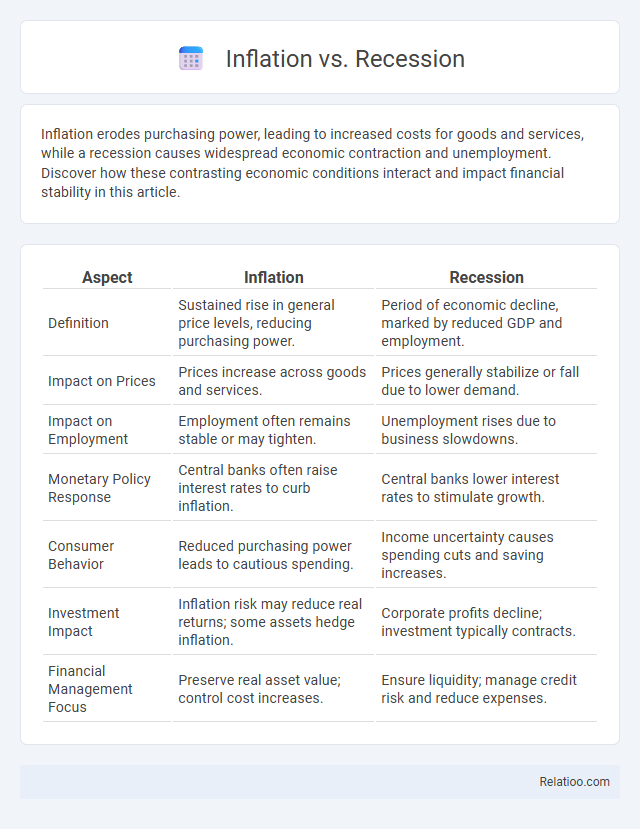

Inflation erodes purchasing power, leading to increased costs for goods and services, while a recession causes widespread economic contraction and unemployment. Discover how these contrasting economic conditions interact and impact financial stability in this article.

Table of Comparison

| Aspect | Inflation | Recession |

|---|---|---|

| Definition | Sustained rise in general price levels, reducing purchasing power. | Period of economic decline, marked by reduced GDP and employment. |

| Impact on Prices | Prices increase across goods and services. | Prices generally stabilize or fall due to lower demand. |

| Impact on Employment | Employment often remains stable or may tighten. | Unemployment rises due to business slowdowns. |

| Monetary Policy Response | Central banks often raise interest rates to curb inflation. | Central banks lower interest rates to stimulate growth. |

| Consumer Behavior | Reduced purchasing power leads to cautious spending. | Income uncertainty causes spending cuts and saving increases. |

| Investment Impact | Inflation risk may reduce real returns; some assets hedge inflation. | Corporate profits decline; investment typically contracts. |

| Financial Management Focus | Preserve real asset value; control cost increases. | Ensure liquidity; manage credit risk and reduce expenses. |

Understanding Inflation and Recession: Key Definitions

Inflation represents the general rise in prices reducing your purchasing power, while recession is an economic downturn characterized by declining GDP and increased unemployment. Understanding inflation involves recognizing its causes such as demand-pull or cost-push factors, and how it impacts consumer behavior and savings. Recession indicates a significant contraction in economic activity affecting businesses and job markets, emphasizing the importance of monitoring indicators like GDP growth rates and unemployment levels.

Causes of Inflation vs Causes of Recession

Inflation is primarily caused by demand-pull factors such as increased consumer spending, supply chain disruptions, and rising production costs, while cost-push inflation arises from higher wages and raw material prices. In contrast, a recession is triggered by factors like declining consumer confidence, falling investment, high interest rates, and reduced government spending, which result in decreased economic activity and rising unemployment. Understanding these distinct causes is crucial for policymakers to implement targeted measures that stabilize prices and promote sustainable economic growth.

Economic Indicators: Spotting Inflation and Recession

Economic indicators like GDP growth rate, unemployment rate, and Consumer Price Index (CPI) are crucial for spotting inflation and recession trends. Inflation is characterized by rising CPI and diminishing purchasing power, whereas a recession is marked by negative GDP growth and rising unemployment. Monitoring these indicators helps you make informed financial decisions and anticipate economic shifts.

How Inflation Impacts Households and Businesses

Inflation erodes purchasing power, causing household budgets to stretch thinner as prices for essentials like food, energy, and housing rise. Businesses face increased costs for raw materials and labor, which can lead to higher prices for consumers or squeezed profit margins. Your financial planning must account for inflation's impact on savings, borrowing costs, and overall economic stability to maintain resilience during economic fluctuations.

Recession Effects on Employment and Investment

Recession significantly impacts employment by causing widespread job losses and increased unemployment rates due to reduced consumer demand and business revenues. Investment declines sharply as companies postpone or cancel capital expenditures, creating a negative cycle that slows economic growth further. These effects contrast with inflation, where rising prices can erode purchasing power but do not necessarily trigger the same level of employment or investment reduction seen in recessions.

Government Policies: Tackling Inflation vs Recession

Government policies targeting inflation often involve tightening monetary measures such as raising interest rates to reduce consumer spending and control price rises. In contrast, recession-fighting strategies typically emphasize expansionary fiscal policies like increased public spending and tax cuts to stimulate economic growth and job creation. Your understanding of these distinct approaches helps in recognizing how policy decisions can either stabilize prices or boost economic activity depending on the economic challenge faced.

Historical Examples: Inflationary vs Recessionary Periods

Historical examples illustrate inflationary periods such as the 1970s stagflation, marked by soaring oil prices and double-digit inflation, contrasting sharply with recessionary periods like the 2008 financial crisis, characterized by significant GDP contraction and rising unemployment. Inflationary eras often feature persistent demand-pull or cost-push pressures, exemplified by Zimbabwe's hyperinflation in the late 2000s, while recessionary phases demonstrate reduced consumer spending and investment, as seen during the Great Depression of the 1930s. Analyzing these timelines highlights the dynamic impacts on economic stability, monetary policy responses, and long-term market adjustments.

Inflation or Recession: Which is Worse for the Economy?

Inflation erodes purchasing power and can lead to uncertainty in investment, while recession results in higher unemployment and reduced consumer spending, impacting GDP growth negatively. Moderate inflation is often manageable, but runaway inflation or deep recessions both disrupt economic stability significantly. Policymakers emphasize controlling inflation to avoid stagflation, a scenario where inflation and recession coexist, worsening economic conditions.

Strategies for Investors During Inflation and Recession

During inflation, investors should focus on assets that traditionally hedge against rising prices, such as commodities, real estate, and Treasury Inflation-Protected Securities (TIPS). In a recession, preserving capital becomes crucial, so diversifying into defensive stocks, high-quality bonds, and cash equivalents can protect your portfolio. Understanding these strategies helps you navigate market volatility and optimize returns despite economic uncertainties.

Preparing for the Future: Managing Inflation and Recession Risks

Effective preparation for future economic uncertainties involves adopting strategies that mitigate the impacts of both inflation and recession. Diversifying investments across asset classes such as stocks, bonds, and real estate can protect capital during inflationary pressures and economic downturns. Maintaining liquidity and building emergency savings provide essential buffers to manage cash flow disruptions caused by fluctuating inflation rates and recessive periods.

Infographic: Inflation vs Recession

relatioo.com

relatioo.com