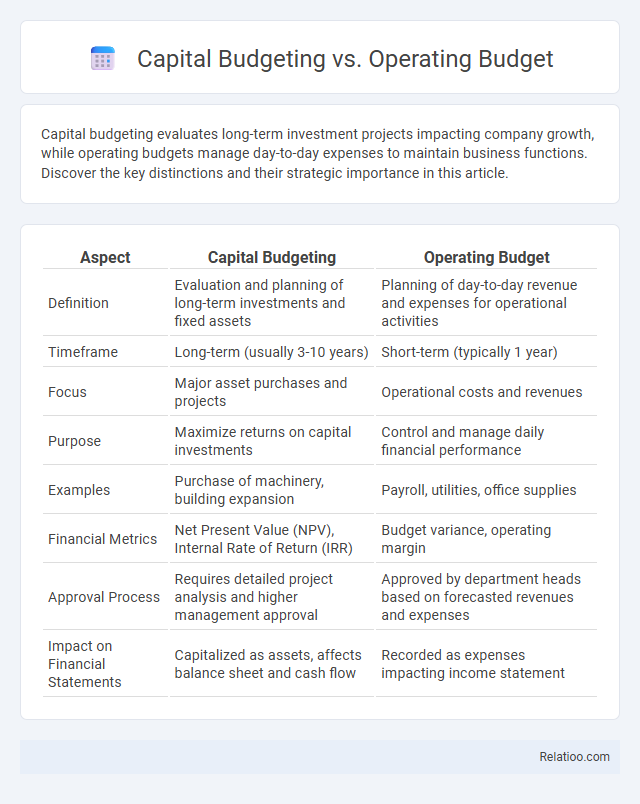

Capital budgeting evaluates long-term investment projects impacting company growth, while operating budgets manage day-to-day expenses to maintain business functions. Discover the key distinctions and their strategic importance in this article.

Table of Comparison

| Aspect | Capital Budgeting | Operating Budget |

|---|---|---|

| Definition | Evaluation and planning of long-term investments and fixed assets | Planning of day-to-day revenue and expenses for operational activities |

| Timeframe | Long-term (usually 3-10 years) | Short-term (typically 1 year) |

| Focus | Major asset purchases and projects | Operational costs and revenues |

| Purpose | Maximize returns on capital investments | Control and manage daily financial performance |

| Examples | Purchase of machinery, building expansion | Payroll, utilities, office supplies |

| Financial Metrics | Net Present Value (NPV), Internal Rate of Return (IRR) | Budget variance, operating margin |

| Approval Process | Requires detailed project analysis and higher management approval | Approved by department heads based on forecasted revenues and expenses |

| Impact on Financial Statements | Capitalized as assets, affects balance sheet and cash flow | Recorded as expenses impacting income statement |

Introduction to Capital and Operating Budgets

Capital budgeting involves evaluating long-term investments and projects to determine their potential profitability and impact on a company's financial health, while operating budgets focus on the day-to-day expenses and revenues necessary for running the business. The capital budget includes expenditures for assets like machinery, buildings, and technology upgrades, aimed at growth and expansion. Operating budgets cover costs such as salaries, utilities, and inventory, providing a framework for managing regular business operations efficiently.

Definition of Capital Budgeting

Capital budgeting refers to the process of evaluating and selecting long-term investments or projects that will generate future cash flows for a business, typically involving significant capital expenditures such as purchasing equipment, expanding facilities, or launching new products. Operating budget, in contrast, focuses on the day-to-day expenses and revenues required to run your business operations within a specific period, usually a fiscal year. Understanding the distinction helps you allocate resources efficiently, ensuring that strategic investments through capital budgeting complement short-term operational needs captured in the operating budget.

Definition of Operating Budget

An operating budget is a detailed projection of a company's expected revenues and expenses over a specific period, primarily focusing on day-to-day operational costs such as salaries, utilities, and materials. Unlike a capital budget, which deals with long-term investments in assets and infrastructure, the operating budget aims to manage short-term financial performance and resource allocation efficiently. Understanding your operating budget enables you to control operational expenses, optimize cash flow, and support strategic decision-making for sustainable business growth.

Key Differences Between Capital and Operating Budgets

Capital budgets focus on long-term investments in assets such as equipment, buildings, and infrastructure, emphasizing expenditures that provide benefits over multiple years. Operating budgets cover the day-to-day expenses required to run the business, including salaries, utilities, and maintenance costs, with a focus on short-term financial planning. The key differences lie in their time horizon, purpose, and impact on financial statements, where capital budgeting involves large, infrequent expenditures and operating budgets manage ongoing, recurring costs.

Objectives of Capital Budgeting

Capital budgeting focuses on evaluating and selecting long-term investment projects to maximize firm value by analyzing cash flows, risk, and return metrics such as Net Present Value (NPV) and Internal Rate of Return (IRR). Its primary objective is to allocate capital efficiently to projects that enhance profitability and achieve strategic growth while ensuring sustainable competitive advantage. In contrast, operating budgets manage day-to-day expenses and revenues to maintain financial control and operational efficiency within shorter time frames.

Objectives of Operating Budget

The operating budget primarily aims to forecast and control an organization's day-to-day expenses and revenues to ensure efficient resource allocation and cost management. It helps in setting financial targets for sales, production, and administrative costs, facilitating short-term planning and performance evaluation. Unlike the capital budgeting process, which focuses on long-term investments in assets, the operating budget centers on managing operational activities to meet immediate financial goals.

Examples of Capital Budget Items

Capital budgeting involves long-term investment decisions such as purchasing machinery, acquiring land, or constructing buildings, which are essential for asset growth and business expansion. Operating budgeting focuses on daily expenses like salaries, utilities, and rent that maintain ongoing business activities. The overall budget combines both aspects, balancing capital expenditures with operating costs to ensure financial stability and project profitability.

Examples of Operating Budget Items

Operating budget items typically include salaries and wages, utility expenses, office supplies, and maintenance costs that are necessary for the day-to-day functioning of a business. Capital budgeting, in contrast, involves evaluating and planning for long-term investments such as purchasing machinery or facility upgrades. Understanding the differences between your operating budget and capital budget helps ensure accurate financial planning and resource allocation.

Impact on Financial Planning and Decision-Making

Capital budgeting involves evaluating long-term investments and their potential to generate future cash flows, significantly influencing strategic financial planning and resource allocation. Operating budgets focus on short-term revenue and expense projections, enabling precise control over daily operations and improving immediate decision-making efficiency. Comprehensive budgeting integrates both capital and operating budgets, ensuring balanced financial planning that supports sustainable growth and risk management.

Choosing the Right Budget for Organizational Needs

Choosing the right budget for your organizational needs involves understanding the distinct functions of capital budgeting, operating budget, and general budget. Capital budgeting focuses on long-term investments in assets and projects that generate future value, while the operating budget manages day-to-day expenses and revenues to maintain efficient business operations. Your decision should align with whether your priority is strategic growth, operational control, or comprehensive financial planning to optimize resource allocation and drive sustainable success.

Infographic: Capital Budgeting vs Operating Budget

relatioo.com

relatioo.com