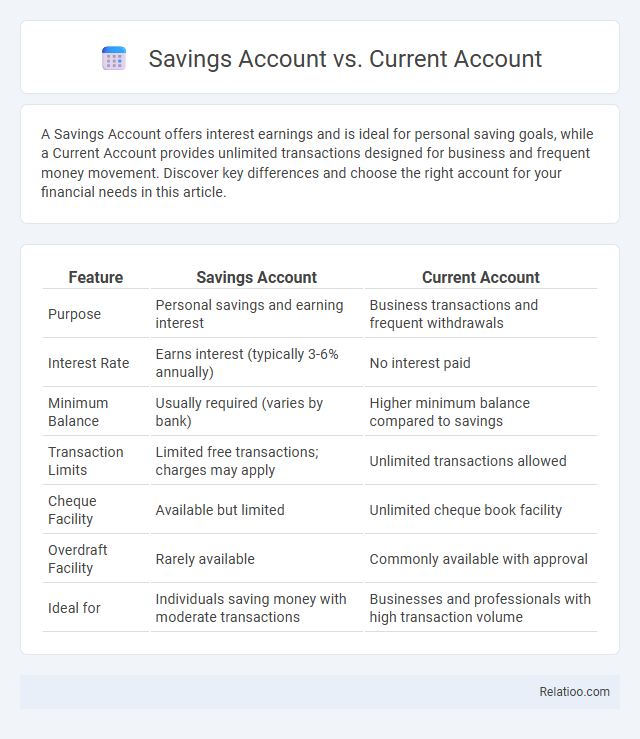

A Savings Account offers interest earnings and is ideal for personal saving goals, while a Current Account provides unlimited transactions designed for business and frequent money movement. Discover key differences and choose the right account for your financial needs in this article.

Table of Comparison

| Feature | Savings Account | Current Account |

|---|---|---|

| Purpose | Personal savings and earning interest | Business transactions and frequent withdrawals |

| Interest Rate | Earns interest (typically 3-6% annually) | No interest paid |

| Minimum Balance | Usually required (varies by bank) | Higher minimum balance compared to savings |

| Transaction Limits | Limited free transactions; charges may apply | Unlimited transactions allowed |

| Cheque Facility | Available but limited | Unlimited cheque book facility |

| Overdraft Facility | Rarely available | Commonly available with approval |

| Ideal for | Individuals saving money with moderate transactions | Businesses and professionals with high transaction volume |

Introduction to Savings and Current Accounts

Savings accounts offer a secure place to store your money while earning interest, ideal for individuals looking to save for future needs. Current accounts provide easy access to funds with unlimited transactions, tailored for businesses or individuals requiring frequent account activity. Understanding the features of savings and current accounts helps you choose the right option to manage your finances effectively.

Key Differences Between Savings and Current Accounts

Savings accounts primarily serve individuals aiming to grow their funds through interest earnings, with withdrawal limits and fewer transactional capabilities. Current accounts cater to businesses and high-frequency transactions, offering unlimited withdrawals and no interest accrual. Key differences include interest rates, transaction limits, minimum balance requirements, and intended usage--savings accounts emphasize fund accumulation, while current accounts prioritize liquidity and operational efficiency.

Purpose and Ideal Users of Each Account

Savings accounts are designed for individuals seeking to save money while earning interest, making them ideal for personal finance management and long-term goals. Current accounts cater to businesses and professionals who require frequent transactions, offering unlimited withdrawals and deposits without interest. Your choice depends on whether you prioritize growth through interest (savings account) or seamless transactional capabilities for daily business operations (current account).

Interest Rates: Savings vs Current Accounts

Savings accounts typically offer higher interest rates compared to current accounts, making them ideal for individuals looking to grow their deposits over time. Current accounts generally provide little to no interest but offer greater flexibility for frequent transactions and business operations. Interest rates on savings accounts can range from 3% to 7% annually, depending on the bank and economic conditions, whereas current accounts usually have rates close to 0%.

Transaction Limits and Flexibility

Savings accounts typically offer higher interest rates but impose transaction limits such as a maximum number of withdrawals per month to encourage saving. Current accounts provide greater transaction flexibility with unlimited deposits and withdrawals, making them ideal for frequent business activities. Savings accounts prioritize long-term growth with restricted access, while current accounts facilitate continuous cash flow without restrictions, suiting different financial needs.

Account Opening Requirements

Savings account opening requirements generally include proof of identity, proof of address, and an initial deposit, designed to encourage personal savings with limited transactions. Current account opening mandates stricter documentation such as business registration certificates and tax identification numbers, catering mainly to businesses requiring frequent transactions. Your choice between savings and current accounts should consider the ease of meeting these requirements based on your personal or business financial needs.

Fees and Maintenance Charges

Savings accounts typically have lower maintenance charges and minimal fees, focusing on encouraging deposits and interest earnings, whereas current accounts often involve higher fees due to their frequent transaction nature aimed at businesses. Savings accounts may charge fees if the balance falls below a minimum threshold, while current accounts often include monthly or annual service charges regardless of balance. Transaction fees in current accounts are usually higher due to unlimited withdrawals, while savings accounts limit free transactions to manage costs.

Benefits and Drawbacks of Savings Accounts

Savings accounts offer interest earnings and easy access to funds, making them ideal for individuals aiming to grow their deposits with minimal risk; however, they often impose withdrawal limits and lower transactional flexibility compared to current accounts. Current accounts provide unlimited transactions and are suited for daily business activities but typically do not earn interest, reducing potential growth on stored funds. Savings accounts benefit from FDIC or similar insurance protection, enhancing security, but may include fees or minimum balance requirements that could diminish overall returns.

Benefits and Drawbacks of Current Accounts

Current accounts offer unlimited transactions and easy access to funds, making them ideal for daily business operations and frequent payments. However, they generally provide little to no interest on deposited balances, which limits your potential for savings growth. The lack of interest and possible maintenance fees can be drawbacks compared to savings accounts that offer interest earnings but restrict the number of transactions.

How to Choose the Right Account for Your Needs

Evaluate your financial goals and spending habits to choose the right account for your needs between savings, current, and savings accounts. Savings accounts offer interest on deposits and are ideal for building emergency funds, while current accounts provide easy access for frequent transactions without interest benefits. Assess your requirement for liquidity, transaction frequency, and interest earnings to determine which account aligns best with Your financial lifestyle.

Infographic: Savings Account vs Current Account

relatioo.com

relatioo.com