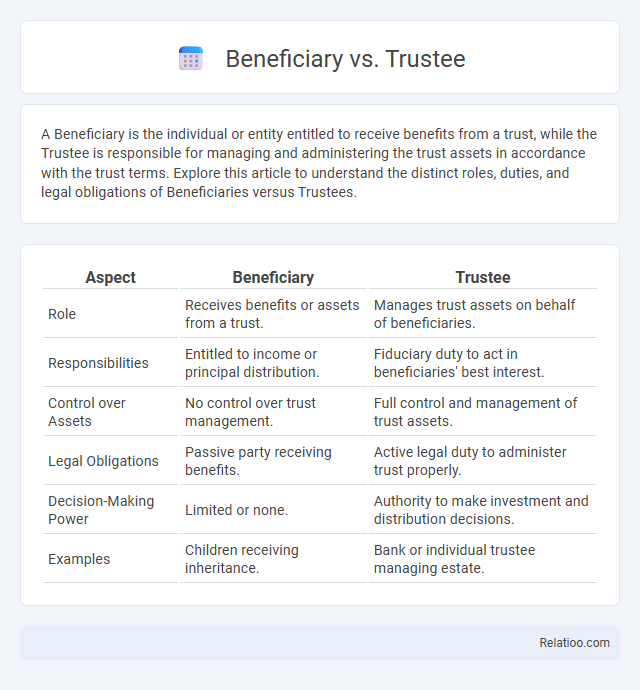

A Beneficiary is the individual or entity entitled to receive benefits from a trust, while the Trustee is responsible for managing and administering the trust assets in accordance with the trust terms. Explore this article to understand the distinct roles, duties, and legal obligations of Beneficiaries versus Trustees.

Table of Comparison

| Aspect | Beneficiary | Trustee |

|---|---|---|

| Role | Receives benefits or assets from a trust. | Manages trust assets on behalf of beneficiaries. |

| Responsibilities | Entitled to income or principal distribution. | Fiduciary duty to act in beneficiaries' best interest. |

| Control over Assets | No control over trust management. | Full control and management of trust assets. |

| Legal Obligations | Passive party receiving benefits. | Active legal duty to administer trust properly. |

| Decision-Making Power | Limited or none. | Authority to make investment and distribution decisions. |

| Examples | Children receiving inheritance. | Bank or individual trustee managing estate. |

Understanding the Roles: Beneficiary vs Trustee

The beneficiary is the individual or entity entitled to receive benefits or assets from a trust, while the trustee is responsible for managing and administering the trust according to its terms. Your understanding of these distinct roles is crucial for ensuring proper trust management and protecting the interests of the beneficiary. The trustee holds fiduciary duty, meaning they must act in the best interest of the beneficiary while complying with legal and financial obligations.

Key Differences Between Beneficiary and Trustee

A Trustee manages and administers assets held in a trust according to legal obligations and the trust document's terms, ensuring proper handling and distribution. A Beneficiary receives the benefits or assets from the trust but has no control over management decisions or responsibilities the Trustee holds. Understanding your role as a Beneficiary or Trustee is crucial for effectively navigating responsibilities, rights, and expectations within trust arrangements.

Legal Definitions of Beneficiary and Trustee

A beneficiary is an individual or entity entitled to receive benefits or assets from a trust, will, or insurance policy as defined by the legal document establishing the arrangement. A trustee is a person or institution appointed to manage and administer the trust assets according to the terms set forth in the trust agreement for the benefit of the beneficiary. Your understanding of these distinct roles ensures proper execution of trusts and protection of your legal rights in estate planning.

Responsibilities of a Trustee

A trustee is legally responsible for managing the trust assets in the best interest of the beneficiaries, ensuring proper administration according to the trust deed and relevant laws. Trustees must maintain accurate records, invest assets prudently, and distribute funds according to the terms of the trust. Unlike beneficiaries who receive benefits, trustees hold fiduciary duties including loyalty, care, and impartiality while overseeing the trust.

Rights and Expectations of a Beneficiary

Beneficiaries hold the right to receive benefits or assets from a trust as dictated by the trust document, while trustees have the fiduciary duty to manage and distribute those assets responsibly. The trustee must act in the best interests of the beneficiary, ensuring transparency, timely distribution, and adherence to the terms of the trust. Beneficiaries expect regular communication, accurate accounting, and protection of their entitlements from mismanagement or breach of trust by the trustee.

Trust Types and Their Impact on Beneficiaries and Trustees

Trust types such as revocable, irrevocable, and discretionary trusts distinctly influence the roles and rights of beneficiaries and trustees, shaping asset management and distribution outcomes. Revocable trusts allow grantors to modify terms, affecting beneficiaries' future interests, whereas irrevocable trusts provide greater asset protection but limit beneficiary control. Trustees bear fiduciary duties to manage trust assets prudently, balancing beneficiary rights with trust terms, which vary by trust structure and impact financial and legal responsibilities.

How Trustees Manage and Distribute Trust Assets

Trustees hold a fiduciary duty to manage and distribute trust assets in accordance with the trust document's terms, ensuring that the beneficiaries' interests are protected and that assets are administered prudently. They invest trust funds, pay debts and taxes, and allocate income or principal to beneficiaries while maintaining transparency through regular accounting. Trustees must balance legal, financial, and ethical responsibilities to optimize asset growth and meet beneficiaries' needs over the trust's duration.

Common Conflicts Between Beneficiaries and Trustees

Conflicts between beneficiaries and trustees often arise from disagreements over fiduciary responsibilities, asset management, and distribution timing. Beneficiaries may challenge trustee decisions if they suspect mismanagement, lack of transparency, or failure to act in the best interest of the trust. Clear communication, detailed trust terms, and adherence to legal duties can help mitigate disputes and protect the integrity of trust administration.

How to Choose the Right Trustee or Beneficiary

Choosing the right trustee involves evaluating their financial expertise, reliability, and impartiality to ensure proper management and distribution of trust assets. Beneficiaries should be clearly identified based on the trust's purpose and their entitlement to benefits, considering legal and familial implications. Balancing the trustee's fiduciary duties with the beneficiaries' rights is crucial for effective trust administration and avoiding conflicts.

Frequently Asked Questions About Beneficiaries and Trustees

A beneficiary is the person or entity entitled to receive benefits from a trust, estate, or insurance policy, while a trustee is responsible for managing the trust assets according to the trust document and legal requirements. Frequently asked questions often address the roles and responsibilities of trustees, how beneficiaries can enforce their rights, and what happens if a trustee fails to act in the beneficiary's best interest. Understanding the distinction between beneficiaries and trustees helps clarify issues such as trust distributions, fiduciary duties, and dispute resolution within estate planning.

Infographic: Beneficiary vs Trustee

relatioo.com

relatioo.com