Contribution per Unit measures profit earned from each individual product sold, while Total Contribution sums the profit from all units sold, highlighting overall business performance. Learn how to optimize both metrics for maximum profitability in this article.

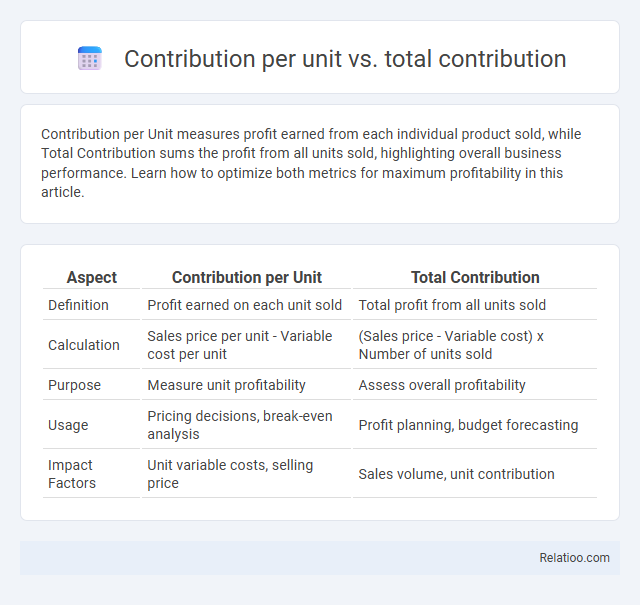

Table of Comparison

| Aspect | Contribution per Unit | Total Contribution |

|---|---|---|

| Definition | Profit earned on each unit sold | Total profit from all units sold |

| Calculation | Sales price per unit - Variable cost per unit | (Sales price - Variable cost) x Number of units sold |

| Purpose | Measure unit profitability | Assess overall profitability |

| Usage | Pricing decisions, break-even analysis | Profit planning, budget forecasting |

| Impact Factors | Unit variable costs, selling price | Sales volume, unit contribution |

Understanding Contribution per Unit

Contribution per Unit measures the profit earned on each individual product sold, calculated as sales price minus variable cost per unit. Understanding this metric helps you identify which products deliver the highest profitability on a per-unit basis, enabling better pricing and production decisions. Total Contribution aggregates these profits across all units sold, while overall Contribution often refers to total profit after fixed costs are considered.

Defining Total Contribution

Total Contribution represents the aggregate profit generated by all units sold, calculated by multiplying Contribution per Unit by the total quantity sold. Contribution per Unit measures the surplus of sales price over variable cost for a single item, serving as a key indicator for pricing and production decisions. Understanding Total Contribution helps businesses evaluate overall profitability and the ability to cover fixed costs.

Key Differences Between Contribution per Unit and Total Contribution

Contribution per Unit measures the profit earned from each individual product sold by subtracting variable costs per unit from the selling price per unit. Total Contribution represents the overall profit generated from all units sold and is calculated by multiplying the Contribution per Unit by the total number of units sold. Key differences highlight that Contribution per Unit focuses on profitability at a single-item level, whereas Total Contribution considers aggregate profitability across the entire sales volume.

Calculating Contribution per Unit: Formula and Examples

Contribution per Unit is calculated using the formula: Contribution per Unit = Selling Price per Unit - Variable Cost per Unit, which helps determine the profit generated from each individual product sold. Total Contribution is the aggregate profit from all units sold, expressed as Total Contribution = Contribution per Unit x Number of Units Sold. Understanding these metrics enables businesses to analyze profitability and make informed decisions on pricing, production, and sales strategies.

How to Compute Total Contribution

Total Contribution is computed by multiplying the Contribution per Unit by the number of units sold, providing a clear measure of overall profitability from sales volume. Contribution per Unit is calculated by subtracting variable costs per unit from the selling price per unit, which represents the profit made on each individual product sold. Understanding Your Total Contribution helps in analyzing how sales levels impact fixed costs coverage and profit margins.

Role of Contribution per Unit in Pricing Decisions

Contribution per unit represents the profit generated from each product sold after variable costs are deducted and serves as a critical metric in pricing decisions by highlighting profitability at the unit level. Total contribution, calculated by multiplying contribution per unit by sales volume, measures overall profitability but can obscure the impact of individual product pricing. Focusing on contribution per unit enables businesses to set prices that maximize profit margins, optimize product mix, and respond effectively to cost changes, ensuring pricing strategies align with financial goals.

The Importance of Total Contribution in Profit Analysis

Total contribution represents the aggregate profit generated by all units sold, calculated by multiplying the contribution per unit by the total number of units sold. Unlike contribution per unit, which measures profitability on a single-item basis, total contribution provides a comprehensive view critical for evaluating overall business performance and capacity to cover fixed costs. Analyzing total contribution enables managers to make informed decisions on pricing, production levels, and resource allocation to maximize profit.

Impact on Break-even Analysis

Contribution per Unit quantifies the profit earned from each individual product sold, crucial for assessing pricing strategies. Total Contribution aggregates this value across all units sold, directly influencing your break-even point by covering fixed costs. Understanding both metrics sharpens break-even analysis, enabling precise decisions on sales volume and cost management to achieve profitability.

Practical Applications in Business Decision-Making

Contribution per Unit measures the profit earned from each product sold, essential for pricing and product mix decisions, while Total Contribution aggregates this value across all units, reflecting the overall profitability impact. Contribution, the difference between sales revenue and variable costs, provides a crucial indicator of how sales affect net profit. Understanding these metrics enables you to optimize resource allocation, identify high-margin products, and improve break-even analysis for effective business strategies.

Contribution per Unit vs Total Contribution: Summary Table

Contribution per Unit measures the profit earned on each individual item sold, calculated as sales price minus variable cost per unit. Total Contribution represents the aggregate profit from all units sold, determined by multiplying Contribution per Unit by the total sales volume. You should analyze both metrics to optimize pricing strategies and maximize overall profitability in your business.

Infographic: Contribution per Unit vs Total Contribution

relatioo.com

relatioo.com