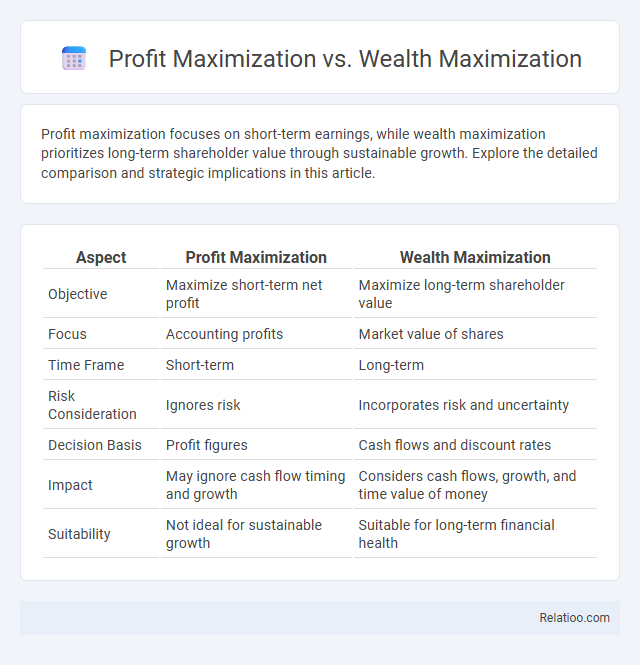

Profit maximization focuses on short-term earnings, while wealth maximization prioritizes long-term shareholder value through sustainable growth. Explore the detailed comparison and strategic implications in this article.

Table of Comparison

| Aspect | Profit Maximization | Wealth Maximization |

|---|---|---|

| Objective | Maximize short-term net profit | Maximize long-term shareholder value |

| Focus | Accounting profits | Market value of shares |

| Time Frame | Short-term | Long-term |

| Risk Consideration | Ignores risk | Incorporates risk and uncertainty |

| Decision Basis | Profit figures | Cash flows and discount rates |

| Impact | May ignore cash flow timing and growth | Considers cash flows, growth, and time value of money |

| Suitability | Not ideal for sustainable growth | Suitable for long-term financial health |

Introduction to Financial Objectives

Profit maximization focuses on short-term earnings by increasing revenues and reducing costs, often prioritizing immediate financial gains without considering long-term sustainability. Wealth maximization aims to enhance the overall value of shareholders' equity by emphasizing cash flow timing and risk, ensuring sustained growth and increased market value. Financial goals integrate both approaches, striving to balance profitability and shareholder wealth while supporting strategic objectives such as liquidity, solvency, and business expansion.

Defining Profit Maximization

Profit maximization refers to the financial objective of increasing a company's earnings by maximizing net income within a specific period. It primarily focuses on short-term gains by enhancing revenue and reducing costs, often disregarding risks and long-term sustainability. Compared to wealth maximization, which aims at increasing the overall value of shareholders' equity over time, profit maximization is a narrower goal centered solely on immediate profitability.

Understanding Wealth Maximization

Wealth maximization focuses on increasing the overall value of your assets and long-term financial health, prioritizing sustainable growth over short-term profits. Unlike profit maximization, which aims to maximize immediate earnings, wealth maximization considers risk, timing, and the impact of decisions on shareholder value. Your financial goal should align with wealth maximization to ensure balanced growth that benefits stakeholders and secures future financial stability.

Key Differences Between Profit and Wealth Maximization

Profit maximization focuses on increasing short-term earnings, emphasizing immediate revenue growth and cost reduction without considering risk or long-term effects on the firm's value. Wealth maximization prioritizes enhancing the overall value of shareholders' equity, factoring in future cash flows, risk, and timing to ensure sustainable growth and market reputation. Unlike profit maximization, wealth maximization provides a comprehensive financial goal by aligning with long-term company health and investor interests.

Importance of Time Value of Money

Profit maximization focuses on short-term gains without considering cash flow timing, while wealth maximization emphasizes long-term value by accounting for the time value of money, ensuring your investments generate the highest possible returns over time. Financial goals incorporate both approaches but prioritize maximizing the present value of future cash flows to enhance overall financial health. Understanding the importance of time value of money allows you to make informed decisions that increase sustainable wealth rather than just immediate profits.

Risk Considerations in Decision-Making

Profit maximization emphasizes short-term gains but often neglects risk factors, leading to potentially volatile outcomes. Wealth maximization incorporates risk assessments by focusing on the present value of future cash flows, aligning decision-making with long-term financial stability. Financial goals integrate risk tolerance and return expectations, ensuring balanced strategies that optimize both growth and security.

Impact on Shareholder Value

Profit maximization focuses on increasing a company's short-term earnings, which may neglect long-term sustainability and shareholder value. Wealth maximization emphasizes enhancing the market value of shareholders' equity, aligning financial decisions with long-term growth and risk management. Your financial goals should prioritize wealth maximization to ensure lasting shareholder value rather than just immediate profit.

Short-Term vs. Long-Term Focus

Profit maximization emphasizes short-term gains by increasing revenue and reducing costs within a specific accounting period, often overlooking risk and sustainability. Wealth maximization prioritizes long-term value creation by enhancing shareholder wealth through strategic investments and risk management that ensure sustainable growth. Financial goals balance both perspectives by setting measurable targets that align immediate operational efficiency with future financial stability and growth.

Real-World Examples and Case Studies

Profit maximization emphasizes short-term earnings, exemplified by companies like retail chains offering steep discounts to boost quarterly sales, sometimes at the expense of customer loyalty. Wealth maximization focuses on long-term value, as seen in tech giants like Apple, which reinvest profits into innovation and brand development, increasing stockholder equity over time. Financial goals encompass both approaches, demonstrated by diversified conglomerates like Berkshire Hathaway balancing immediate revenue generation with sustainable growth to satisfy varied investor expectations.

Conclusion: Choosing the Optimal Financial Strategy

Selecting the optimal financial strategy hinges on aligning profit maximization, wealth maximization, and overarching financial goals with a company's long-term vision and stakeholder expectations. Wealth maximization prioritizes sustainable growth and market value enhancement, offering a more comprehensive approach than immediate profit maximization, which often favors short-term gains. Firms targeting enduring success should integrate wealth maximization principles into their financial planning to ensure both profitability and increased shareholder wealth over time.

Infographic: Profit Maximization vs Wealth Maximization

relatioo.com

relatioo.com