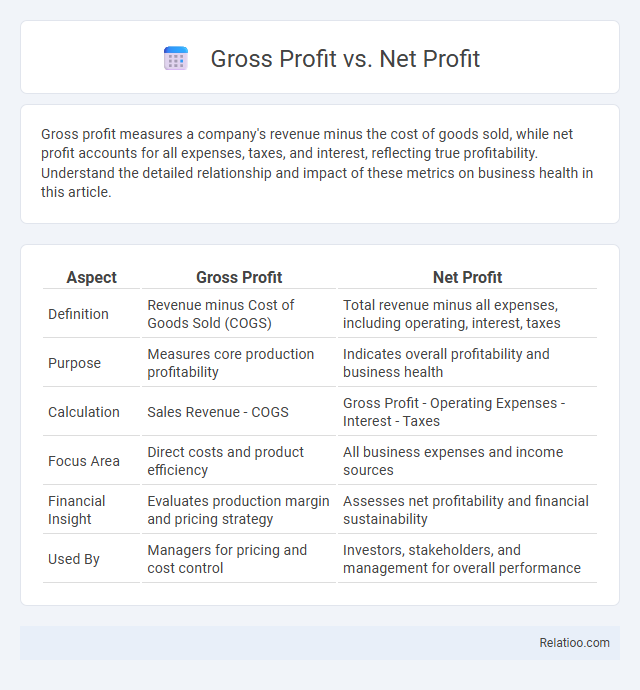

Gross profit measures a company's revenue minus the cost of goods sold, while net profit accounts for all expenses, taxes, and interest, reflecting true profitability. Understand the detailed relationship and impact of these metrics on business health in this article.

Table of Comparison

| Aspect | Gross Profit | Net Profit |

|---|---|---|

| Definition | Revenue minus Cost of Goods Sold (COGS) | Total revenue minus all expenses, including operating, interest, taxes |

| Purpose | Measures core production profitability | Indicates overall profitability and business health |

| Calculation | Sales Revenue - COGS | Gross Profit - Operating Expenses - Interest - Taxes |

| Focus Area | Direct costs and product efficiency | All business expenses and income sources |

| Financial Insight | Evaluates production margin and pricing strategy | Assesses net profitability and financial sustainability |

| Used By | Managers for pricing and cost control | Investors, stakeholders, and management for overall performance |

Introduction to Gross Profit and Net Profit

Gross profit is the amount a company earns from sales after subtracting the cost of goods sold (COGS), reflecting core operational efficiency. Net profit, also known as the bottom line, represents the remaining earnings after all expenses, taxes, and interest are deducted, indicating overall profitability. These key figures are critical components of financial statements, providing insight into a company's financial health and performance.

Definition of Gross Profit

Gross profit represents the revenue remaining after subtracting the cost of goods sold (COGS) from total sales, highlighting your business's core profitability before operating expenses and taxes. This metric is crucial for evaluating how efficiently a company produces and sells its products. Financial statements detail gross profit alongside net profit, which accounts for all expenses, providing a comprehensive view of overall financial health.

Definition of Net Profit

Net profit, also known as net income, represents the amount of money remaining after all operating expenses, interest, taxes, and other costs have been deducted from total revenue. It provides a clear indicator of a company's overall profitability, unlike gross profit which only considers revenue minus the cost of goods sold. Financial statements, particularly the income statement, detail net profit as a critical metric for assessing business performance and financial health.

Key Differences Between Gross Profit and Net Profit

Gross profit represents a company's revenue minus the cost of goods sold (COGS), highlighting profitability from core operations without factoring in operating expenses, taxes, or interest. Net profit, also known as the bottom line, deducts all operating expenses, taxes, interest, and other costs from total revenue, reflecting overall profitability. Financial statements, including the income statement, provide detailed breakdowns of gross profit and net profit, offering critical insights for assessing business performance.

Formula for Calculating Gross Profit

Gross profit is calculated by subtracting the cost of goods sold (COGS) from total revenue, expressed as Gross Profit = Revenue - COGS. Net profit, which accounts for all expenses including operating costs, taxes, and interest, is the remaining income after deducting these from gross profit. The financial statement, specifically the income statement, details both gross profit and net profit, providing critical insight into a company's profitability and operational efficiency.

Formula for Calculating Net Profit

Net profit is calculated by subtracting total expenses, including cost of goods sold (COGS), operating expenses, interest, and taxes, from total revenue. Gross profit, found by deducting COGS from total revenue, does not include operating expenses or taxes. Your financial statement summarizes these figures, with the net profit formula crucial for assessing overall business profitability and financial health.

Importance of Gross Profit in Financial Analysis

Gross profit represents the core profitability of a company's sales after deducting the cost of goods sold, making it a crucial metric in financial analysis to assess operational efficiency. Unlike net profit, which includes all expenses such as taxes and interest, gross profit highlights the direct relationship between revenue and production costs, providing insight into pricing strategies and cost management. Financial statements, particularly the income statement, rely on gross profit to evaluate product viability and guide decision-making for sustainable growth.

Significance of Net Profit for Businesses

Net profit represents the true profitability of your business after all expenses, taxes, and costs have been deducted from gross profit, making it a critical indicator of financial health. Unlike gross profit, which only accounts for direct costs of goods sold, net profit provides a comprehensive view of your business's ability to generate sustainable earnings reflected in the financial statement. Understanding net profit allows you to make informed decisions about budgeting, investments, and long-term strategic planning, ensuring your business remains viable and profitable.

Common Mistakes When Comparing Gross and Net Profit

Gross profit represents revenue minus the cost of goods sold, while net profit accounts for all expenses, including operating costs, taxes, and interest, as shown in the financial statement. A common mistake is comparing gross profit directly to net profit without considering additional expenses, which can lead to inaccurate assessments of a company's profitability. Misinterpreting these figures often results in overlooking critical financial insights necessary for informed decision-making and accurate business performance evaluation.

Gross Profit vs Net Profit: Which Metric Matters Most?

Gross profit reveals your company's core profitability by subtracting the cost of goods sold from total revenue, highlighting how efficiently you produce or deliver services. Net profit, often called the bottom line, accounts for all expenses including operating costs, taxes, and interest, offering a comprehensive view of your business's overall financial health. Analyzing both gross profit and net profit together is crucial for making informed decisions, as gross profit indicates production efficiency while net profit reflects the true profitability shown in your financial statement.

Infographic: Gross Profit vs Net Profit

relatioo.com

relatioo.com