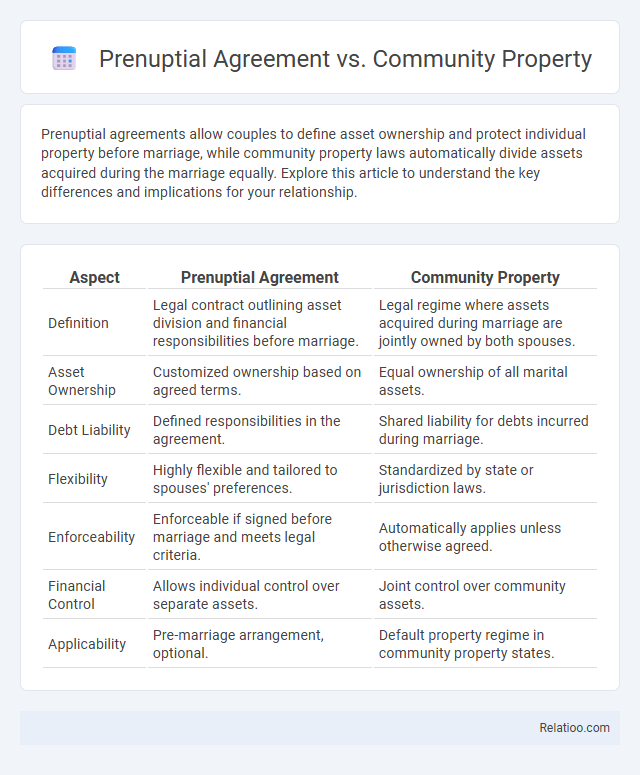

Prenuptial agreements allow couples to define asset ownership and protect individual property before marriage, while community property laws automatically divide assets acquired during the marriage equally. Explore this article to understand the key differences and implications for your relationship.

Table of Comparison

| Aspect | Prenuptial Agreement | Community Property |

|---|---|---|

| Definition | Legal contract outlining asset division and financial responsibilities before marriage. | Legal regime where assets acquired during marriage are jointly owned by both spouses. |

| Asset Ownership | Customized ownership based on agreed terms. | Equal ownership of all marital assets. |

| Debt Liability | Defined responsibilities in the agreement. | Shared liability for debts incurred during marriage. |

| Flexibility | Highly flexible and tailored to spouses' preferences. | Standardized by state or jurisdiction laws. |

| Enforceability | Enforceable if signed before marriage and meets legal criteria. | Automatically applies unless otherwise agreed. |

| Financial Control | Allows individual control over separate assets. | Joint control over community assets. |

| Applicability | Pre-marriage arrangement, optional. | Default property regime in community property states. |

Understanding Prenuptial Agreements

Understanding prenuptial agreements is essential for protecting your individual assets and outlining financial responsibilities clearly before marriage. Unlike community property laws, which automatically divide all marital assets equally in divorce or death, a prenuptial agreement allows you to specify the division of property, debts, and spousal support. This personalized contract ensures clarity and fairness tailored to your unique financial situation, minimizing potential conflicts in the future.

Defining Community Property

Community property refers to the legal framework in certain states where assets and debts acquired during marriage are considered jointly owned and equally divided upon divorce. Prenuptial agreements, in contrast, are private contracts that allow couples to define the ownership and division of property independently from community property laws. Understanding the distinction between community property and prenuptial agreements is essential for managing marital assets and protecting individual property rights.

Key Differences Between Prenuptial Agreements and Community Property

A prenuptial agreement is a legal contract created before marriage outlining the division of assets and financial responsibilities, while community property refers to a state-specific default legal regime where marital assets are equally owned by both spouses. The key differences lie in autonomy and customization: prenuptial agreements allow you to specify unique terms tailored to your financial situation, whereas community property laws apply uniformly without personalized arrangements. Understanding these distinctions helps you protect your assets and clarify financial rights during marriage or divorce.

Legal Implications of Prenuptial Agreements

Prenuptial agreements establish clear terms for asset division and debt responsibility, overriding default state laws such as community property rules that split all marital assets 50/50. These contracts can protect individual wealth, clarify spousal support obligations, and prevent lengthy legal disputes during divorce or death. Courts enforce prenuptial agreements if they are entered voluntarily, with full financial disclosure, and without fraud or coercion, making them a powerful tool for financial planning in marriage.

How Community Property Laws Work

Community property laws divide marital assets and debts equally between partners, regardless of who earned or acquired them during the marriage, impacting how property is managed and distributed upon divorce or death. A prenuptial agreement allows you to customize asset division, potentially overriding default community property rules by specifying separate ownership of certain properties and financial responsibilities. Understanding how community property laws work helps you make informed decisions about protecting your assets with a prenuptial agreement tailored to your unique financial situation.

Benefits of Having a Prenuptial Agreement

A prenuptial agreement offers clear legal protection by specifying asset division and financial responsibilities, which community property laws may not fully address. Your financial interests and individual assets are safeguarded, preventing disputes in divorce or estate matters. This proactive contract ensures transparency and peace of mind, unlike the default equal sharing under community property rules.

Drawbacks of Community Property Systems

Community property systems can complicate asset division, often failing to account for individual contributions and the complexities of modern financial arrangements. Unlike prenuptial agreements that offer personalized terms and clearer asset protection, community property rules may lead to inequitable distributions in the event of divorce or death. This lack of flexibility often results in prolonged legal disputes and increased emotional stress for separating couples.

When to Consider a Prenuptial Agreement

You should consider a prenuptial agreement when anticipating significant changes in financial status, such as owning extensive assets or starting a business before marriage. Unlike community property laws that automatically divide marital assets equally, a prenuptial agreement allows personalized asset protection and clear financial boundaries tailored to your specific needs. Evaluating your financial situation and potential future earnings can help determine if formalizing terms through a prenuptial agreement provides greater security than relying solely on community property regulations.

Impact on Asset Division During Divorce

A prenuptial agreement clearly defines asset division boundaries, protecting Your individual property and minimizing disputes during a divorce, unlike community property laws which automatically split marital assets equally. Community property states consider all assets acquired during marriage as jointly owned, potentially disregarding the intent or contributions documented in a prenuptial agreement. Understanding the legal impact of a prenuptial agreement versus community property rules can help You safeguard Your financial interests and ensure a fair division of assets.

Choosing the Right Option for Your Relationship

Choosing the right legal arrangement for your relationship depends on understanding the distinct implications of a prenuptial agreement versus community property laws. Prenuptial agreements provide tailored asset protection and financial clarity by outlining property division and debt responsibility, while community property laws automatically split marital assets equally in certain states like California and Texas. Evaluating personal circumstances, asset complexity, and state regulations ensures selecting the most advantageous option for financial security and mutual agreement.

Infographic: Prenuptial Agreement vs Community Property

relatioo.com

relatioo.com