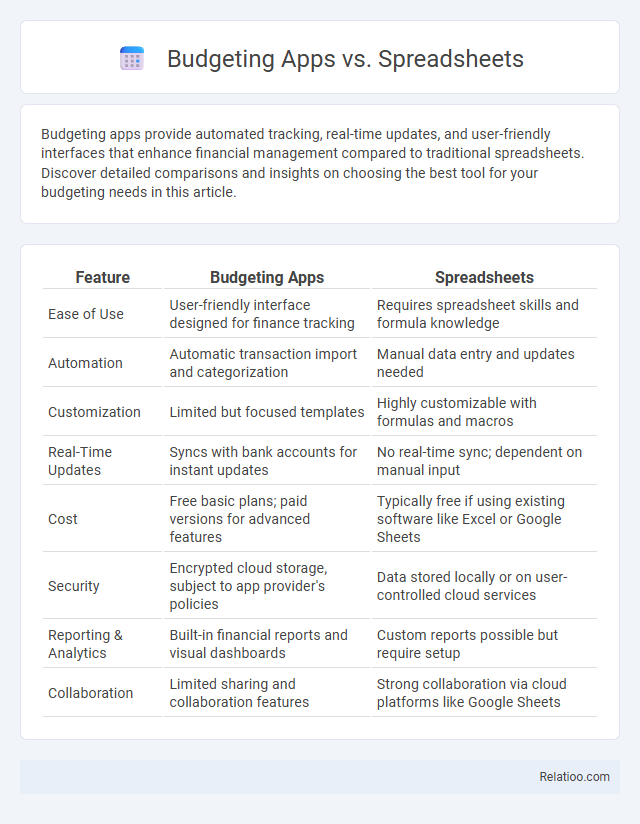

Budgeting apps provide automated tracking, real-time updates, and user-friendly interfaces that enhance financial management compared to traditional spreadsheets. Discover detailed comparisons and insights on choosing the best tool for your budgeting needs in this article.

Table of Comparison

| Feature | Budgeting Apps | Spreadsheets |

|---|---|---|

| Ease of Use | User-friendly interface designed for finance tracking | Requires spreadsheet skills and formula knowledge |

| Automation | Automatic transaction import and categorization | Manual data entry and updates needed |

| Customization | Limited but focused templates | Highly customizable with formulas and macros |

| Real-Time Updates | Syncs with bank accounts for instant updates | No real-time sync; dependent on manual input |

| Cost | Free basic plans; paid versions for advanced features | Typically free if using existing software like Excel or Google Sheets |

| Security | Encrypted cloud storage, subject to app provider's policies | Data stored locally or on user-controlled cloud services |

| Reporting & Analytics | Built-in financial reports and visual dashboards | Custom reports possible but require setup |

| Collaboration | Limited sharing and collaboration features | Strong collaboration via cloud platforms like Google Sheets |

Introduction to Budgeting Tools

Budgeting tools vary from user-friendly apps designed for automated expense tracking to customizable spreadsheets favored for detailed financial analysis. Budgeting apps offer real-time transaction syncing and visual reports to simplify money management, while spreadsheets provide flexibility through formulas and personalized budget categories. Expense tracking serves as a foundational element in both methods, enabling precise monitoring of spending habits and financial goals.

What Are Budgeting Apps?

Budgeting apps are digital tools designed to help users plan, track, and manage their personal finances by categorizing income and expenses automatically through linked bank accounts. These apps offer real-time updates, customizable budgeting categories, and visual reports that simplify financial oversight compared to manual spreadsheets. Unlike traditional expense tracking methods, budgeting apps provide integrated alerts, goal-setting features, and synchronization across multiple devices for seamless budgeting on the go.

Benefits of Using Budgeting Apps

Budgeting apps offer real-time expense tracking and personalized insights, enabling users to optimize savings and spending efficiently. They automate transaction categorization and provide visual reports, which improve financial decision-making compared to manual spreadsheets. Integrating bank feeds and alerts helps prevent overspending and keeps budgets accurate without extensive manual input.

What Are Budgeting Spreadsheets?

Budgeting spreadsheets are customizable digital tools that enable users to organize and track their income, expenses, and savings using software like Microsoft Excel or Google Sheets. These spreadsheets offer flexibility in creating personalized budget categories, applying formulas for automatic calculations, and visualizing financial data through charts and graphs. Unlike dedicated budgeting apps, spreadsheets require manual data entry but provide greater control over budget structure and detailed financial analysis.

Advantages of Budgeting Spreadsheets

Budgeting spreadsheets offer customizable and detailed financial tracking by allowing users to create tailored categories, formulas, and visualizations that suit individual budgeting needs. They provide greater control over data privacy and flexibility compared to apps, as users store files locally without relying on third-party services. Spreadsheets also enable comprehensive analysis of expenses and income trends, facilitating informed financial planning and goal setting.

Key Differences: Apps vs Spreadsheets

Budgeting apps offer real-time expense tracking, automated categorization, and user-friendly interfaces, while spreadsheets provide customizable templates and full control over data manipulation but require manual entry. Apps sync with bank accounts for instant updates, making budgeting more efficient for You, whereas spreadsheets demand more hands-on management, ideal for those comfortable with formulas. The key difference lies in automation and ease of use in apps versus flexibility and customization in spreadsheets.

User Experience: Automation and Customization

Budgeting apps deliver superior user experience through automation features like transaction syncing, real-time alerts, and predictive analytics, reducing manual input and improving accuracy. Spreadsheets offer unmatched customization with flexible formulas and tailored layouts but require significant manual data entry and financial literacy. Expense tracking tools prioritize simplicity and automation for quick categorization but often lack advanced customization options, balancing ease of use with limited personalization.

Cost Comparison: Free vs Paid Options

Budgeting apps often offer both free and paid versions, with free options providing basic features while paid plans unlock advanced tools like automated insights and multi-account syncing. Spreadsheets are typically free if you have access to software like Google Sheets or Excel, making them a cost-effective choice but requiring manual entry and formula setup. Expense tracking tools vary widely, with many free apps focusing on simple tracking, whereas premium versions may include budgeting, bill reminders, and detailed reporting, helping you decide which option fits Your financial management needs within Your budget.

Security and Privacy Considerations

Budgeting apps offer advanced encryption and multi-factor authentication to safeguard sensitive financial data, while spreadsheets rely heavily on user-applied security measures like password protection, which can be less reliable. Expense tracking tools integrated with budgeting apps often share data across platforms, raising privacy concerns if third-party access is not strictly controlled. Users prioritizing security and privacy should evaluate app permissions, data storage policies, and the transparency of data handling practices compared to the more manual but controlled environment spreadsheets provide.

Choosing the Best Tool for Your Needs

Budgeting apps offer automated expense tracking and real-time syncing across devices, ideal for users seeking convenience and detailed analytics. Spreadsheets provide customizable budgeting templates and complete control over data, making them suitable for those comfortable with manual input and advanced customization. Expense tracking tools focus on monitoring spending patterns and categorizing transactions, best for individuals who prioritize simplicity and overview rather than comprehensive budgeting features.

Infographic: Budgeting apps vs Spreadsheets

relatioo.com

relatioo.com