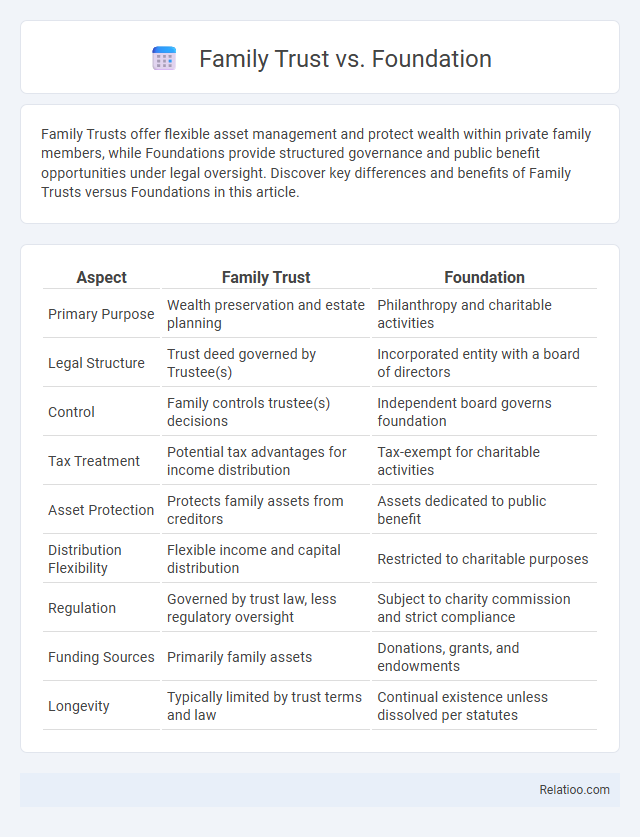

Family Trusts offer flexible asset management and protect wealth within private family members, while Foundations provide structured governance and public benefit opportunities under legal oversight. Discover key differences and benefits of Family Trusts versus Foundations in this article.

Table of Comparison

| Aspect | Family Trust | Foundation |

|---|---|---|

| Primary Purpose | Wealth preservation and estate planning | Philanthropy and charitable activities |

| Legal Structure | Trust deed governed by Trustee(s) | Incorporated entity with a board of directors |

| Control | Family controls trustee(s) decisions | Independent board governs foundation |

| Tax Treatment | Potential tax advantages for income distribution | Tax-exempt for charitable activities |

| Asset Protection | Protects family assets from creditors | Assets dedicated to public benefit |

| Distribution Flexibility | Flexible income and capital distribution | Restricted to charitable purposes |

| Regulation | Governed by trust law, less regulatory oversight | Subject to charity commission and strict compliance |

| Funding Sources | Primarily family assets | Donations, grants, and endowments |

| Longevity | Typically limited by trust terms and law | Continual existence unless dissolved per statutes |

Introduction to Family Trusts and Foundations

Family trusts provide a legal mechanism for You to manage and protect assets, ensuring wealth preservation and efficient estate planning. Foundations function as separate legal entities that hold and distribute assets, often used for philanthropic purposes and asset protection. Both structures offer distinct benefits in control, tax planning, and confidentiality tailored to Your specific family and financial goals.

Key Differences Between Family Trusts and Foundations

Family trusts and foundations differ primarily in their legal structure and purpose; family trusts are private arrangements used to manage and distribute assets for beneficiaries, while foundations are separate legal entities often established for philanthropic goals or long-term family wealth preservation. Family trusts provide flexibility in asset management and tax benefits by allowing income distribution among beneficiaries, whereas foundations offer greater control through a board of directors and are subject to more stringent reporting and regulatory requirements. Understanding these distinctions is crucial for estate planning, as family trusts prioritize beneficiary interests with fewer administrative burdens, while foundations emphasize charitable intent and fiduciary oversight.

Legal Structures and Jurisdictions

Family Trusts offer flexible legal structures for asset protection and estate planning, governed by trust law varying across jurisdictions like the US, Australia, and the UK. Foundations operate as separate legal entities with distinct governance, commonly used in jurisdictions such as Liechtenstein and Panama for philanthropy and private wealth management. Your choice between a Family Trust and a Foundation depends on factors including desired control, tax implications, and the specific legal framework of the jurisdiction in which you operate.

Purpose and Objectives

A Family Trust is primarily designed to manage and protect family wealth, ensuring asset distribution according to the settlor's wishes while minimizing tax liabilities. Foundations serve philanthropic, charitable, or succession purposes, often providing a more formal structure for asset protection with rigid governance rules. Comparing Family Trust vs Foundation highlights that Family Trusts emphasize flexible wealth management and succession among beneficiaries, whereas Foundations focus on long-term preservation and charitable objectives.

Governance and Management

Family Trust governance typically involves trustees who manage assets on behalf of beneficiaries, ensuring fiduciary duties and flexibility in decision-making. Foundations operate under stricter regulatory frameworks with a board of directors, emphasizing charitable purposes and formalized governance structures. Your choice between a Family Trust and a Foundation depends on the desired level of control, transparency, and regulatory compliance in managing and protecting family assets.

Tax Implications and Benefits

Family trusts offer flexible income distribution and potential tax benefits by allowing income splitting among beneficiaries, reducing overall tax liability. Foundations provide asset protection and estate planning advantages but are subject to specific regulatory requirements and may have less favorable tax treatment compared to trusts. Understanding your financial goals helps determine whether a family trust or foundation better optimizes tax implications and benefits tailored to your estate planning strategy.

Asset Protection and Privacy

Family trusts offer robust asset protection by legally separating ownership from control, ensuring assets are shielded from creditors and legal claims while maintaining beneficiary privacy. Foundations provide strong asset protection with an independent governing structure, enhancing confidentiality and long-term wealth preservation but usually involve more regulatory oversight. Comparing both, family trusts typically deliver greater flexibility and privacy for individuals seeking personalized control, whereas foundations emphasize formal governance and public transparency, impacting the level of privacy and protection.

Succession Planning and Inheritance

In succession planning and inheritance, a Family Trust offers flexibility by allowing You to designate beneficiaries and manage asset distribution over generations while minimizing probate and tax implications. Foundations provide structured control and asset protection, often used for philanthropic goals but with less direct beneficiary involvement compared to Family Trusts. Family Limited Partnerships combine asset control with estate tax advantages, enabling You to transfer wealth efficiently while maintaining decision-making authority within the family.

Costs and Administration

Family trusts typically involve moderate setup fees and annual administration costs, including trustee fees and tax filings, offering flexibility in asset management and distribution. Foundations usually incur higher establishment expenses and ongoing administrative costs due to regulatory compliance and governance requirements, suited for long-term philanthropic goals. Comparing the two, family trusts generally provide a more cost-effective and simpler structure, while foundations demand greater financial and administrative commitment but deliver enhanced control and public benefit opportunities.

Choosing Between a Family Trust and a Foundation

Choosing between a Family Trust and a Foundation depends on your specific asset protection and estate planning needs, as Family Trusts offer flexible management of assets and income distribution, while Foundations provide a more structured and often charitable-focused approach with legal personality. Your decision should consider factors such as control, tax implications, and the long-term goals for wealth preservation or philanthropy. Evaluating the legal requirements and benefits of each entity ensures your estate strategy aligns with your financial objectives and family legacy.

Infographic: Family Trust vs Foundation

relatioo.com

relatioo.com