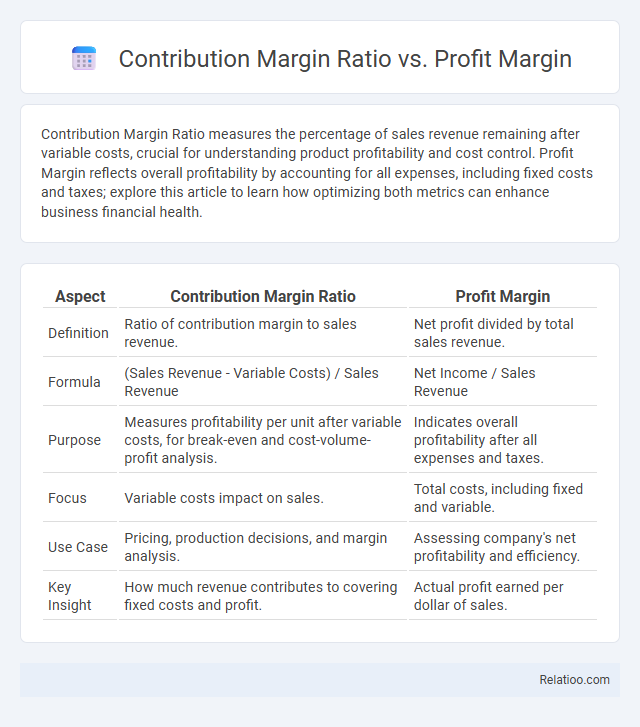

Contribution Margin Ratio measures the percentage of sales revenue remaining after variable costs, crucial for understanding product profitability and cost control. Profit Margin reflects overall profitability by accounting for all expenses, including fixed costs and taxes; explore this article to learn how optimizing both metrics can enhance business financial health.

Table of Comparison

| Aspect | Contribution Margin Ratio | Profit Margin |

|---|---|---|

| Definition | Ratio of contribution margin to sales revenue. | Net profit divided by total sales revenue. |

| Formula | (Sales Revenue - Variable Costs) / Sales Revenue | Net Income / Sales Revenue |

| Purpose | Measures profitability per unit after variable costs, for break-even and cost-volume-profit analysis. | Indicates overall profitability after all expenses and taxes. |

| Focus | Variable costs impact on sales. | Total costs, including fixed and variable. |

| Use Case | Pricing, production decisions, and margin analysis. | Assessing company's net profitability and efficiency. |

| Key Insight | How much revenue contributes to covering fixed costs and profit. | Actual profit earned per dollar of sales. |

Understanding Contribution Margin Ratio

Contribution Margin Ratio measures the percentage of sales revenue remaining after variable costs are deducted, highlighting how much revenue contributes to fixed costs and profit. Unlike Profit Margin, which reflects overall profitability including fixed costs and expenses, Contribution Margin Ratio focuses purely on the efficiency of variable cost management and contribution to breaking even. Understanding this ratio is crucial for pricing decisions, cost control, and maximizing operational leverage in business financial analysis.

Defining Profit Margin

Profit margin measures the percentage of revenue that turns into profit after all expenses, reflecting your company's overall profitability. Contribution margin ratio indicates the proportion of sales revenue that exceeds variable costs, highlighting funds available for fixed costs and profit. Understanding profit margin helps you evaluate financial health by comparing net income to total revenue.

Key Differences Between Contribution Margin Ratio and Profit Margin

The contribution margin ratio measures the percentage of sales revenue remaining after variable costs, highlighting the portion available to cover fixed costs and generate profit. Profit margin reflects the net income as a percentage of sales, accounting for all expenses including fixed costs, taxes, and interest. Key differences include that the contribution margin ratio focuses solely on variable costs and sales revenue relationship, while profit margin encompasses total profitability after all expenses.

Calculating Contribution Margin Ratio

The Contribution Margin Ratio is calculated by dividing the contribution margin by total sales revenue, which indicates the percentage of each sales dollar available to cover fixed costs and generate profit. Contribution margin itself is the difference between sales revenue and variable costs, showing the amount contributing to fixed costs. Profit margin, calculated as net income divided by sales revenue, reflects the overall profitability after all expenses are accounted for.

Calculating Profit Margin

Calculating profit margin involves dividing net profit by total revenue and expressing the result as a percentage, highlighting the overall profitability of a business after all expenses. The contribution margin ratio measures the percentage of sales revenue remaining after variable costs, which helps in understanding how much revenue contributes to fixed costs and profit. Unlike contribution margin ratio, profit margin accounts for all expenses including fixed costs, taxes, and interest, providing a comprehensive view of financial health.

Importance of Contribution Margin Ratio in Decision-Making

The Contribution Margin Ratio is a critical metric in decision-making as it indicates the percentage of sales revenue available to cover fixed costs and generate profit, helping you determine the profitability of individual products or services. Unlike Profit Margin, which shows overall profitability after all expenses, the Contribution Margin Ratio focuses on variable costs, enabling more precise cost control and pricing strategies. Understanding Contribution Margin allows businesses to prioritize high-margin products, optimize resource allocation, and make informed decisions that directly impact financial performance.

Significance of Profit Margin in Business Analysis

Profit margin measures the percentage of revenue remaining after all expenses, highlighting overall business profitability and financial health. Contribution margin ratio indicates the portion of sales contributing to fixed costs and profit, essential for break-even analysis and decision-making. Profit margin's significance lies in assessing long-term sustainability, pricing strategies, and operational efficiency, providing a comprehensive view beyond the contribution margin's focus on cost structure.

Applications in Cost-Volume-Profit Analysis

Contribution Margin Ratio reveals the percentage of sales revenue available to cover fixed costs and generate profit, playing a crucial role in Cost-Volume-Profit (CVP) analysis for determining breakeven points and target sales. Profit Margin measures overall profitability by indicating the portion of revenue remaining after all expenses, essential for assessing business efficiency but less specific to CVP decisions. Contribution, representing the difference between sales and variable costs, directly informs CVP analysis by highlighting the incremental profit earned per unit, enabling precise decision-making on pricing, product mix, and cost control.

Impact on Pricing and Operational Strategy

Contribution Margin Ratio highlights the percentage of each sales dollar available to cover fixed costs and generate profit, making it crucial for pricing decisions that maximize profitability without sacrificing volume. Profit Margin reflects the overall profitability after all expenses, guiding strategic adjustments in operational efficiency and cost control to enhance net income. Understanding Contribution helps in identifying the direct financial impact of sales on profitability, enabling businesses to optimize product mix and resource allocation for improved operational strategy.

Choosing the Right Margin Metric for Your Business

Choosing the right margin metric for your business depends on what financial insights are most critical for decision-making. The Contribution Margin Ratio highlights the percentage of sales revenue available to cover fixed costs and generate profit, making it essential for pricing and break-even analysis. Profit Margin provides a broader measure of overall profitability after all expenses, helping evaluate the company's efficiency and long-term sustainability.

Infographic: Contribution Margin Ratio vs Profit Margin

relatioo.com

relatioo.com