Finance charges include all fees associated with borrowing, such as interest rates and additional costs, reflecting the total cost of credit. Understanding the difference between finance charges and interest rates is essential for better financial decisions; learn more in this article.

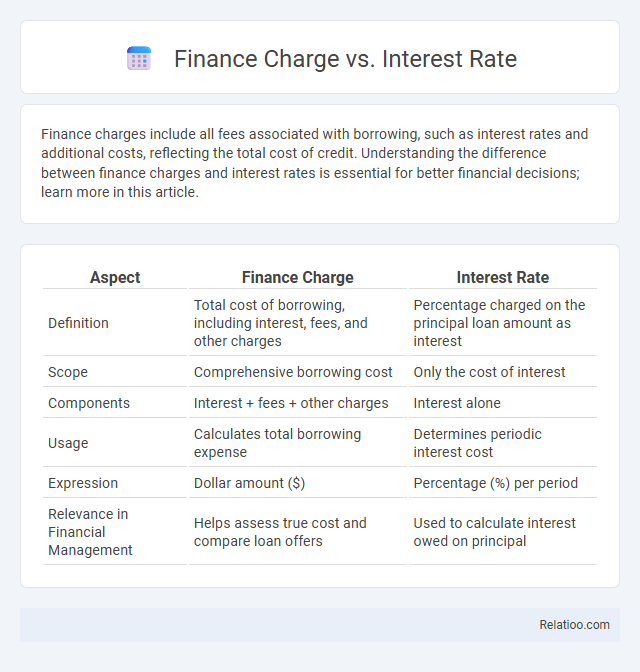

Table of Comparison

| Aspect | Finance Charge | Interest Rate |

|---|---|---|

| Definition | Total cost of borrowing, including interest, fees, and other charges | Percentage charged on the principal loan amount as interest |

| Scope | Comprehensive borrowing cost | Only the cost of interest |

| Components | Interest + fees + other charges | Interest alone |

| Usage | Calculates total borrowing expense | Determines periodic interest cost |

| Expression | Dollar amount ($) | Percentage (%) per period |

| Relevance in Financial Management | Helps assess true cost and compare loan offers | Used to calculate interest owed on principal |

Understanding Finance Charges: An Overview

Finance charges encompass all costs associated with borrowing, including interest rates, fees, and other expenses, providing a comprehensive measure of the total cost of credit. The interest rate represents the percentage charged on the principal loan amount over a specified period, forming a key component of the finance charge but not reflecting additional fees like service or late payment charges. Understanding finance charges helps borrowers accurately compare loan offers by revealing the true cost beyond just the interest rate, enabling more informed financial decisions.

What Is an Interest Rate?

An interest rate represents the percentage charged by a lender on the principal amount of a loan, reflecting the cost of borrowing money over a specific period. Unlike the finance charge, which includes all fees and costs associated with the loan, the interest rate solely indicates the cost expressed as a percentage of the loan balance. Understanding the interest rate is crucial for comparing loan offers and calculating the amount of interest payable throughout the life of the loan.

Key Differences Between Finance Charges and Interest Rates

Finance charges represent the total cost of borrowing, including interest rates, fees, and other related expenses, while interest rates specifically denote the percentage charged on the principal loan amount over a period. Your finance charge provides a comprehensive view of your loan's cost, helping you evaluate the true expense beyond just the interest rate. Understanding these differences enables better financial decisions and clearer comparisons between loan offers.

Components Included in a Finance Charge

A finance charge encompasses all costs associated with borrowing, including interest, loan fees, service charges, and other related expenses, making it broader than just the interest rate. The interest rate represents the percentage of the principal charged exclusively for the use of money over time, excluding additional fees or costs. Understanding the components included in a finance charge is crucial for accurately comparing loan offers, as it reflects the total cost of credit beyond just interest payments.

How Interest Rates Are Calculated

Interest rates are calculated based on the principal loan amount, the duration of the loan, and the annual percentage rate (APR), which reflects the cost of borrowing expressed as a yearly rate. Your finance charge, however, includes not only the interest but also fees and other costs associated with the loan, making it a broader measure of the cost of credit. Understanding the difference between the interest rate and the finance charge helps you evaluate the true cost of your loans and credit products.

The Impact of Finance Charges on Loan Cost

Finance charges represent the total cost of borrowing, including interest rates and additional fees such as origination or service charges, directly increasing the overall loan cost. Your loan's finance charge affects the effective amount you repay, beyond just the nominal interest rate quoted by lenders. Understanding and comparing finance charges enables you to accurately assess the true expense of loans and make informed financial decisions.

Real-Life Examples: Finance Charge vs Interest Rate

Finance charge represents the total cost of borrowing, including interest, fees, and other charges, whereas the interest rate specifically refers to the percentage charged on the principal loan amount. For example, a credit card might have an interest rate of 15%, but the finance charge could include additional fees like late payment charges, increasing the overall cost. Understanding both helps consumers accurately compare loan offers and manage their debt more effectively.

Why Finance Charges Matter in Credit Agreements

Finance charges represent the total cost of borrowing, including interest rates and additional fees, providing a complete picture of what You will pay over the life of a credit agreement. Unlike interest rates that only reflect the cost of borrowing principal, finance charges include charges such as origination fees, service fees, and insurance costs, which can significantly impact Your total debt. Understanding finance charges helps You make informed decisions by comparing credit offers and avoiding unexpected costs beyond the stated interest rates.

Tips for Comparing Loan Offers Effectively

When comparing loan offers, focus on the finance charge, which includes all fees and interest costs, providing a comprehensive view of the loan's total cost. The interest rate indicates the cost of borrowing on an annual basis but often excludes additional fees that affect your payments. Your best strategy is to analyze the annual percentage rate (APR), as it combines the interest rate and finance charges, helping you make a more informed decision.

Frequently Asked Questions About Finance Charges and Interest Rates

Finance charges represent the total cost of borrowing, including interest rates and any additional fees, while interest rates specifically refer to the percentage charged on the principal loan amount. Frequently asked questions about finance charges often clarify how these charges differ from simple interest rates and what components are included in the finance charge. You should understand that finance charges encompass all costs related to credit, helping you compare loan offers accurately.

Infographic: Finance Charge vs Interest Rate

relatioo.com

relatioo.com