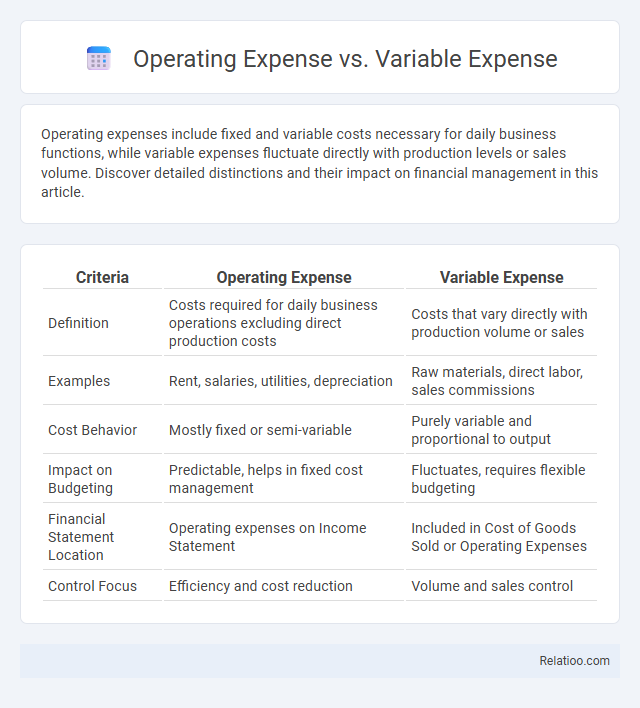

Operating expenses include fixed and variable costs necessary for daily business functions, while variable expenses fluctuate directly with production levels or sales volume. Discover detailed distinctions and their impact on financial management in this article.

Table of Comparison

| Criteria | Operating Expense | Variable Expense |

|---|---|---|

| Definition | Costs required for daily business operations excluding direct production costs | Costs that vary directly with production volume or sales |

| Examples | Rent, salaries, utilities, depreciation | Raw materials, direct labor, sales commissions |

| Cost Behavior | Mostly fixed or semi-variable | Purely variable and proportional to output |

| Impact on Budgeting | Predictable, helps in fixed cost management | Fluctuates, requires flexible budgeting |

| Financial Statement Location | Operating expenses on Income Statement | Included in Cost of Goods Sold or Operating Expenses |

| Control Focus | Efficiency and cost reduction | Volume and sales control |

Understanding Operating Expenses

Operating expenses encompass all costs required to run your business daily, including both fixed and variable expenses such as rent, utilities, and raw materials. Variable expenses fluctuate directly with production volume, like inventory and labor costs, while fixed expenses remain constant regardless of output. Understanding operating expenses helps you control costs, manage budgets effectively, and improve overall financial health by distinguishing between these expense types.

Defining Variable Expenses

Variable expenses fluctuate directly with your business activity, such as raw materials and direct labor costs, making them distinct from fixed operating expenses like rent or insurance. Operating expenses encompass both fixed and variable costs required to run daily business operations, while variable expenses change in proportion to production volume or sales. Understanding variable expenses is crucial for managing cash flow and optimizing profit margins in your business.

Key Differences Between Operating and Variable Expenses

Operating expenses include all costs necessary to run your business, such as rent, utilities, and salaries, regardless of production levels. Variable expenses fluctuate directly with production volume, including raw materials and direct labor costs. The key difference lies in stability; operating expenses remain constant over time, while variable expenses change proportionally with your output.

Examples of Operating Expenses

Operating expenses include costs essential for daily business operations, such as rent, utilities, salaries, and depreciation, regardless of production levels. Variable expenses fluctuate directly with production volume, like raw materials, direct labor, and sales commissions. Understanding the distinction helps businesses manage cash flow by identifying fixed costs versus expenses that vary with operational activity.

Examples of Variable Expenses

Variable expenses are costs that fluctuate directly with business activity levels, such as raw materials, direct labor, and sales commissions. Operating expenses include both fixed and variable costs necessary to run daily operations but exclude the cost of goods sold; examples are rent, utilities, and office supplies. Unlike fixed operating expenses, variable expenses like shipping fees, packaging materials, and credit card transaction fees change based on sales volume and production output.

Impact of Expenses on Business Profitability

Operating expenses include fixed costs like rent and salaries that remain constant regardless of production levels, while variable expenses fluctuate directly with your business activity, such as raw materials and direct labor. Understanding the balance between these costs is crucial because high operating expenses can reduce profitability even when sales are strong, whereas managing variable expenses effectively can optimize profit margins during sales fluctuations. Your business profitability depends on minimizing fixed costs and controlling variable expenses to maintain a healthy operating leverage and cash flow.

Fixed vs Variable in Operating Expenses

Operating expenses include both fixed and variable costs that are necessary to run your business, with fixed expenses such as rent and salaries remaining constant regardless of production levels, while variable expenses fluctuate based on operational activity, like raw materials and utilities. Understanding the distinction between fixed and variable operating expenses is crucial for accurate budgeting and financial forecasting. Properly managing these expenses helps you optimize cash flow and improve profitability by controlling costs linked to business volume changes.

Budgeting for Operating and Variable Expenses

Operating expenses include all costs required to run your business daily, such as rent, utilities, and salaries, while variable expenses fluctuate directly with production levels, like raw materials and sales commissions. Budgeting for these expenses involves accurately forecasting fixed operating costs separately from variable expenses to maintain cash flow stability and optimize resource allocation. Your budget should regularly track variable expense trends to adjust spending based on sales volume, ensuring efficient cost control and profitability.

Managing and Reducing Business Expenses

Operating expenses encompass all costs required to run a business, including fixed expenses like rent and utilities and variable expenses such as raw materials and direct labor. Managing business expenses effectively involves monitoring variable expenses closely, as these fluctuate with production volume and can be adjusted more flexibly to improve cash flow. Reducing operating expenses requires strategic cost control measures, such as negotiating supplier contracts, optimizing labor efficiency, and automating processes to minimize waste and increase overall profitability.

Importance of Expense Classification in Financial Reporting

Accurate classification of operating expense, variable expense, and fixed expense is crucial for precise financial reporting and analysis. Operating expenses include all costs necessary for day-to-day business functions, while variable expenses fluctuate with production levels, impacting cost control strategies. Properly distinguishing these expenses enhances budgeting accuracy, profitability assessment, and strategic decision-making for improved financial management.

Infographic: Operating Expense vs Variable Expense

relatioo.com

relatioo.com