addressing your healthcare preferences under specific state legal requirements, including witnessing and notarization to ensure validity. Trusts, governed by state trust laws, require formal creation through a written agreement, often notarized, to manage assets efficiently and avoid probate. Understanding these differing legal frameworks helps you effectively plan for both healthcare decisions and asset management.

Benefits of Setting Up a Living Will

Setting up a living will ensures that your healthcare preferences are respected during critical medical situations, avoiding confusion for family members and medical personnel. Unlike trusts that primarily manage financial assets, a living will directly addresses end-of-life care decisions, providing clear instructions about life-sustaining treatments. Establishing a living will helps reduce emotional stress on loved ones by clarifying your wishes regarding medical interventions and palliative care.

Advantages of Establishing a Trust

Establishing a trust offers significant advantages, including avoiding probate, providing greater control over asset distribution, and protecting your privacy by keeping details out of public court records. Trusts can also offer tax benefits and protection against creditors, ensuring your beneficiaries receive the intended assets without unnecessary delays or legal complications. You can tailor the terms to meet specific needs, making a trust a flexible and powerful estate planning tool compared to a living will or simple will.

Choosing Between a Living Will and Trust

Choosing between a living will and a trust depends on your specific estate planning goals and needs; a living will primarily outlines your medical care preferences if you become incapacitated, while a trust manages and protects your assets during your lifetime and after death. Your living will ensures clear directives for healthcare decisions, avoiding family disputes, whereas a trust offers control over asset distribution and potential tax benefits. Understanding the distinct purposes and benefits of each can help you make an informed decision tailored to your personal and financial circumstances.

Common Mistakes in Estate Planning

Common mistakes in estate planning often include confusing a living will, trust, and power of attorney, leading to gaps in asset management and healthcare directives. You might fail to update your trust or living will regularly, which can result in outdated instructions that don't reflect your current wishes or family circumstances. Ensuring clarity between these documents and working with an experienced estate planning attorney helps prevent costly legal disputes and protects your legacy effectively.

Frequently Asked Questions About Living Wills and Trusts

A Living Will outlines your healthcare preferences in case you become incapacitated, while a Trust manages your assets during and after your lifetime. Frequently asked questions often address the differences in control, costs, and legal formalities between these documents. Understanding how a Living Will and Trust interact can ensure your wishes are honored and your estate is managed efficiently.

Infographic: Living Will vs Trust

relatioo.com

relatioo.com