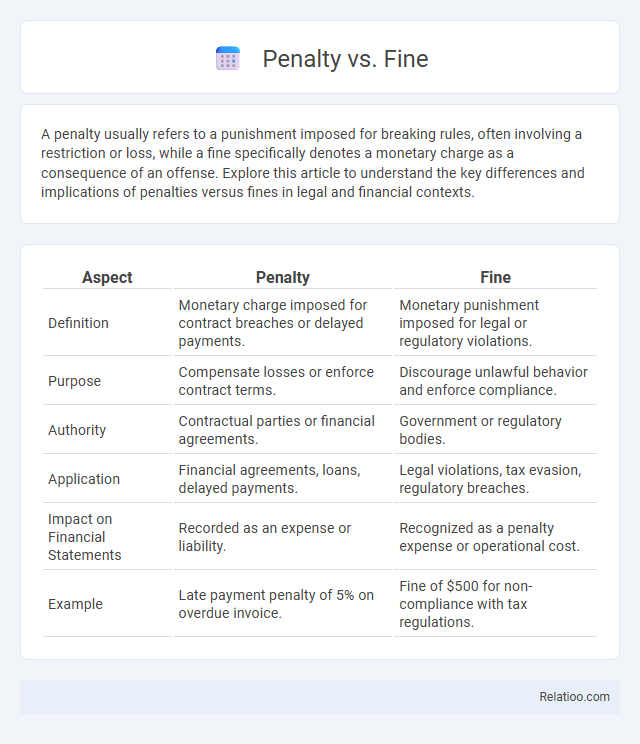

A penalty usually refers to a punishment imposed for breaking rules, often involving a restriction or loss, while a fine specifically denotes a monetary charge as a consequence of an offense. Explore this article to understand the key differences and implications of penalties versus fines in legal and financial contexts.

Table of Comparison

| Aspect | Penalty | Fine |

|---|---|---|

| Definition | Monetary charge imposed for contract breaches or delayed payments. | Monetary punishment imposed for legal or regulatory violations. |

| Purpose | Compensate losses or enforce contract terms. | Discourage unlawful behavior and enforce compliance. |

| Authority | Contractual parties or financial agreements. | Government or regulatory bodies. |

| Application | Financial agreements, loans, delayed payments. | Legal violations, tax evasion, regulatory breaches. |

| Impact on Financial Statements | Recorded as an expense or liability. | Recognized as a penalty expense or operational cost. |

| Example | Late payment penalty of 5% on overdue invoice. | Fine of $500 for non-compliance with tax regulations. |

Understanding Penalty and Fine: Key Definitions

A penalty is a punishment imposed for breaking a rule or law, often including restrictions or additional obligations beyond monetary payments. A fine specifically refers to a financial charge imposed as a penalty for violating legal regulations or contractual terms. Understanding these distinctions aids in comprehending legal consequences and enforcement mechanisms in various judicial and administrative contexts.

Legal Foundations of Penalties and Fines

Penalties and fines are both legal sanctions imposed for violations of laws or regulations, yet they differ in scope and application. Penalties encompass a broad range of punishments, including monetary fines, imprisonment, and community service, all grounded in statutory or regulatory authority. Fines specifically refer to monetary charges levied as punitive or deterrent measures, established under legal frameworks such as criminal codes or administrative statutes.

Differences Between Penalty and Fine

A penalty is a broader term referring to any punishment imposed for violating rules or laws, which can include fines, imprisonment, or other sanctions, while a fine specifically denotes a monetary charge levied as a consequence of an offense. The difference lies in scope: penalties encompass various forms of disciplinary actions, whereas fines are purely financial penalties. Understanding these distinctions helps you navigate legal or regulatory consequences with greater clarity.

Common Scenarios Involving Penalties

Common scenarios involving penalties often arise in contract breaches, late tax payments, and sports rule violations where specific punitive amounts or actions are enforced to ensure compliance. Penalties serve as deterrents by imposing financial or operational consequences, distinct from fines which are typically monetary charges levied by legal authorities for infractions. Understanding the application of penalties in lease agreements, employment contracts, and regulatory compliance helps mitigate risks and avoid costly disputes.

Typical Situations Where Fines Are Imposed

Fines are typically imposed in situations where legal or regulatory violations occur, such as traffic infractions, environmental breaches, or failure to comply with public safety laws. You may receive a fine for actions like speeding, illegal parking, or non-payment of taxes, which serve as monetary punishments to deter future violations. Unlike penalties that can include non-monetary consequences, fines are specific financial charges aimed at enforcing compliance and accountability.

Legal Consequences: Penalty vs Fine

Legal consequences of a penalty and a fine differ primarily in severity and context; a penalty often refers to a broader range of punishments imposed for breaches of contract or regulations, including suspension or revocation of rights. Fines are monetary charges specifically imposed as punishment for legal violations such as traffic infractions or statutory offenses. Understanding these distinctions helps you accurately assess potential liabilities and the impacts on your legal standing.

Calculation and Assessment Methods

Penalty calculation typically involves a fixed amount or a percentage of the outstanding obligation, assessed based on predefined rules in contracts or laws. Fine assessment methods often rely on the severity of the offense, legal guidelines, and judicial discretion, resulting in variable monetary charges. Unlike penalties and fines, charges are frequently determined through objective formulas or regulatory tariffs linked directly to the infraction or service cost.

Impact on Individuals and Organizations

Fines impose a direct financial burden on individuals and organizations, often leading to immediate monetary loss that can affect budgets and cash flow. Penalties, which may include fines or other sanctions, can damage reputations and result in long-term operational restrictions or legal consequences. Understanding how each type of penalty impacts your compliance efforts is essential for minimizing financial risks and preserving your organization's integrity.

Penalty and Fine Enforcement Procedures

Penalty enforcement procedures involve formal administrative actions or legal steps taken to ensure compliance with regulations, often including notifications, hearings, and possible sanctions for violations. Fine enforcement procedures typically require the assessment of a monetary charge by an authority, followed by billing, payment deadlines, and potential collection actions such as liens or wage garnishments if unpaid. Both procedures emphasize due process, documentation, and the authority's power to compel adherence to laws or regulations, with penalties often broader in scope and fines specifically monetary.

Choosing the Right Course: Penalty or Fine

Choosing the right course between a penalty and a fine depends on the nature of the violation and the governing legal framework. Penalties often refer to broader consequences including sanctions or restrictions, while fines specifically denote monetary charges imposed for infractions such as traffic violations or regulatory noncompliance. Understanding jurisdiction-specific definitions and enforcement mechanisms is crucial to determine the appropriate corrective measure and ensure effective legal or administrative compliance.

Infographic: Penalty vs Fine

relatioo.com

relatioo.com