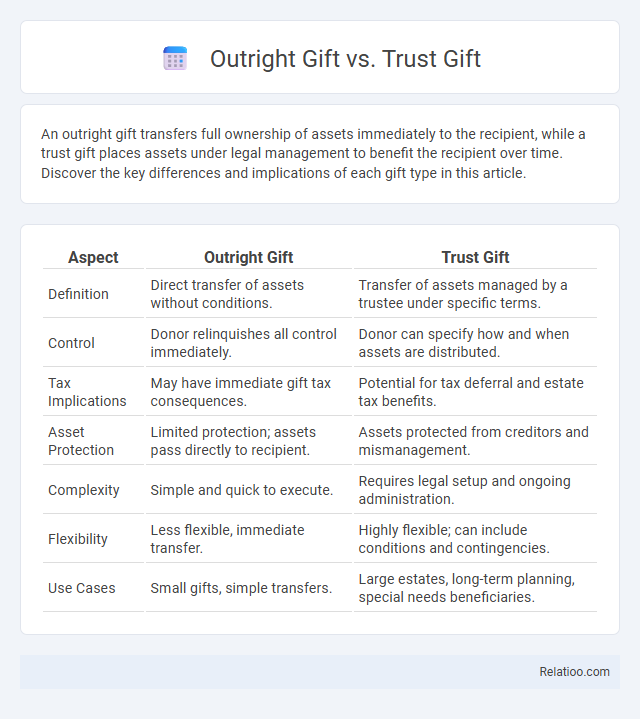

An outright gift transfers full ownership of assets immediately to the recipient, while a trust gift places assets under legal management to benefit the recipient over time. Discover the key differences and implications of each gift type in this article.

Table of Comparison

| Aspect | Outright Gift | Trust Gift |

|---|---|---|

| Definition | Direct transfer of assets without conditions. | Transfer of assets managed by a trustee under specific terms. |

| Control | Donor relinquishes all control immediately. | Donor can specify how and when assets are distributed. |

| Tax Implications | May have immediate gift tax consequences. | Potential for tax deferral and estate tax benefits. |

| Asset Protection | Limited protection; assets pass directly to recipient. | Assets protected from creditors and mismanagement. |

| Complexity | Simple and quick to execute. | Requires legal setup and ongoing administration. |

| Flexibility | Less flexible, immediate transfer. | Highly flexible; can include conditions and contingencies. |

| Use Cases | Small gifts, simple transfers. | Large estates, long-term planning, special needs beneficiaries. |

Understanding Outright Gifts

Outright gifts involve the direct transfer of assets or money from the donor to the recipient without conditions, providing immediate ownership and control to the donee. Unlike trust gifts, which place assets under the management of a trustee until certain terms are met, outright gifts simplify the gifting process by eliminating legal complexities and ongoing administrative responsibilities. Understanding outright gifts empowers you to make informed decisions that ensure your generosity results in prompt benefits for your beneficiaries.

Understanding Trust Gifts

Understanding trust gifts involves transferring assets into a legal entity that manages and distributes the property according to the grantor's instructions, offering control over timing and conditions. Unlike outright gifts, trust gifts provide potential tax benefits and creditor protection while ensuring assets are used for specific purposes. This method is especially valuable for complex estate planning, allowing for tailored management of wealth for beneficiaries.

Key Differences Between Outright and Trust Gifts

Outright gifts transfer assets directly to the recipient immediately, offering simplicity and potential tax benefits, while trust gifts involve placing assets into a trust managed by a trustee for future distribution, providing control and protection over how and when Your gift is used. Trust gifts are ideal for managing large estates, protecting beneficiaries, or setting conditions on asset use, whereas outright gifts suit straightforward, immediate support. Understanding these key differences helps maximize the impact of Your gifting strategy according to your financial and philanthropic goals.

Advantages of Making an Outright Gift

An outright gift transfers full ownership of assets immediately, offering simplicity and ease of administration compared to trust gifts. Your recipients gain immediate access to the gifted property without the complexities and fees associated with trust management. This method also maximizes tax benefits by removing the asset from your estate promptly, reducing potential estate tax liabilities.

Advantages of Creating a Trust Gift

Creating a trust gift offers significant advantages such as enhanced asset protection, precise control over distribution, and potential tax benefits compared to outright gifting. Your assets placed in a trust can avoid probate, ensuring privacy and faster transfer to beneficiaries. Trust gifts allow you to set specific terms and conditions, providing long-term financial security tailored to your intentions.

Disadvantages of Outright Gifts

Outright gifts can create immediate tax liabilities and reduce your control over assets, exposing them to creditors or potential misuse by recipients. Unlike trust gifts, outright gifts lack structured protections for beneficiaries and may complicate estate planning by unintentionally triggering gift taxes. You risk losing flexibility in managing your wealth and ensuring your intentions are honored through outright gifting.

Disadvantages of Trust Gifts

Trust gifts involve complex legal and administrative processes that can result in higher costs and longer timelines compared to outright gifts. You may face limited flexibility in accessing or modifying trust assets once the gift is transferred, potentially restricting your ability to respond to changing financial needs. Additionally, trust gifts can incur ongoing management fees and, in some cases, unfavorable tax treatment depending on the jurisdiction and trust structure.

Tax Implications: Outright Gift vs Trust Gift

Outright gifts are transferred directly to the recipient, resulting in immediate gift tax implications based on the IRS annual exclusion limit, currently $17,000 per recipient for 2024. Trust gifts involve placing assets in a trust, potentially deferring or reducing gift tax liability through mechanisms like the annual gift tax exclusion and lifetime exemption, and allowing for greater control over distribution. Trust gifts may also affect estate tax planning by removing assets from the taxable estate, while outright gifts reduce the donor's taxable estate but provide no control over asset use once given.

Choosing the Right Gift Strategy

Choosing the right gift strategy involves understanding the differences between outright gifts, trust gifts, and general gifting methods. Outright gifts transfer ownership immediately, offering simplicity and tax exclusion benefits, while trust gifts provide control over asset distribution, protection from creditors, and potential estate tax advantages. Your decision should align with your financial goals, estate size, and desire to manage how and when beneficiaries receive the assets.

Frequently Asked Questions About Gifting Methods

Outright gifts transfer assets directly to recipients immediately, offering simplicity and immediate ownership, while trust gifts place assets into a trust managed by a trustee for the beneficiary, providing control and potential tax benefits. Understanding how gifting impacts estate taxes, gift tax limits, and control over the gifted assets is crucial to choosing the best method for your financial goals. You should consider factors such as the size of the gift, your intentions for asset management, and the tax implications to determine whether an outright gift, trust gift, or other gifting strategies suit your needs.

Infographic: Outright Gift vs Trust Gift

relatioo.com

relatioo.com