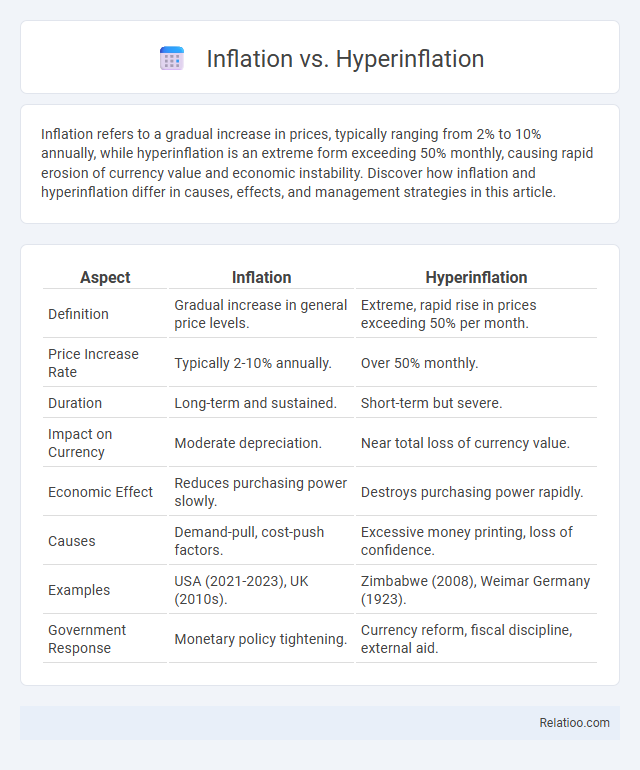

Inflation refers to a gradual increase in prices, typically ranging from 2% to 10% annually, while hyperinflation is an extreme form exceeding 50% monthly, causing rapid erosion of currency value and economic instability. Discover how inflation and hyperinflation differ in causes, effects, and management strategies in this article.

Table of Comparison

| Aspect | Inflation | Hyperinflation |

|---|---|---|

| Definition | Gradual increase in general price levels. | Extreme, rapid rise in prices exceeding 50% per month. |

| Price Increase Rate | Typically 2-10% annually. | Over 50% monthly. |

| Duration | Long-term and sustained. | Short-term but severe. |

| Impact on Currency | Moderate depreciation. | Near total loss of currency value. |

| Economic Effect | Reduces purchasing power slowly. | Destroys purchasing power rapidly. |

| Causes | Demand-pull, cost-push factors. | Excessive money printing, loss of confidence. |

| Examples | USA (2021-2023), UK (2010s). | Zimbabwe (2008), Weimar Germany (1923). |

| Government Response | Monetary policy tightening. | Currency reform, fiscal discipline, external aid. |

Understanding Inflation: Basics and Causes

Inflation occurs when the general price level of goods and services rises steadily due to increased demand or rising production costs, causing your purchasing power to decline. Hyperinflation is an extreme form of inflation where prices skyrocket uncontrollably, often exceeding 50% per month, usually caused by excessive money printing or severe economic instability. Understanding inflation basics involves recognizing factors like demand-pull inflation, cost-push inflation, and built-in inflation, all of which impact your everyday expenses differently.

What is Hyperinflation? Definition and Triggers

Hyperinflation is an extremely rapid and out-of-control increase in prices, typically exceeding 50% per month, which severely erodes the value of money and destabilizes the economy. Unlike regular inflation, which reflects a gradual rise in prices due to demand-pull or cost-push factors, hyperinflation is often triggered by excessive money printing by central banks, loss of confidence in a country's currency, or fiscal mismanagement. Understanding hyperinflation helps you recognize the catastrophic impact on purchasing power and the urgent need for economic reform when inflation spirals beyond control.

Key Differences: Inflation vs Hyperinflation

Inflation refers to a moderate and sustained increase in the general price level of goods and services, typically measured as an annual percentage between 1% and 10%, while hyperinflation is an extreme form of inflation exceeding 50% per month, resulting in rapid loss of currency value and severe economic instability. Key differences include the rate of price increase, with inflation causing gradual price adjustments and hyperinflation causing prices to skyrocket uncontrollably. Inflation usually reflects normal economic growth or policy adjustments, whereas hyperinflation signals a collapse in monetary confidence, often triggered by fiscal mismanagement or political crises.

Measuring Inflation and Hyperinflation

Measuring inflation typically involves tracking the Consumer Price Index (CPI) or Producer Price Index (PPI), which reflect average price changes in goods and services over time. Hyperinflation, characterized by monthly inflation rates exceeding 50%, requires more frequent and precise data collection to capture rapid currency devaluation and price surges. Accurate measurement of both inflation and hyperinflation is critical for economic policy, using real-time data analytics, inflation expectations surveys, and monetary indicators.

Historical Examples of Hyperinflation

Hyperinflation represents an extreme form of inflation where prices increase uncontrollably, often exceeding 50% monthly, as seen during the Weimar Republic in Germany in the 1920s and Zimbabwe in the late 2000s, causing currency devaluation and economic collapse. Regular inflation typically involves moderate, predictable price increases within 2-10% annually, helping economies grow without destabilization. Historical hyperinflation examples highlight the catastrophic social and economic impacts, such as the breakdown of trade, savings erosion, and severe loss of public confidence in monetary systems.

Economic Impacts of Inflation

Inflation causes a gradual increase in general price levels, reducing purchasing power and eroding savings, which can slow economic growth if uncontrolled. Hyperinflation, an extreme form of inflation exceeding 50% monthly, destabilizes economies by destroying currency value, disrupting markets, and causing widespread uncertainty. Moderate inflation encourages spending and investment, but both high inflation and hyperinflation lead to economic distortions, affecting wages, interest rates, and long-term financial planning.

Societal Consequences of Hyperinflation

Hyperinflation causes severe economic instability, eroding your savings and decimating the real value of wages, which leads to widespread poverty and social unrest. Unlike regular inflation, where prices rise gradually, hyperinflation triggers skyrocketing prices and a collapse in consumer confidence, disrupting daily life and trust in financial institutions. Societal consequences include increased crime rates, resource shortages, and mass migration as people struggle to meet basic needs.

Strategies to Control Inflation

Controlling inflation involves monetary policies such as adjusting interest rates and regulating money supply to stabilize prices and maintain purchasing power. Hyperinflation requires more aggressive strategies like stringent fiscal discipline, reducing government deficits, and sometimes currency reforms to restore confidence in the economy. Your best approach to managing inflation depends on the severity, often combining central bank interventions with structural economic adjustments to ensure long-term price stability.

Central Bank Responses to Hyperinflation

Central banks respond to hyperinflation by implementing aggressive monetary tightening, including sharp interest rate hikes and rapid reduction of money supply to stabilize currency value. They may also establish currency reforms, such as introducing a new currency or pegging to a stable foreign currency, to restore credibility and control runaway prices. Hyperinflation surpasses typical inflation rates, often exceeding 50% monthly, requiring more drastic central bank actions compared to moderate inflation management.

Protecting Your Finances: Coping with Inflation and Hyperinflation

Inflation refers to the gradual increase in prices over time, while hyperinflation is an extreme form where prices skyrocket uncontrollably, severely eroding currency value. Protecting your finances during inflation involves diversifying investments and prioritizing assets that typically appreciate or retain value, such as real estate or commodities. In hyperinflation scenarios, maintaining liquidity and converting cash into stable foreign currencies or tangible goods becomes crucial to preserving purchasing power.

Infographic: Inflation vs Hyperinflation

relatioo.com

relatioo.com