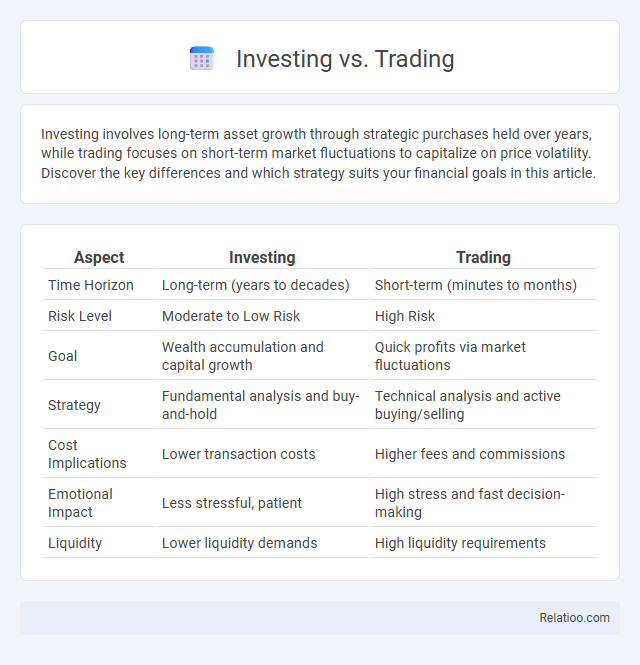

Investing involves long-term asset growth through strategic purchases held over years, while trading focuses on short-term market fluctuations to capitalize on price volatility. Discover the key differences and which strategy suits your financial goals in this article.

Table of Comparison

| Aspect | Investing | Trading |

|---|---|---|

| Time Horizon | Long-term (years to decades) | Short-term (minutes to months) |

| Risk Level | Moderate to Low Risk | High Risk |

| Goal | Wealth accumulation and capital growth | Quick profits via market fluctuations |

| Strategy | Fundamental analysis and buy-and-hold | Technical analysis and active buying/selling |

| Cost Implications | Lower transaction costs | Higher fees and commissions |

| Emotional Impact | Less stressful, patient | High stress and fast decision-making |

| Liquidity | Lower liquidity demands | High liquidity requirements |

Understanding Investing and Trading

Investing involves building wealth gradually through long-term asset appreciation, dividends, or interest, while trading focuses on short-term market fluctuations to capitalize on price volatility. Understanding the distinct goals, risk levels, and time commitments of investing versus trading is crucial for developing a strategy tailored to Your financial objectives. Effective money management integrates both approaches by controlling risk and optimizing returns within Your overall portfolio framework.

Key Differences Between Investing and Trading

Investing involves long-term strategies aimed at wealth growth through buying and holding assets such as stocks, bonds, or real estate, typically emphasizing fundamental analysis and patience. Trading, on the other hand, centers on short-term market movements, utilizing technical analysis and frequent transactions to capitalize on price volatility. Understanding these key differences helps you tailor your money management approach to match your financial goals and risk tolerance effectively.

Goals and Objectives: Wealth Building vs. Quick Profits

Investing focuses on long-term wealth building by acquiring assets that appreciate over time, aligning with goals like retirement planning and financial security. Trading aims for quick profits through frequent buying and selling of stocks, relying on market volatility and short-term price movements. Effective money management balances risk and reward by setting clear objectives, managing capital allocation, and preserving capital to support either strategy's specific financial goals.

Time Horizons: Long-Term vs. Short-Term Approaches

Investing typically involves a long-term time horizon, allowing Your assets to grow steadily through compounding, dividends, and capital appreciation over years or decades. Trading focuses on short-term approaches, capitalizing on market volatility and price fluctuations within days, weeks, or months to generate quick returns. Effective money management balances these strategies by controlling risk, setting clear goals, and adjusting exposure according to Your financial timeline and market conditions.

Risk Management Strategies

Investing involves long-term asset allocation focused on growth and income, while trading requires short-term market timing to capitalize on price fluctuations, both demanding distinct risk management strategies. Effective risk management includes diversification, setting stop-loss orders, and maintaining a balanced portfolio to protect Your capital from significant losses. Employing proper position sizing and regularly reviewing market conditions helps mitigate risks and optimize returns across investing, trading, and money management activities.

Tools and Techniques Used

Investing primarily relies on long-term tools such as fundamental analysis, portfolio diversification, and dollar-cost averaging to build wealth steadily. Trading utilizes short-term techniques including technical analysis, chart patterns, and algorithmic trading to capitalize on market fluctuations. Your success in both depends heavily on effective money management tools like stop-loss orders, position sizing, and risk-reward assessments to protect capital and optimize returns.

Psychological Factors: Mindset and Discipline

Investing, trading, and money management require distinct psychological approaches, where mindset and discipline play crucial roles in your financial success. Investing demands patience and a long-term perspective, while trading calls for quick decision-making and emotional control to handle market volatility. Effective money management hinges on consistent discipline to maintain risk tolerance and avoid impulsive behaviors that can undermine your portfolio growth.

Costs and Fees Comparison

Investing typically incurs lower costs with expenses such as mutual fund management fees averaging 0.5% to 1.0% annually and minimal trading commissions, making it cost-effective for long-term growth. Trading involves higher fees due to frequent transactions, including brokerage commissions that can range from $4.95 to $9.99 per trade, plus potential margin interest and short-term capital gains taxes. Money management services often charge a percentage of assets under management (AUM), commonly between 0.5% and 2%, covering portfolio oversight and rebalancing, which can add to overall costs compared to self-directed investing or trading.

Suitability: Which Approach Fits Your Financial Goals

Investing suits those seeking long-term growth by buying and holding assets, aligning well with retirement or wealth-building goals. Trading appeals to individuals comfortable with short-term market fluctuations aiming for quick profits through frequent buying and selling. Your choice should reflect your risk tolerance, time commitment, and financial objectives to ensure the strategy fits your personal goals effectively.

Making the Right Choice: Investing, Trading, or Both

Choosing between investing, trading, or combining both strategies depends on your financial goals, risk tolerance, and time commitment. Investing emphasizes long-term growth through asset appreciation and dividends, while trading focuses on short-term market fluctuations to capitalize on price movements. Effective money management balances these approaches by diversifying portfolios, setting risk limits, and maintaining discipline to maximize returns and minimize losses.

Infographic: Investing vs Trading

relatioo.com

relatioo.com