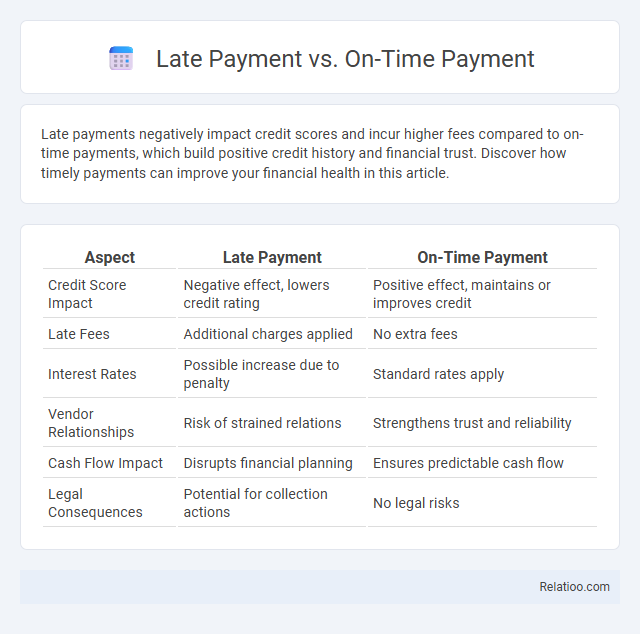

Late payments negatively impact credit scores and incur higher fees compared to on-time payments, which build positive credit history and financial trust. Discover how timely payments can improve your financial health in this article.

Table of Comparison

| Aspect | Late Payment | On-Time Payment |

|---|---|---|

| Credit Score Impact | Negative effect, lowers credit rating | Positive effect, maintains or improves credit |

| Late Fees | Additional charges applied | No extra fees |

| Interest Rates | Possible increase due to penalty | Standard rates apply |

| Vendor Relationships | Risk of strained relations | Strengthens trust and reliability |

| Cash Flow Impact | Disrupts financial planning | Ensures predictable cash flow |

| Legal Consequences | Potential for collection actions | No legal risks |

Understanding Late Payments and On-Time Payments

Late payments occur when a payment is made after the due date, often resulting in penalties, increased interest rates, and potential damage to credit scores. On-time payments are those completed by the due date, positively impacting credit history, maintaining good standing with creditors, and avoiding additional fees. Understanding the implications of late versus on-time payments is crucial for financial health, creditworthiness, and effective debt management.

Key Differences Between Late and On-Time Payments

Late payment occurs when a borrower fails to fulfill a financial obligation by the agreed-upon due date, potentially leading to penalties, increased interest, and a negative impact on credit scores. On-time payment, in contrast, means settling the payment within the specified timeframe, which helps maintain a positive credit history and avoids additional fees. The payment due date is the fixed deadline set by the lender that distinguishes timely payments from late ones, making it a critical factor in managing financial obligations effectively.

Financial Consequences of Late Payments

Late payments often incur high interest fees and penalties that increase the overall debt burden, harming credit scores and reducing future loan eligibility. On-time payments maintain a positive credit history, enabling better access to favorable interest rates and financial products. Payment due dates serve as critical deadlines, and missing them triggers negative financial consequences such as late fees, increased interest rates, and potential service disruptions.

Benefits of Paying On Time

Paying on time improves your credit score, reduces the risk of late fees, and maintains a positive payment history with lenders. Your timely payments demonstrate financial responsibility, increasing your chances for better loan terms and lower interest rates. Avoiding late payments also prevents penalties and potential damage to your credit reputation.

Impact on Credit Score and Financial Health

Late payment negatively affects your credit score by signaling risk to lenders, potentially leading to higher interest rates and reduced credit opportunities. On-time payment strengthens your credit history, improving your credit score and enhancing your financial health through better borrowing terms and increased trust from creditors. Payment due dates are critical to monitor, as missing them shifts a payment from on-time to late, directly impacting your credit score and overall financial stability.

Common Reasons for Late Payments

Common reasons for late payments include insufficient funds, miscommunication between payer and payee, and delays in invoice processing. Businesses and individuals may also face late payments due to billing errors, lack of automated reminders, or unexpected financial hardships. Understanding these causes helps improve cash flow management by implementing timely follow-ups and clear payment terms.

Strategies to Encourage On-Time Payments

Implement clear payment terms and send timely reminders to improve your business's cash flow. Offering incentives like early payment discounts or flexible payment plans encourages customers to pay on time. Use automated invoicing systems to reduce late payments and maintain detailed records for tracking outstanding balances efficiently.

Legal Implications of Late Payments

Late payment can trigger significant legal implications including interest penalties, collection fees, and potential damage to your credit score, whereas on-time payment helps maintain positive financial standing and contractual compliance. Payment due dates establish mandatory deadlines that, if ignored, may lead to legal actions such as lawsuits or liens by creditors seeking recovery of owed amounts. Understanding the distinctions between late payment, on-time payment, and payment due helps protect your financial rights and avoid costly legal consequences.

Tips for Managing Payment Deadlines

Effective management of payment deadlines involves recognizing the differences between late payment, on-time payment, and payment due dates. To avoid late fees and potential credit damage, you should set calendar reminders for each payment due date and prioritize payments based on urgency. Utilizing automated payment systems and budgeting tools helps ensure on-time payment, maintaining your financial health and credit score.

Building Better Payment Habits for Long-Term Success

Consistently making on-time payments strengthens credit scores and establishes a reliable financial reputation, while late payments can lead to penalties, increased interest rates, and diminished creditworthiness. Understanding the payment due date and setting reminders helps avoid missed payments and promotes disciplined budgeting. Building better payment habits through timely settlements supports long-term financial success, access to better loan terms, and overall economic stability.

Infographic: Late Payment vs On-Time Payment

relatioo.com

relatioo.com