Automatic payments ensure timely, recurring bill settlements by securely auto-debiting your account, reducing late fees and administrative effort. Explore this article to understand the benefits and drawbacks of automatic payments versus one-time payments for managing your finances.

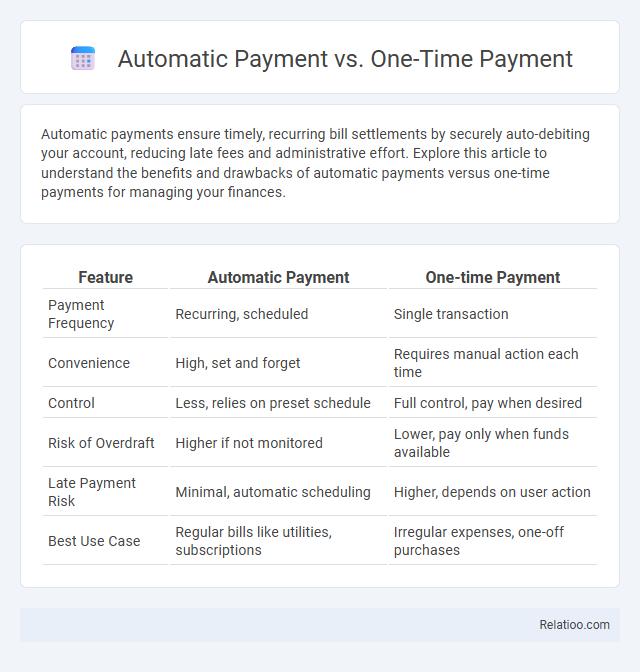

Table of Comparison

| Feature | Automatic Payment | One-time Payment |

|---|---|---|

| Payment Frequency | Recurring, scheduled | Single transaction |

| Convenience | High, set and forget | Requires manual action each time |

| Control | Less, relies on preset schedule | Full control, pay when desired |

| Risk of Overdraft | Higher if not monitored | Lower, pay only when funds available |

| Late Payment Risk | Minimal, automatic scheduling | Higher, depends on user action |

| Best Use Case | Regular bills like utilities, subscriptions | Irregular expenses, one-off purchases |

Understanding Automatic Payments

Automatic payments streamline your financial management by scheduling recurring transactions directly from your bank account or credit card, ensuring bills are paid on time without manual effort. Unlike one-time payments, which require you to initiate each transaction individually, automatic payments reduce the risk of late fees and service interruptions. Understanding automatic payments empowers you to maintain consistent cash flow, avoid missed deadlines, and simplify budgeting for monthly expenses.

What is a One-time Payment?

A one-time payment is a single transaction made to settle a bill or purchase, without any recurring charges or future automatic deductions, allowing you full control over your finances. Unlike automatic payments that withdraw funds regularly on scheduled dates, one-time payments require manual processing each time you pay, ensuring payment only when you initiate it. This method is ideal for pay-as-you-go services or irregular expenses where you want to avoid ongoing commitments.

Key Differences Between Automatic and One-time Payments

Automatic payments are recurring transactions scheduled to pay bills or services regularly without manual intervention, ensuring consistent financial management and avoiding late fees. One-time payments are single, manual transactions made for a specific invoice or purchase, providing more control and flexibility for users who prefer to manage each payment individually. The key difference lies in automation and frequency: automatic payments offer convenience and predictability through scheduled deductions, while one-time payments require active user initiation and are used for occasional or non-recurring expenses.

Benefits of Setting Up Automatic Payments

Setting up automatic payments ensures timely bill settlements, reducing the risk of late fees and credit score damage. Businesses and consumers benefit from improved financial management and cash flow predictability. Compared to one-time payments, automatic payments provide convenience and consistency, eliminating the need for manual payment tracking.

Advantages of One-time Payment Methods

One-time payment methods offer the advantage of full control over expenses, allowing users to avoid recurring charges and manage their budgets effectively. This payment type eliminates the risk of unexpected automatic withdrawals, enhancing financial transparency and security. Users benefit from simplicity and flexibility, as they can decide exactly when and how much to pay without committing to ongoing transactions.

Disadvantages of Automatic Payments

Automatic payments can lead to overdrafts if there are insufficient funds in the account, causing unexpected fees and financial strain. They may reduce budget control and awareness, as payments are deducted without manual approval or review. Errors or fraudulent charges can persist unnoticed for longer periods with automatic payments compared to one-time payments, increasing the risk of financial loss.

Potential Drawbacks of One-time Payment

One-time payments often risk missing due dates, leading to late fees or service interruptions, unlike automatic payments which ensure consistent transactions. The lack of automatic processing in one-time payments requires active management and regular monitoring, increasing the chance of human error or oversight. This payment method can also hinder cash flow planning as expenses must be manually tracked and scheduled each billing period.

Security Considerations for Payment Choices

Automatic payments offer enhanced security by reducing the risk of missed payments and late fees through scheduled transactions that use encrypted data protocols. One-time payments provide control over each transaction, minimizing exposure to potential fraud but requiring constant vigilance to avoid phishing and unauthorized charges. Automatic payments with multi-factor authentication and tokenization significantly increase protection against cyber threats compared to single-instance payments.

Choosing the Best Payment Option for Your Needs

Choosing the best payment option for your needs depends on factors like convenience, budgeting, and control over expenses. Automatic payment ensures bills are paid on time without manual effort, reducing late fees, while one-time payment offers flexibility for occasional or irregular expenses. Evaluating your payment frequency and financial discipline helps determine whether automatic payments or one-time payments align better with your financial goals.

Future Trends in Digital Payment Methods

Future trends in digital payment methods indicate a significant shift towards automatic payments due to their convenience and efficiency in managing recurring expenses. One-time payments remain essential for flexibility and control over individual transactions, especially in e-commerce and service industries. You can optimize your financial strategy by balancing the use of automatic payments for routine bills and one-time payments for occasional purchases, adapting to emerging technologies like blockchain and AI-driven payment platforms.

Infographic: Automatic Payment vs One-time Payment

relatioo.com

relatioo.com