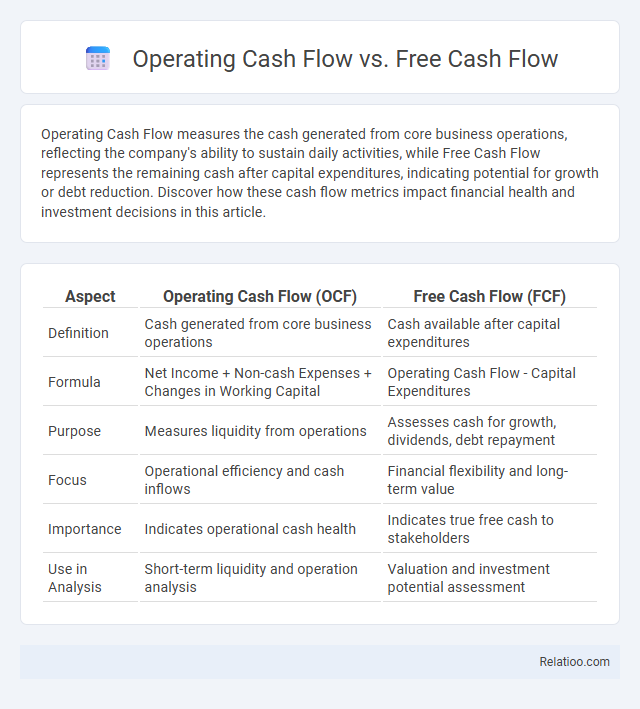

Operating Cash Flow measures the cash generated from core business operations, reflecting the company's ability to sustain daily activities, while Free Cash Flow represents the remaining cash after capital expenditures, indicating potential for growth or debt reduction. Discover how these cash flow metrics impact financial health and investment decisions in this article.

Table of Comparison

| Aspect | Operating Cash Flow (OCF) | Free Cash Flow (FCF) |

|---|---|---|

| Definition | Cash generated from core business operations | Cash available after capital expenditures |

| Formula | Net Income + Non-cash Expenses + Changes in Working Capital | Operating Cash Flow - Capital Expenditures |

| Purpose | Measures liquidity from operations | Assesses cash for growth, dividends, debt repayment |

| Focus | Operational efficiency and cash inflows | Financial flexibility and long-term value |

| Importance | Indicates operational cash health | Indicates true free cash to stakeholders |

| Use in Analysis | Short-term liquidity and operation analysis | Valuation and investment potential assessment |

Introduction to Operating Cash Flow and Free Cash Flow

Operating Cash Flow measures the cash a company generates from its regular business operations, highlighting its ability to maintain and grow core activities. Free Cash Flow represents the cash remaining after deducting capital expenditures from operating cash flow, indicating the funds available for expansion, debt repayment, or dividends. Understanding these cash flow types helps you assess a company's financial health and operational efficiency.

Defining Operating Cash Flow (OCF)

Operating Cash Flow (OCF) measures the cash generated by Your company's core business operations, excluding expenses related to investments or financing. It reflects the liquidity and efficiency of day-to-day activities by showing the actual cash inflow from sales minus operating expenses. Understanding OCF is essential for assessing whether the business generates sufficient cash to maintain operations and fund growth without external financing.

Defining Free Cash Flow (FCF)

Free Cash Flow (FCF) represents the cash generated by your business after accounting for capital expenditures needed to maintain or expand asset base, reflecting true liquidity available for growth, debt repayment, or dividends. Operating Cash Flow (OCF) measures cash generated from core business operations, excluding investment and financing activities, while Cash Flow encompasses all cash inflows and outflows within a period. Understanding FCF provides a clearer picture of financial health by highlighting cash accessible beyond regular operating expenses and reinvestment needs.

Key Differences Between OCF and FCF

Operating Cash Flow (OCF) measures the cash generated from a company's core business operations, reflecting its ability to generate cash internally without external financing. Free Cash Flow (FCF) represents the cash available after capital expenditures, indicating the funds a company can use for expansion, dividends, or debt repayment. The key difference lies in OCF excluding capital expenditures, while FCF accounts for these investments, providing a clearer picture of financial flexibility and sustainability.

Calculation Methods for OCF and FCF

Operating Cash Flow (OCF) is calculated by adjusting net income for non-cash expenses like depreciation and changes in working capital, reflecting the cash generated from core business operations. Free Cash Flow (FCF) is derived by subtracting capital expenditures from OCF, showing the cash available for distribution after maintaining or expanding asset base. Understanding these calculation methods helps You assess a company's liquidity and financial health more accurately than using simple cash flow metrics alone.

Importance of OCF in Financial Analysis

Operating Cash Flow (OCF) represents the cash generated from a company's core business operations, crucial for assessing its ability to sustain day-to-day activities without relying on external financing. Free Cash Flow (FCF) subtracts capital expenditures from OCF, indicating the cash available for expansion, dividends, or debt repayment, while Cash Flow is a broader term encompassing all cash inflows and outflows. OCF is essential in financial analysis as it reveals the true liquidity derived from operational efficiency, providing investors and analysts with insights into the company's financial health and sustainability.

Importance of FCF in Investment Decisions

Operating Cash Flow measures the cash generated from core business operations, while Free Cash Flow (FCF) represents the cash available after capital expenditures, crucial for assessing a company's ability to generate surplus cash for investors. Free Cash Flow is a key indicator for investment decisions because it reflects the actual liquidity your business can use for expansion, dividends, or debt repayment, providing a clearer picture of financial health than Operating Cash Flow alone. Understanding the differences in these cash flow metrics helps investors evaluate sustainable profitability and long-term value creation effectively.

Common Misconceptions About OCF and FCF

Operating Cash Flow (OCF) is often confused with Free Cash Flow (FCF), but OCF represents the cash generated from core business operations, excluding capital expenditures, while FCF accounts for these investments, reflecting the actual cash available to investors. A common misconception is that high OCF always indicates strong financial health; however, if capital expenditures are substantial, FCF may be low or negative, signaling potential cash constraints. Many also mistakenly equate Cash Flow with OCF or FCF without recognizing it as a broader term that includes all cash movements, including financing and investing activities.

Practical Examples: OCF vs FCF

Operating Cash Flow (OCF) represents the cash generated from a company's core business activities, such as sales receipts and payments to suppliers, highlighting its operational efficiency. Free Cash Flow (FCF) adjusts OCF by subtracting capital expenditures, revealing the cash available for growth, dividends, or debt reduction; for example, a firm with $500,000 OCF and $150,000 in capital investments has an FCF of $350,000. While Cash Flow refers broadly to all cash movements including financing and investing activities, analyzing OCF versus FCF provides practical insight into a company's ability to sustain operations versus fund expansion or return value to shareholders.

Which Metric Matters Most for Your Business?

Operating Cash Flow measures cash generated from core business operations, providing insight into a company's ability to sustain day-to-day activities. Free Cash Flow accounts for capital expenditures, highlighting how much cash remains for expansion, debt repayment, or dividends after maintaining assets. Free Cash Flow often matters most for businesses seeking growth or investment opportunities, while Operating Cash Flow is crucial for evaluating operational efficiency and liquidity.

Infographic: Operating Cash Flow vs Free Cash Flow

relatioo.com

relatioo.com