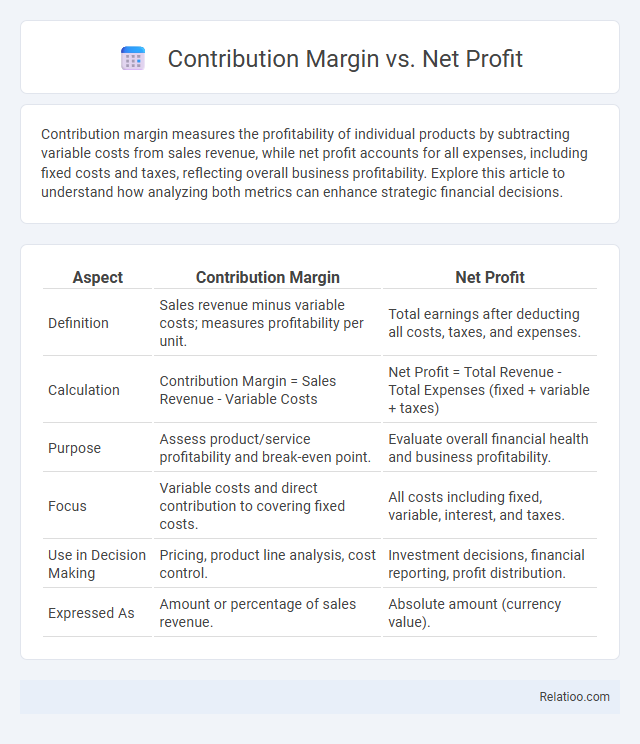

Contribution margin measures the profitability of individual products by subtracting variable costs from sales revenue, while net profit accounts for all expenses, including fixed costs and taxes, reflecting overall business profitability. Explore this article to understand how analyzing both metrics can enhance strategic financial decisions.

Table of Comparison

| Aspect | Contribution Margin | Net Profit |

|---|---|---|

| Definition | Sales revenue minus variable costs; measures profitability per unit. | Total earnings after deducting all costs, taxes, and expenses. |

| Calculation | Contribution Margin = Sales Revenue - Variable Costs | Net Profit = Total Revenue - Total Expenses (fixed + variable + taxes) |

| Purpose | Assess product/service profitability and break-even point. | Evaluate overall financial health and business profitability. |

| Focus | Variable costs and direct contribution to covering fixed costs. | All costs including fixed, variable, interest, and taxes. |

| Use in Decision Making | Pricing, product line analysis, cost control. | Investment decisions, financial reporting, profit distribution. |

| Expressed As | Amount or percentage of sales revenue. | Absolute amount (currency value). |

Understanding Contribution Margin

Contribution margin represents the difference between sales revenue and variable costs, indicating the amount available to cover fixed costs and generate profit. It is crucial for analyzing the profitability of individual products or services by highlighting how much each unit contributes to covering fixed expenses. Understanding contribution margin helps businesses make informed decisions on pricing, production levels, and product emphasis to maximize overall net profit.

What is Net Profit?

Net profit represents the total earnings remaining after all expenses, including operating costs, taxes, and interest, have been deducted from your total revenue, providing a clear picture of actual profitability. Unlike contribution margin, which measures how much revenue contributes to covering fixed costs, net profit reflects the ultimate financial gain from business operations. Understanding net profit helps you assess overall financial health and make informed decisions about your company's growth and sustainability.

Key Differences Between Contribution Margin and Net Profit

Contribution margin represents the amount remaining from sales revenue after variable costs are deducted, highlighting how much contributes to covering fixed costs and generating profit, whereas net profit is the final earnings after all expenses, including fixed costs, taxes, and interest, are subtracted. Your business can use contribution margin to analyze product profitability and make informed pricing decisions, while net profit provides a comprehensive view of overall financial performance. Understanding the difference helps prioritize operational efficiency versus overall profitability objectives.

Importance of Contribution Margin in Decision-Making

Contribution margin represents the revenue remaining after variable costs, essential for covering fixed costs and driving profit, making it a critical metric in your business decision-making. Unlike net profit, which accounts for all expenses including fixed costs and taxes, contribution margin helps identify the profitability of individual products or services. Understanding contribution margin enables you to optimize pricing, manage costs, and prioritize high-margin offerings to improve overall financial health.

How Net Profit Reflects Overall Business Health

Net profit, derived after subtracting all expenses including fixed and variable costs, taxes, and interest from total revenue, offers a comprehensive indicator of a company's overall financial health. Unlike contribution margin, which highlights how sales cover variable costs, net profit reflects the effectiveness of managing every aspect of business operations, including overhead and financing. Analyzing net profit trends provides key insights into long-term sustainability, efficiency, and profitability, essential for strategic decision-making.

Calculation Methods: Contribution Margin vs Net Profit

Contribution margin is calculated by subtracting variable costs from total sales revenue, highlighting the amount available to cover fixed costs and profit. Net profit is derived by deducting all expenses, including fixed costs, taxes, and interest, from total revenue, reflecting the overall profitability of Your business. Understanding these calculation methods helps You accurately analyze financial performance and make informed decisions.

Role of Fixed and Variable Costs

Contribution margin highlights the revenue remaining after deducting variable costs, serving as a crucial metric to cover fixed costs and generate profit. Net profit accounts for all expenses, including fixed and variable costs, taxes, and interest, providing a comprehensive view of the company's financial health. Contribution specifically targets how variable costs influence profitability by isolating costs that fluctuate with production levels, while fixed costs remain constant regardless of sales volume.

Impact on Pricing Strategies

Contribution margin directly influences your pricing strategies by highlighting the profitability of individual products, allowing you to focus on items with higher margins to maximize revenue. Net profit provides a comprehensive view of overall business performance, helping you understand how pricing decisions affect total profitability after all expenses. Assessing both contribution margin and net profit ensures you set prices that cover variable costs, contribute to fixed costs, and generate sustainable profits.

Common Mistakes in Analyzing Profit Metrics

Common mistakes in analyzing Contribution Margin, Net Profit, and Contribution often stem from confusing these distinct profit metrics and their purposes. Contribution Margin reflects the profitability of individual products by subtracting variable costs, while Net Profit accounts for all expenses, including fixed costs and taxes, providing the overall business profitability. Ensure Your financial analysis clearly distinguishes these metrics to avoid misinterpretation that can lead to flawed decision-making.

Choosing the Right Metric for Business Goals

Choosing the right metric for your business goals depends on understanding the distinctions between contribution margin, net profit, and contribution. Contribution margin evaluates the profitability of individual products by subtracting variable costs from sales revenue, making it ideal for pricing and product line decisions. Net profit accounts for all expenses, including fixed costs and taxes, providing a comprehensive view of overall business profitability essential for long-term financial planning.

Infographic: Contribution Margin vs Net Profit

relatioo.com

relatioo.com