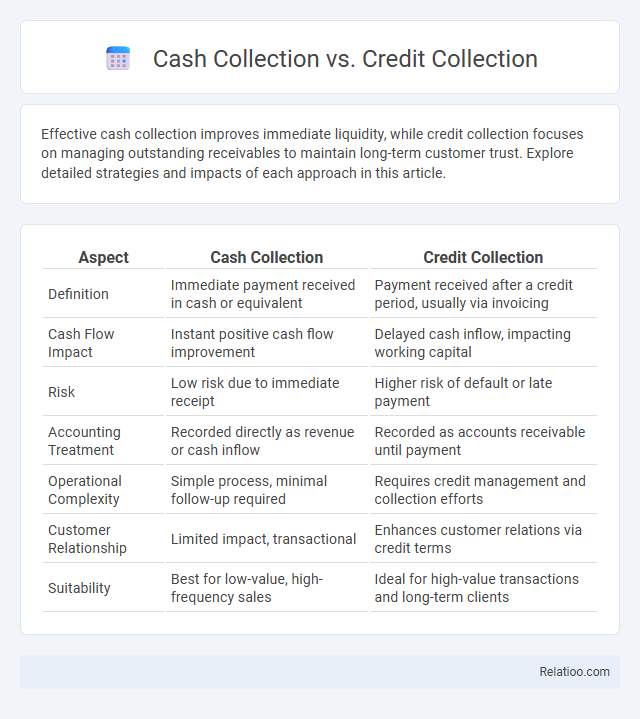

Effective cash collection improves immediate liquidity, while credit collection focuses on managing outstanding receivables to maintain long-term customer trust. Explore detailed strategies and impacts of each approach in this article.

Table of Comparison

| Aspect | Cash Collection | Credit Collection |

|---|---|---|

| Definition | Immediate payment received in cash or equivalent | Payment received after a credit period, usually via invoicing |

| Cash Flow Impact | Instant positive cash flow improvement | Delayed cash inflow, impacting working capital |

| Risk | Low risk due to immediate receipt | Higher risk of default or late payment |

| Accounting Treatment | Recorded directly as revenue or cash inflow | Recorded as accounts receivable until payment |

| Operational Complexity | Simple process, minimal follow-up required | Requires credit management and collection efforts |

| Customer Relationship | Limited impact, transactional | Enhances customer relations via credit terms |

| Suitability | Best for low-value, high-frequency sales | Ideal for high-value transactions and long-term clients |

Introduction to Cash Collection and Credit Collection

Cash collection involves the immediate gathering of payments, typically in cash or equivalent forms, ensuring swift cash flow for your business operations. Credit collection focuses on recovering payments from customers who have purchased goods or services on credit, managing outstanding invoices and minimizing bad debt risk. Understanding the distinctions between cash collection and credit collection is essential for optimizing your company's liquidity and financial health.

Key Differences Between Cash and Credit Collection

Cash collection involves the immediate receipt of payments, ensuring instant liquidity and minimizing credit risk, while credit collection focuses on managing outstanding invoices and ensuring timely payments from customers on credit terms. Your business benefits from efficient cash collection by improving cash flow, whereas credit collection requires monitoring customer creditworthiness and enforcing payment terms to reduce bad debts. Understanding these differences helps optimize your financial operations and maintain a healthy balance between liquidity and customer relations.

Advantages of Cash Collection

Cash collection ensures immediate liquidity, reducing the risk of bad debts and improving cash flow stability for businesses. This method minimizes administrative costs associated with tracking accounts receivable and follow-up procedures, enhancing overall operational efficiency. Businesses benefit from stronger financial control and quicker reinvestment opportunities when prioritizing cash collection over credit or general collection methods.

Benefits of Credit Collection

Credit collection improves your business cash flow by reducing the risk of late payments and bad debt, ensuring more predictable revenue streams. It enhances customer relationships through structured follow-up processes and flexible payment arrangements, which can increase customer loyalty and retention. Efficient credit collection also lowers administrative costs by streamlining the recovery process and minimizing the need for legal action.

Challenges in Cash Collection Processes

Cash collection faces challenges such as delayed payments, inaccurate cash application, and reconciliation issues that disrupt cash flow management. Inefficient communication between departments and customers often results in increased days sales outstanding (DSO) and elevated operational costs. Implementing automated cash application systems and real-time payment tracking can mitigate manual errors and accelerate cash collections.

Risks Associated with Credit Collection

Cash collection ensures immediate liquidity and minimal risk since payments occur at the point of sale, while credit collection involves delayed payment, increasing exposure to default risk and bad debt. Credit collection risks include customer insolvency, delayed payments, and higher administrative costs, requiring robust credit assessment and monitoring systems. Effective collection strategies mitigate these risks by optimizing payment terms and utilizing credit insurance or factoring services.

Impact on Business Cash Flow

Effective cash collection accelerates inflow, directly improving business liquidity and enabling timely operational expenses and investments. Credit collection involves managing receivables and payment terms, which influences cash flow timing and the risk of bad debts that can strain financial stability. Overall, optimizing collection processes reduces delays and defaults, sustaining steady cash flow crucial for business growth and solvency.

Methods to Improve Cash Collection Efficiency

Implementing automated invoicing systems and digital payment options enhances cash collection efficiency by reducing delays and errors. Establishing clear credit policies and proactive communication with customers improves credit collection by minimizing payment disputes and defaults. Leveraging data analytics to track payment patterns and prioritize collections streamlines overall collection processes and boosts cash flow management.

Best Practices for Managing Credit Collections

Effective credit collection requires establishing clear credit policies, regular monitoring of accounts receivable, and leveraging automated reminder systems to reduce payment delays. Prioritizing personalized communication and negotiating flexible payment plans can enhance customer relationships while improving cash flow. Employing data analytics to identify high-risk accounts enables targeted collection strategies that minimize bad debt and optimize overall collection efficiency.

Choosing the Right Collection Strategy for Your Business

Understanding the differences between cash collection, credit collection, and general collection processes is crucial for optimizing your business's cash flow and minimizing risk. Cash collection involves immediate payment receipt, enhancing liquidity, while credit collection requires systematic follow-ups to ensure timely payments and manage accounts receivable effectively. Selecting the right collection strategy depends on your business model, customer behavior, and risk tolerance to balance revenue certainty and customer relationship management.

Infographic: Cash Collection vs Credit Collection

relatioo.com

relatioo.com