Diversification reduces investment risk by spreading assets across various sectors, while hedging involves using financial instruments to offset potential losses in specific investments. Discover the key differences and applications of diversification and hedging in this article.

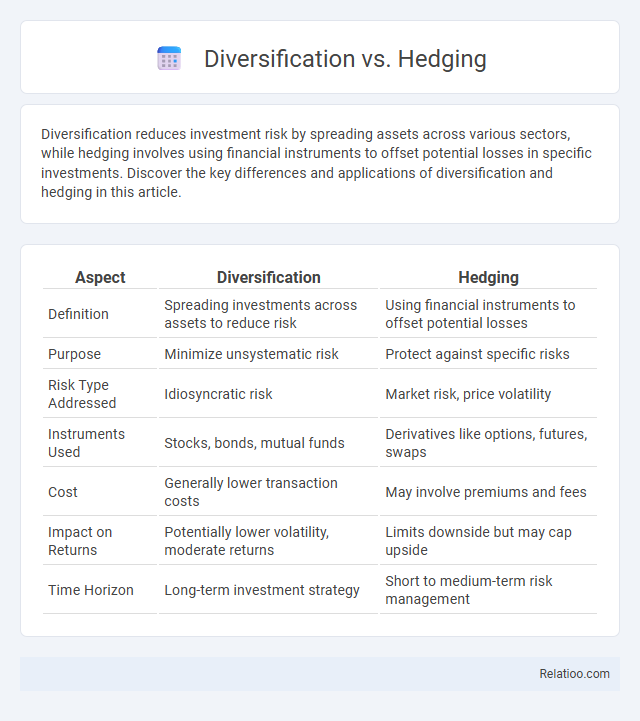

Table of Comparison

| Aspect | Diversification | Hedging |

|---|---|---|

| Definition | Spreading investments across assets to reduce risk | Using financial instruments to offset potential losses |

| Purpose | Minimize unsystematic risk | Protect against specific risks |

| Risk Type Addressed | Idiosyncratic risk | Market risk, price volatility |

| Instruments Used | Stocks, bonds, mutual funds | Derivatives like options, futures, swaps |

| Cost | Generally lower transaction costs | May involve premiums and fees |

| Impact on Returns | Potentially lower volatility, moderate returns | Limits downside but may cap upside |

| Time Horizon | Long-term investment strategy | Short to medium-term risk management |

Introduction to Diversification and Hedging

Diversification involves spreading your investments across various asset classes to reduce risk, while hedging uses financial instruments like options or futures to protect against potential losses. By diversifying, you minimize exposure to any single asset's volatility, and through hedging, you actively offset downside risks in your portfolio. Understanding the distinction helps you build a balanced investment strategy that safeguards your financial goals effectively.

Key Concepts: What Is Diversification?

Diversification involves spreading investments across various asset classes and sectors to reduce risk by minimizing exposure to any single source of loss. Hedging, in contrast, specifically uses financial instruments or strategies to offset potential losses from an existing position, often through derivatives like options or futures. While both aim to protect portfolios, diversification emphasizes risk distribution, whereas hedging focuses on mitigating specific risks associated with market fluctuations.

Understanding Hedging in Financial Markets

Hedging in financial markets involves using financial instruments or strategies to reduce the risk of adverse price movements in assets, often through derivatives like options and futures. Unlike diversification, which spreads investment across various assets to mitigate risk, hedging directly offsets potential losses in a specific position. Effective hedging requires understanding market correlations and volatility to optimize risk management and preserve capital during market fluctuations.

Similarities Between Diversification and Hedging

Diversification and hedging both aim to reduce investment risk by managing exposure to market fluctuations and uncertainties. Diversification spreads investments across various assets or sectors to minimize the impact of any single asset's poor performance, while hedging involves using financial instruments like options or futures to offset potential losses. Both strategies enhance portfolio stability by mitigating risk, although diversification focuses on asset variety and hedging on protective instruments.

Core Differences: Diversification vs Hedging

Diversification involves spreading investments across different assets to reduce overall portfolio risk, while hedging uses financial instruments like options or futures to offset potential losses in specific investments. Diversification minimizes risk by avoiding concentration in a single asset class, whereas hedging actively protects against adverse price movements in existing positions. Both strategies aim to manage risk but differ fundamentally in approach, with diversification enhancing portfolio stability and hedging providing targeted risk mitigation.

Risks Reduced by Diversification

Diversification reduces risks by spreading investments across various asset classes, industries, and geographic regions to minimize the impact of any single investment's poor performance. It primarily targets unsystematic risk, which is company or sector-specific, unlike hedging that focuses on offsetting potential losses through derivatives or other financial instruments. Effective diversification leads to a more stable portfolio return by lowering volatility and reducing exposure to specific economic, political, or market event risks.

Risks Managed by Hedging Strategies

Hedging strategies primarily manage financial risks such as price volatility, currency fluctuations, and interest rate changes by using derivatives like options, futures, and swaps to offset potential losses. Unlike diversification, which spreads investment risk across various assets or sectors to reduce exposure, hedging directly targets specific risk factors inherent in a portfolio. Effective risk management through hedging ensures more predictable cash flows and protects against adverse market movements, making it essential for stabilizing earnings in volatile environments.

Practical Examples: Diversification in Action

Diversification in action can be seen in an investor allocating assets across stocks, bonds, and real estate to spread risk and enhance returns, such as combining blue-chip stocks with emerging market funds and government bonds. Hedging involves using financial instruments like options or futures contracts to offset potential losses, exemplified by a farmer locking in crop prices through futures to protect against market volatility. Unlike simple diversification, which reduces unsystematic risk by spreading investments, hedging directly targets specific risks, providing a strategic safeguard against adverse price movements.

Real-World Hedging Techniques

Real-world hedging techniques involve using financial instruments such as futures, options, and swaps to minimize risks associated with price fluctuations in commodities, currencies, or interest rates. Diversification reduces portfolio risk by spreading investments across various asset classes or sectors, while hedging specifically targets protection against adverse price movements in a particular asset or exposure. You can optimize your risk management strategy by combining both diversification and hedging to shield your portfolio from volatility and unforeseen market changes.

Choosing the Right Approach for Your Portfolio

Choosing the right approach for your portfolio depends on your risk tolerance and investment goals; diversification spreads investments across various asset classes to reduce unsystematic risk, while hedging uses financial instruments like options or futures to protect against specific market downturns. Diversification minimizes the impact of individual asset volatility by balancing different sectors, geographic regions, and asset types, whereas hedging provides targeted risk management strategies tailored to potential losses. A combination of both can optimize portfolio resilience by balancing broad market exposure with protective measures against adverse movements.

Infographic: Diversification vs Hedging

relatioo.com

relatioo.com