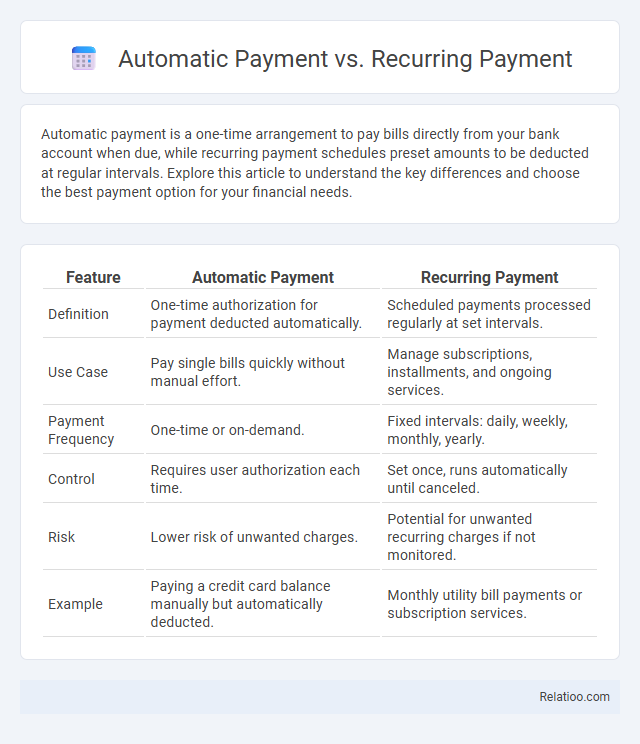

Automatic payment is a one-time arrangement to pay bills directly from your bank account when due, while recurring payment schedules preset amounts to be deducted at regular intervals. Explore this article to understand the key differences and choose the best payment option for your financial needs.

Table of Comparison

| Feature | Automatic Payment | Recurring Payment |

|---|---|---|

| Definition | One-time authorization for payment deducted automatically. | Scheduled payments processed regularly at set intervals. |

| Use Case | Pay single bills quickly without manual effort. | Manage subscriptions, installments, and ongoing services. |

| Payment Frequency | One-time or on-demand. | Fixed intervals: daily, weekly, monthly, yearly. |

| Control | Requires user authorization each time. | Set once, runs automatically until canceled. |

| Risk | Lower risk of unwanted charges. | Potential for unwanted recurring charges if not monitored. |

| Example | Paying a credit card balance manually but automatically deducted. | Monthly utility bill payments or subscription services. |

Understanding Automatic Payments

Automatic payments are scheduled transactions that authorize your bank or credit card to pay bills automatically on set dates, ensuring timely payments without manual intervention. Recurring payments, while similar, require active setup from you to specify payment amounts and intervals, often used for subscriptions or installment plans. Understanding automatic payments helps you manage your finances by avoiding late fees and maintaining consistent payment schedules effortlessly.

What Are Recurring Payments?

Recurring payments are scheduled transactions where a customer authorizes a merchant to charge their account automatically at regular intervals, such as monthly subscriptions or memberships. These payments ensure consistent billing without requiring manual approval for each transaction, enhancing convenience for both the customer and the business. Unlike one-time automatic payments tied to a specific event, recurring payments are continuous and predefined until canceled.

Key Differences Between Automatic and Recurring Payments

Automatic payments are triggered by a specific event or date, deducting funds from your account without requiring manual approval each time, while recurring payments occur at regular intervals for ongoing services or subscriptions. The key difference lies in control; automatic payments often handle one-time bills like utilities upon due dates, whereas recurring payments are pre-scheduled for continuous charges such as memberships. Understanding these distinctions helps you manage your finances efficiently by choosing the best payment method for each expense type.

How Automatic Payments Work

Automatic payments work by authorizing your bank or credit card provider to deduct fixed amounts from your account at scheduled intervals, eliminating the need to manually initiate each transaction. Unlike recurring payments, which may require authorization for variable amounts or manually set schedules, automatic payments ensure consistent, on-time bill settlements by directly communicating with the billing company. This system reduces the risk of missed payments and helps you manage your finances more efficiently.

Setting Up Recurring Payments: Step-by-Step

Setting up recurring payments involves entering your payment details and selecting the frequency, such as weekly or monthly, on your service provider's platform. Automatic payments, also known as direct debits, are set to withdraw funds automatically from your bank account on the due date to avoid missed payments. Comparing the two, recurring payments typically apply to credit card or digital wallet transactions requiring initial authorization, while automatic payments link directly to bank accounts for seamless billing.

Pros and Cons of Automatic Payments

Automatic payments streamline your bill management by authorizing businesses to withdraw funds directly from your account on a scheduled basis, ensuring timely payments without manual intervention. The primary advantage is convenience and avoiding late fees, but the downside includes potential overdrafts if your balance is insufficient and less control over exact payment dates or amounts. Careful monitoring of your account is essential to prevent errors or unauthorized charges, as automatic payments can sometimes lead to financial surprises if not reviewed regularly.

Advantages and Disadvantages of Recurring Payments

Recurring payments offer the advantage of ensuring consistent and timely bill settlements, reducing the risk of late fees and service interruptions. However, your control over individual transactions is limited, which can complicate cancellations or modifications and may lead to unintended charges if not monitored carefully. Compared to automatic and manual payment methods, recurring payments maximize convenience but require diligent account oversight to avoid potential financial mismanagement.

Security Considerations for Both Payment Types

Automatic payment and recurring payment both streamline bill management but differ in authorization and flexibility, impacting security considerations. Your sensitive financial data requires encryption and strong authentication methods, such as two-factor authentication, to prevent unauthorized access during automated transactions. Regularly monitoring account activity and setting transaction alerts enhance security by quickly detecting and addressing any suspicious payment behavior.

Choosing the Right Payment Method for You

Choosing the right payment method depends on your financial habits and billing preferences. Automatic payments withdraw the exact billed amount at each cycle, ideal for variable expenses, while recurring payments charge a fixed amount on a regular schedule, suitable for subscriptions or flat fees. Understanding these differences helps streamline bill management and prevent missed payments, aligning your payment strategy with your budget and cash flow.

Frequently Asked Questions: Automatic vs Recurring Payments

Automatic payments are transactions initiated by the payer to settle bills directly from their bank account or credit card on a specific date, while recurring payments are scheduled transactions set up to repeat at regular intervals, often used for subscriptions or memberships. Common questions include whether automatic payments require user intervention each cycle or if they continue automatically, with the answer being that automatic payments can be one-time or recurring depending on setup. Understanding the distinction helps consumers manage cash flow, avoid missed payments, and recognize that recurring payments typically continue until canceled, whereas automatic payments could be either one-time or ongoing.

Infographic: Automatic Payment vs Recurring Payment

relatioo.com

relatioo.com