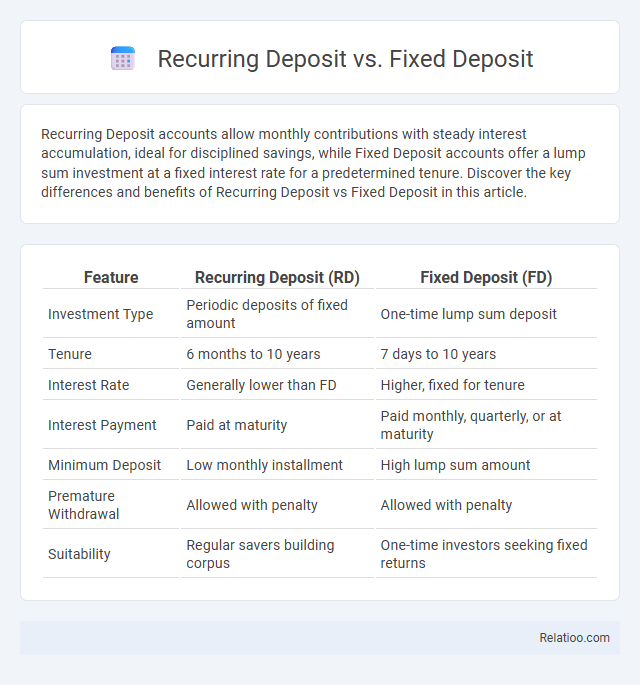

Recurring Deposit accounts allow monthly contributions with steady interest accumulation, ideal for disciplined savings, while Fixed Deposit accounts offer a lump sum investment at a fixed interest rate for a predetermined tenure. Discover the key differences and benefits of Recurring Deposit vs Fixed Deposit in this article.

Table of Comparison

| Feature | Recurring Deposit (RD) | Fixed Deposit (FD) |

|---|---|---|

| Investment Type | Periodic deposits of fixed amount | One-time lump sum deposit |

| Tenure | 6 months to 10 years | 7 days to 10 years |

| Interest Rate | Generally lower than FD | Higher, fixed for tenure |

| Interest Payment | Paid at maturity | Paid monthly, quarterly, or at maturity |

| Minimum Deposit | Low monthly installment | High lump sum amount |

| Premature Withdrawal | Allowed with penalty | Allowed with penalty |

| Suitability | Regular savers building corpus | One-time investors seeking fixed returns |

Introduction to Recurring Deposit and Fixed Deposit

Recurring Deposit (RD) is a financial instrument where individuals deposit a fixed amount regularly for a predetermined tenure, earning interest at a rate comparable to Fixed Deposits (FD). Fixed Deposit allows a lump sum deposit for a fixed period, offering higher interest rates than regular savings accounts and guaranteed returns upon maturity. Both RD and FD serve as secure investment options with varying liquidity and deposit structures suitable for disciplined savings and wealth growth.

Key Differences Between RD and FD

Recurring Deposit (RD) requires regular monthly deposits of a fixed amount, whereas Fixed Deposit (FD) involves a lump sum investment for a predetermined tenure. RD offers flexibility for disciplined savings with lower minimum amounts, while FD generally provides higher interest rates due to larger deposits and fixed tenure. Both instruments guarantee a fixed return, but premature withdrawal penalties and interest payout schemes vary significantly between RD and FD.

How Recurring Deposits Work

Recurring Deposits (RDs) require you to invest a fixed amount monthly for a predetermined tenure, earning interest compounded quarterly, which makes it an ideal disciplined savings tool. Unlike Fixed Deposits (FDs) where a lump sum is invested once, RDs help you accumulate wealth gradually while offering higher interest rates than regular Savings accounts. Your consistent contributions in RDs can maximize returns through compounding, providing a predictable and secure way to build a substantial corpus over time.

How Fixed Deposits Work

Fixed deposits work by allowing you to invest a lump sum amount for a predetermined tenure at a fixed interest rate, ensuring guaranteed returns higher than typical savings accounts. Unlike recurring deposits where you invest small amounts periodically, fixed deposits lock your money until maturity, providing stability and financial planning certainty. Your interest can either be compounded quarterly or paid out monthly, maximizing growth based on the chosen tenure and bank policies.

Interest Rates Comparison: RD vs FD

Interest rates for Recurring Deposits (RD) typically range from 5.5% to 7.5% per annum, similar to Fixed Deposit (FD) rates which can go up to 7.5% or higher depending on tenure and bank policies. Savings accounts usually offer lower interest rates around 3% to 4%, making RD and FD better options for higher returns on your savings. Understanding the subtle differences in compounding frequency and lock-in periods between RD and FD can help you maximize your interest earnings efficiently.

Flexibility and Tenure Options

Recurring Deposits offer high flexibility with monthly contributions and tenure options typically ranging from 6 months to 10 years, allowing systematic savings. Fixed Deposits provide locked-in funds for pre-defined periods, usually between 7 days to 10 years, with minimal withdrawal flexibility but higher interest rates. Savings accounts present the greatest liquidity and flexibility, permitting unlimited deposits and withdrawals, but with lower interest rates and no fixed tenure.

Risk Factors and Safety

Recurring Deposits (RDs) and Fixed Deposits (FDs) offer higher safety and lower risk compared to Savings accounts due to their fixed tenure and assured returns backed by banks and government insurance schemes like the Deposit Insurance and Credit Guarantee Corporation (DICGC). Your Savings account carries liquidity benefits but higher risk exposure due to fluctuating interest rates and inflation eroding real returns. Understanding these risk factors helps in choosing the right instrument for capital preservation and financial security.

Premature Withdrawal Rules

Recurring Deposit (RD) generally allows premature withdrawal but often imposes a penalty on the interest earned, reducing overall returns. Fixed Deposit (FD) permits early withdrawal before maturity with a deduction in interest rates or a penalty fee, which varies depending on the bank's policy and the deposit tenure completed. Savings accounts offer the highest liquidity with no restrictions or penalties on withdrawals, making them suitable for emergency fund access but yielding the lowest interest rates compared to RD and FD.

Tax Implications for RD and FD

Recurring Deposits (RD) and Fixed Deposits (FD) both attract tax on the interest earned, which is added to your taxable income and taxed according to your income slab, unlike Savings Accounts where interest up to Rs10,000 is exempt under Section 80TTA. While TDS (Tax Deducted at Source) is applicable on FD interest exceeding Rs40,000 (Rs50,000 for senior citizens), no TDS applies on RD interest during the tenure as it is paid out at maturity but still taxable. Choosing between RD and FD should include consideration of your tax bracket and liquidity needs, as tax implications directly affect the post-tax returns.

Which Is Better: RD or FD?

Recurring Deposits (RD) and Fixed Deposits (FD) both offer guaranteed returns with varying flexibility; RD requires regular monthly deposits, ideal for disciplined savings, while FD involves a lump-sum investment with fixed tenure and interest rates. FD typically offers slightly higher interest rates compared to RD, making it better for larger, one-time investments aiming for higher returns over a fixed period. Choosing between RD and FD depends on individual cash flow and financial goals, with FD suited for lump-sum investment and RD better for those prioritizing systematic savings with moderate returns.

Infographic: Recurring Deposit vs Fixed Deposit

relatioo.com

relatioo.com