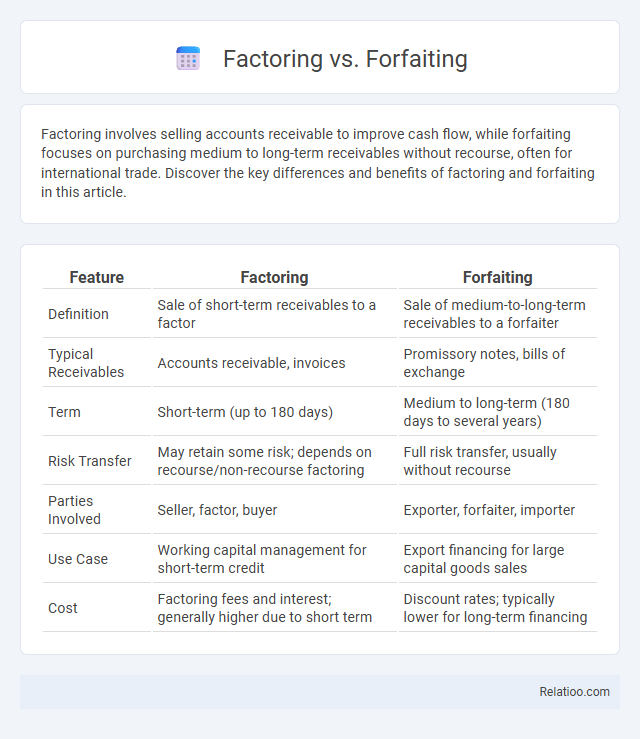

Factoring involves selling accounts receivable to improve cash flow, while forfaiting focuses on purchasing medium to long-term receivables without recourse, often for international trade. Discover the key differences and benefits of factoring and forfaiting in this article.

Table of Comparison

| Feature | Factoring | Forfaiting |

|---|---|---|

| Definition | Sale of short-term receivables to a factor | Sale of medium-to-long-term receivables to a forfaiter |

| Typical Receivables | Accounts receivable, invoices | Promissory notes, bills of exchange |

| Term | Short-term (up to 180 days) | Medium to long-term (180 days to several years) |

| Risk Transfer | May retain some risk; depends on recourse/non-recourse factoring | Full risk transfer, usually without recourse |

| Parties Involved | Seller, factor, buyer | Exporter, forfaiter, importer |

| Use Case | Working capital management for short-term credit | Export financing for large capital goods sales |

| Cost | Factoring fees and interest; generally higher due to short term | Discount rates; typically lower for long-term financing |

Introduction to Factoring and Forfaiting

Factoring and forfaiting are financial solutions designed to improve cash flow by converting receivables into immediate funds for businesses. Factoring involves selling short-term accounts receivable to a third party (factor) at a discount, allowing Your company to receive quick payment and outsource debt collection. Forfaiting, on the other hand, deals with medium to long-term international trade receivables, where the forfaiter purchases the receivables without recourse, providing exporters with risk-free cash flow and protection against buyer default.

Definition and Key Concepts

Factoring involves a business selling its accounts receivable to a third party at a discount for immediate cash flow, focusing on short-term credit management. Forfaiting is the purchase of medium- to long-term export receivables without recourse, transferring both credit and political risks to the forfaiter. Financial agreements are legally binding contracts outlining terms for financing arrangements, including interest rates, repayment schedules, and collateral, ensuring clarity and enforceability between involved parties.

How Factoring Works

Factoring involves a business selling its accounts receivable to a third party, called a factor, at a discount in exchange for immediate cash flow. The factor assumes the responsibility of collecting payments from the customers, thereby improving the business's working capital and reducing credit risk. This financial tool is especially valuable for companies seeking to accelerate cash inflows without waiting for invoice due dates.

How Forfaiting Works

Forfaiting involves the purchase of medium- to long-term receivables from exporters, usually without recourse, where the forfaiter assumes all payment risk in exchange for a discount. The forfaiter provides immediate cash to the exporter by buying promissory notes, bills of exchange, or other trade documents, allowing exporters to improve cash flow and transfer credit risk. Unlike factoring, forfaiting typically covers international transactions with higher value and longer payment terms, while financial agreements encompass broader contractual arrangements for funding.

Differences Between Factoring and Forfaiting

Factoring involves selling your accounts receivable to a financial institution to improve cash flow, while forfaiting is the purchase of medium to long-term trade receivables, typically with guarantees like promissory notes or bills of exchange. Factoring is usually used for short-term financing with recourse or non-recourse options, whereas forfaiting is a non-recourse method focused on export receivables without recourse to the exporter. Your choice depends on the duration of receivables, risk tolerance, and the type of transaction involved.

Advantages of Factoring

Factoring offers businesses immediate cash flow by converting receivables into working capital, eliminating the wait for customer payments and enhancing liquidity. You benefit from professional management of credit risks and collections, reducing administrative burdens and improving focus on core operations. Factoring also supports business growth by providing flexible financing without incurring debt or affecting credit ratings.

Benefits of Forfaiting

Forfaiting offers exporters non-recourse financing, eliminating the risk of bad debts by selling medium- to long-term receivables at a discount for immediate cash flow improvement. Unlike factoring, forfaiting typically involves large, single international transactions and does not require ongoing management of receivables, benefiting companies with capital-intensive projects. Its structured payment terms and flexibility in currency options enhance risk management and liquidity for exporters dealing with high-value exports.

Risks and Challenges

Factoring involves selling your receivables to a third party, exposing you to risks such as high discount fees and potential loss of customer relationships. Forfaiting transfers medium- to long-term export receivables without recourse, but it carries challenges like higher costs and limited availability for certain markets. Financial agreements, depending on their type, may introduce complexities related to contractual terms, credit risk, and liquidity management that you must carefully evaluate.

Choosing the Right Option: Factors to Consider

When choosing between factoring, forfaiting, and financial agreements, you must evaluate factors such as the nature of your receivables, risk tolerance, and financing cost. Factoring suits short-term receivables with ongoing credit management needs, while forfaiting is ideal for large, one-off exports with guaranteed payment risk transfer. Financial agreements provide more flexible terms but often involve higher collateral requirements and stricter credit assessments tailored to your company's cash flow and growth goals.

Conclusion: Factoring vs Forfaiting

Factoring and forfaiting are both financial solutions designed to improve Your cash flow by converting receivables into immediate funds, but they differ in scope and risk management. Factoring typically involves shorter-term receivables and continuous management of accounts, while forfaiting focuses on non-recourse financing of medium to long-term export receivables, usually without recourse to the seller. Choosing between factoring and forfaiting depends on the transaction size, risk tolerance, and the nature of Your business relationship with buyers.

Infographic: Factoring vs Forfaiting

relatioo.com

relatioo.com