Credit Score and CIBIL Score both measure individual creditworthiness, but the CIBIL Score specifically refers to the credit rating provided by the Credit Information Bureau (India) Limited, ranging from 300 to 900. Learn more about how each score impacts your financial decisions in this article.

Table of Comparison

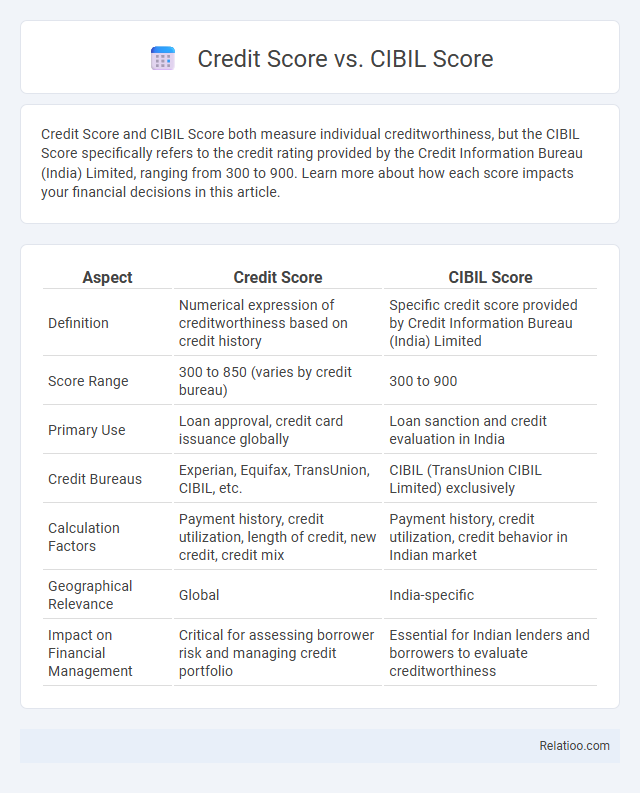

| Aspect | Credit Score | CIBIL Score |

|---|---|---|

| Definition | Numerical expression of creditworthiness based on credit history | Specific credit score provided by Credit Information Bureau (India) Limited |

| Score Range | 300 to 850 (varies by credit bureau) | 300 to 900 |

| Primary Use | Loan approval, credit card issuance globally | Loan sanction and credit evaluation in India |

| Credit Bureaus | Experian, Equifax, TransUnion, CIBIL, etc. | CIBIL (TransUnion CIBIL Limited) exclusively |

| Calculation Factors | Payment history, credit utilization, length of credit, new credit, credit mix | Payment history, credit utilization, credit behavior in Indian market |

| Geographical Relevance | Global | India-specific |

| Impact on Financial Management | Critical for assessing borrower risk and managing credit portfolio | Essential for Indian lenders and borrowers to evaluate creditworthiness |

Understanding Credit Score vs CIBIL Score

CIBIL Score specifically refers to the credit score provided by the Credit Information Bureau (India) Limited, primarily used in India to assess an individual's creditworthiness, while Credit Score is a broader term encompassing various scoring models used globally. Both scores range typically between 300 and 900, reflecting credit history and repayment behavior, but CIBIL Score is tailored to the Indian credit market with data from multiple banks and financial institutions. Understanding the difference is crucial for borrowers, as lenders in India predominantly rely on the CIBIL Score to evaluate loan eligibility and interest rates.

Definition of Credit Score

Credit Score represents a numerical value derived from an individual's credit history, reflecting their creditworthiness to lenders. CIBIL Score is a specific type of Credit Score provided by the Credit Information Bureau (India) Limited, widely used in India for financial assessments. While all Credit Scores indicate financial reliability, CIBIL Score is a regional credit rating, making it essential for loan approvals and credit card eligibility in the Indian market.

What is a CIBIL Score?

A CIBIL Score is a specific type of credit score used in India, generated by the Credit Information Bureau (India) Limited (CIBIL), which ranges from 300 to 900 and reflects an individual's creditworthiness based on their credit history. Unlike generic credit scores used globally, the CIBIL Score factors in data from credit cards, loans, and repayment patterns to help lenders assess the risk of lending. Understanding the CIBIL Score is crucial for obtaining loans and credit approvals, as it directly influences interest rates and credit eligibility.

Key Differences Between Credit Score and CIBIL Score

CIBIL Score is a specific type of credit score provided by the Credit Information Bureau (India) Limited, which ranges from 300 to 900 and is widely used by Indian lenders to assess your creditworthiness. While a credit score is a general term representing your financial reliability, it can be provided by various agencies like Experian, Equifax, or TransUnion, each with its own scoring model and range. Understanding these key differences helps you accurately interpret your credit health and improve your chances of loan approval in different financial contexts.

How Credit Scores are Calculated

Credit scores, including CIBIL scores in India, are calculated based on factors such as payment history, credit utilization ratio, length of credit history, types of credit accounts, and recent credit inquiries. Payment timeliness contributes approximately 35% to the overall score, while credit utilization impacts around 30%. CIBIL, Experian, and Equifax use similar algorithms that analyze credit behavior over time to generate scores ranging typically between 300 and 900, influencing loan eligibility and interest rates.

Factors Affecting CIBIL Score

CIBIL Score is a specific type of credit score used in India, ranging from 300 to 900, that reflects a borrower's creditworthiness based on credit history tracked by the Credit Information Bureau (India) Limited. Factors affecting the CIBIL Score include timely repayment of loans and credit card bills, credit utilization ratio, length of credit history, number of hard inquiries, and types of credit accounts. Maintaining a high CIBIL Score is crucial for obtaining favorable loan terms and credit approvals from Indian financial institutions.

Importance of Checking Your Credit Score

Understanding the difference between Credit Score, CIBIL Score, and other credit scores is crucial for managing your financial health. The CIBIL Score, a specific type of credit score used in India, ranges from 300 to 900 and indicates your creditworthiness to lenders. Regularly checking your credit score helps detect errors, monitor financial behavior, and improve chances of loan approval and better interest rates.

Impact of CIBIL Score on Loan Approval

CIBIL Score is a crucial component of your overall credit score, specifically representing your creditworthiness in India, and significantly influences loan approval decisions by lenders. A higher CIBIL Score, typically above 750, enhances your chances of securing loans with favorable interest rates and terms, as it reflects timely repayment history and financial discipline. Understanding the impact of your CIBIL Score helps you manage your credit behavior effectively to improve loan approval outcomes.

How to Improve Your Credit and CIBIL Score

Improving your credit and CIBIL scores requires timely bill payments, reducing outstanding debt, and maintaining a healthy credit utilization ratio below 30%. Regularly check your credit reports for errors and dispute any inaccuracies that may impact your scores negatively. Building a diverse credit portfolio with a mix of secured and unsecured loans can also enhance your creditworthiness over time.

Frequently Asked Questions: Credit Score vs CIBIL Score

Credit Score and CIBIL Score both measure your creditworthiness, but CIBIL Score is a specific type of Credit Score provided by the Credit Information Bureau (India) Limited, primarily used in India. Your Credit Score ranges typically from 300 to 900, with higher scores indicating better credit health, while CIBIL Score follows a similar range and criteria but is specific to the CIBIL bureau. You should understand that lenders often use CIBIL Score to assess loan eligibility, making it crucial to maintain a strong score for favorable borrowing terms.

Infographic: Credit Score vs CIBIL Score

relatioo.com

relatioo.com