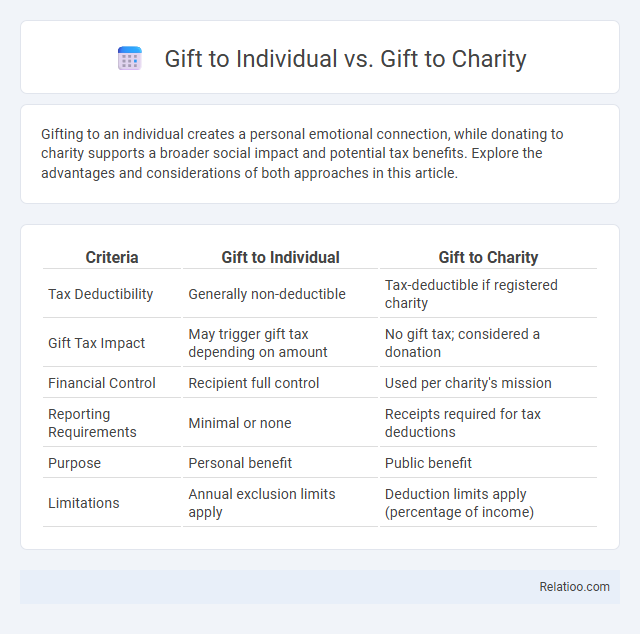

Gifting to an individual creates a personal emotional connection, while donating to charity supports a broader social impact and potential tax benefits. Explore the advantages and considerations of both approaches in this article.

Table of Comparison

| Criteria | Gift to Individual | Gift to Charity |

|---|---|---|

| Tax Deductibility | Generally non-deductible | Tax-deductible if registered charity |

| Gift Tax Impact | May trigger gift tax depending on amount | No gift tax; considered a donation |

| Financial Control | Recipient full control | Used per charity's mission |

| Reporting Requirements | Minimal or none | Receipts required for tax deductions |

| Purpose | Personal benefit | Public benefit |

| Limitations | Annual exclusion limits apply | Deduction limits apply (percentage of income) |

Understanding the Basics: Gift to Individual vs Gift to Charity

Understanding the basics of gifting involves recognizing key differences between gifts to individuals and gifts to charity. Gifts to individuals typically involve personal transfers of money or property without tax deductions, while gifts to charity are donations eligible for tax benefits under IRS regulations. Your awareness of these distinctions ensures proper tax reporting and maximizes financial benefits related to your gifting strategy.

Key Legal Definitions and Differences

Gifts to individuals typically involve transferring property or money without expecting anything in return, governed by laws around intent, delivery, and acceptance. Gifts to charity must meet specific legal requirements, including qualification as a registered nonprofit and compliance with tax deduction regulations under IRS code Section 170. Understanding these distinctions helps Your gifting strategy align with legal definitions, tax implications, and documentation needs, ensuring proper transfer and recognition.

Tax Implications for Donors

Gifting to an individual can trigger gift tax liabilities if the amount exceeds the annual exclusion limit, affecting Your tax return and requiring proper documentation. Gifts to charity often provide significant tax deductions, lowering Your taxable income while supporting nonprofit causes. Understanding these distinctions is crucial for donors to optimize tax benefits and ensure compliance with IRS regulations.

Gift Limits and Exemptions

Gift limits and exemptions vary significantly between gifts to individuals and gifts to charities, impacting your tax responsibilities and planning strategies. Gifts to individuals often fall under the annual gift tax exclusion, currently set at $17,000 per recipient in 2024, allowing you to gift this amount tax-free without affecting your lifetime exemption. Gifts to charities, however, qualify for unlimited tax deductions under IRS rules, enabling you to reduce taxable income without limit, making charitable donations a powerful tool for tax planning.

Reporting Requirements: Documentation and Forms

Gifting to an individual requires detailed documentation of the gift amount, with IRS Form 709 necessary if the value exceeds the annual exclusion limit of $17,000 for 2024. Gifts to charity are subject to different reporting requirements, where donors must keep receipts and use IRS Form 8283 for non-cash gifts over $500 to claim tax deductions. Proper record-keeping and accurate form submission ensure compliance with tax laws, preventing penalties and facilitating transparent gift reporting for both personal and charitable contributions.

Impact on Estate Planning

Gifts to individuals directly reduce the donor's taxable estate, potentially minimizing estate taxes and providing financial support to heirs. Charitable donations not only lower estate taxes through deductions but also fulfill philanthropic goals, enhancing legacy value and public goodwill. Strategic gifting balances asset distribution with tax efficiency, ensuring optimal estate preservation and adherence to the donor's long-term financial and personal objectives.

Advantages of Gifting to Individuals

Gifting to individuals offers personalized emotional impact, fostering stronger relationships through thoughtful and meaningful presents tailored to the recipient's preferences. You enable direct appreciation and gratitude, creating memorable experiences and deepening bonds. This form of gifting also allows for immediate feedback and connection, enhancing the overall value beyond the material gift itself.

Benefits of Donating to Charitable Organizations

Donating to charitable organizations offers significant tax deductions, reducing taxable income more effectively than gifts to individuals. Contributions to registered charities qualify for tax credits and enhance social impact by supporting community programs, healthcare, education, and poverty alleviation. Unlike personal gifts, charitable donations promote long-term societal benefits and align with philanthropic strategies for wealth management.

Common Pitfalls and How to Avoid Them

When gifting to individuals, common pitfalls include failing to understand tax implications and gift limits, which can result in unexpected liabilities; to avoid this, always verify current IRS annual exclusion amounts and consider filing a gift tax return if necessary. Gifts to charity may face issues like improper documentation or selecting non-qualified organizations, leading to denied deductions; ensure donations are made to IRS-recognized 501(c)(3) entities with proper receipts to maximize tax benefits. When gifting in general, avoid pitfalls such as neglecting beneficiary designations, unclear gift intentions, or transferring assets without appraisal, and mitigate these by consulting tax professionals and maintaining thorough records.

Choosing the Right Gifting Strategy for Your Goals

Choosing the right gifting strategy depends on your personal goals, whether it's maximizing tax benefits, creating lasting impact, or fostering relationships. Gifts to individuals often strengthen personal bonds but may have gift tax implications, while gifts to charity can provide significant tax deductions and support causes you care about. Evaluating your priorities and financial situation ensures your gifting approach aligns with your intentions and maximizes the benefits for both you and the recipients.

Infographic: Gift to Individual vs Gift to Charity

relatioo.com

relatioo.com