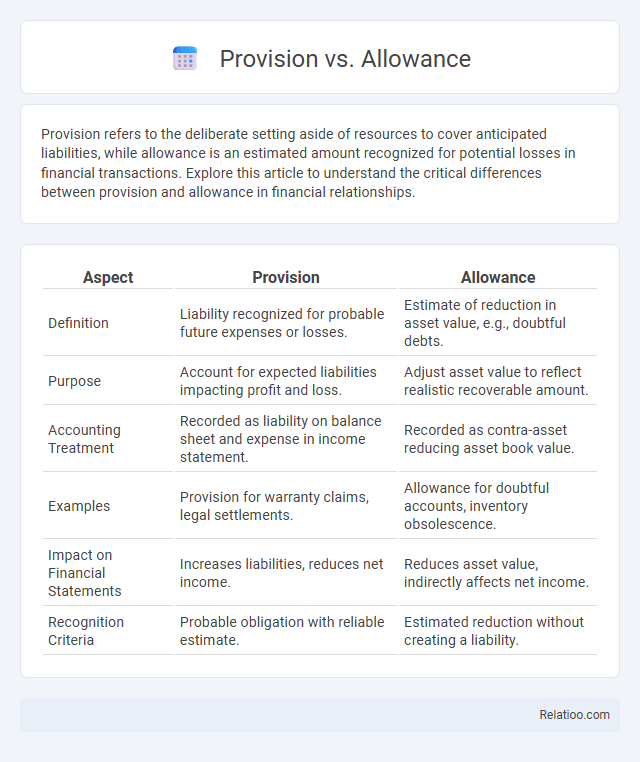

Provision refers to the deliberate setting aside of resources to cover anticipated liabilities, while allowance is an estimated amount recognized for potential losses in financial transactions. Explore this article to understand the critical differences between provision and allowance in financial relationships.

Table of Comparison

| Aspect | Provision | Allowance |

|---|---|---|

| Definition | Liability recognized for probable future expenses or losses. | Estimate of reduction in asset value, e.g., doubtful debts. |

| Purpose | Account for expected liabilities impacting profit and loss. | Adjust asset value to reflect realistic recoverable amount. |

| Accounting Treatment | Recorded as liability on balance sheet and expense in income statement. | Recorded as contra-asset reducing asset book value. |

| Examples | Provision for warranty claims, legal settlements. | Allowance for doubtful accounts, inventory obsolescence. |

| Impact on Financial Statements | Increases liabilities, reduces net income. | Reduces asset value, indirectly affects net income. |

| Recognition Criteria | Probable obligation with reliable estimate. | Estimated reduction without creating a liability. |

Introduction to Provision and Allowance

Provision refers to the amount set aside in financial statements to cover future liabilities or losses that are uncertain in timing or amount but probable in occurrence, ensuring accurate representation of a company's financial position. Allowance, often used in contexts like "Allowance for Doubtful Accounts," represents an estimated reserve against specific anticipated losses, such as uncollectible receivables, and is deducted from related asset accounts. Both provisions and allowances are accounting mechanisms to anticipate and allocate funds for potential financial impacts, but provisions typically relate to broader obligations, whereas allowances focus on specific anticipated reductions in asset values.

Definition of Provision

A provision is a specific liability recognized on a company's balance sheet for a probable future expense or obligation that can be reasonably estimated. An allowance represents a reserved amount to cover potential losses, such as doubtful debts or inventory shrinkage, while an allowance can also refer to permitted deductions or allocations in accounting. Understanding the definition of provision helps you accurately match expenses with revenues, ensuring your financial statements reflect true liabilities and maintain compliance with accounting standards.

Definition of Allowance

Allowance refers to a specific amount set aside in accounting to cover anticipated expenses or potential losses, reflecting a cautious estimate of future liabilities. Unlike provisions, which are recognized for probable obligations with uncertain timing or amount, allowances function as predetermined adjustments to asset values or expected costs. Your financial statements use allowances to present a more accurate financial position by accounting for possible declines in receivables or asset impairments.

Key Differences Between Provision and Allowance

Provisions are liabilities recognized in accounting for probable future expenses based on estimated amounts, ensuring your financial statements reflect anticipated obligations. Allowances, on the other hand, are reductions in asset values, such as allowance for doubtful accounts, used to adjust the carrying amount to a realistic recoverable figure. The key difference lies in provisions addressing anticipated liabilities, while allowances modify asset valuations to account for potential losses.

Purpose and Significance of Provisions

Provisions serve as crucial accounting estimates for anticipated liabilities or losses, ensuring that Your financial statements accurately reflect potential future obligations and present a prudent financial position. Unlike allowances, which primarily adjust asset values for expected unrecoverable amounts such as doubtful debts, provisions address specific liabilities emerging from past events with uncertain timing or amount. The significance of provisions lies in their role in enhancing the reliability and transparency of financial reporting by recognizing probable expenses or losses before they materialize.

Role and Importance of Allowances

Allowances serve as essential financial adjustments in accounting to cover estimated liabilities and potential expenses that are uncertain in timing or amount, helping businesses present a more accurate financial position. While provisions are recognized as liabilities when there is a probable outflow of resources and a reliable estimate can be made, allowances function mainly as adjustments to asset values, such as allowances for doubtful accounts, ensuring realistic asset valuation. The role of allowances is crucial for risk management and financial transparency, as they help prevent overstatement of assets and income, enabling informed decision-making by stakeholders.

Types of Provisions in Accounting

Provisions in accounting are liabilities of uncertain timing or amount, categorized into types such as warranty provisions, restructuring provisions, and bad debt provisions, each addressing specific financial uncertainties. Allowances differ as estimated accounts used to adjust asset values, like allowance for doubtful accounts, whereas provisions reduce profit to account for probable future expenses. Understanding these distinctions supports accurate financial reporting and compliance with accounting standards like IAS 37.

Types of Allowances in Finance

Allowances in finance represent specific allocations made for anticipated expenses or losses, differing from provisions that are estimates for uncertain liabilities. Types of allowances include allowance for doubtful accounts, which accounts for potential credit losses; allowance for depreciation, reflecting asset value reduction over time; and allowance for sales returns, estimating expected product returns. Each allowance type enhances financial accuracy by anticipating specific future expenditures or losses.

Impact on Financial Statements

Provisions impact financial statements by recognizing present liabilities with uncertain timing or amounts, reducing net income through expense recognition and increasing liabilities on the balance sheet. Allowances, such as allowance for doubtful accounts, adjust asset values to reflect estimated losses, decreasing asset carrying amounts and impacting net income via expense recognition. Accurate estimation of both provisions and allowances ensures compliance with accounting standards and provides a realistic view of financial position and performance.

Conclusion: Choosing Between Provision and Allowance

Choosing between provision and allowance depends on your financial reporting needs and the nature of the liability or asset involved. Provisions are recorded for present obligations with uncertain timing or amount, ensuring your accounts reflect potential future expenses accurately. Allowances are used to account for estimated reductions in asset values, such as doubtful accounts, providing a clearer picture of realizable assets.

Infographic: Provision vs Allowance

relatioo.com

relatioo.com