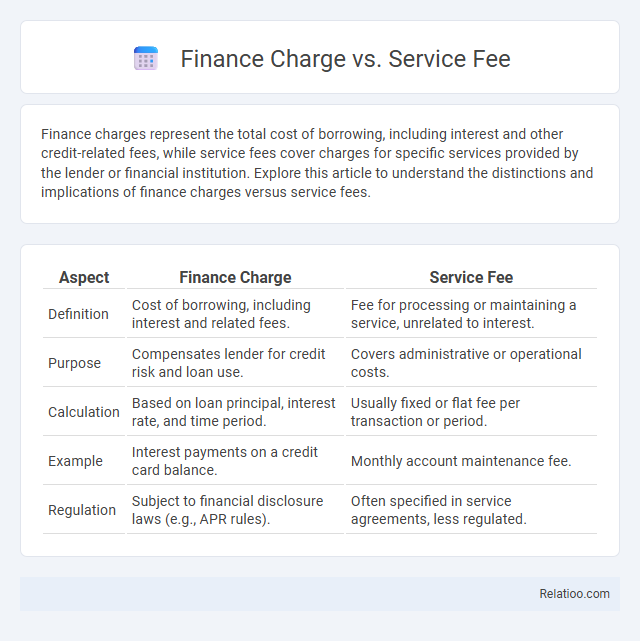

Finance charges represent the total cost of borrowing, including interest and other credit-related fees, while service fees cover charges for specific services provided by the lender or financial institution. Explore this article to understand the distinctions and implications of finance charges versus service fees.

Table of Comparison

| Aspect | Finance Charge | Service Fee |

|---|---|---|

| Definition | Cost of borrowing, including interest and related fees. | Fee for processing or maintaining a service, unrelated to interest. |

| Purpose | Compensates lender for credit risk and loan use. | Covers administrative or operational costs. |

| Calculation | Based on loan principal, interest rate, and time period. | Usually fixed or flat fee per transaction or period. |

| Example | Interest payments on a credit card balance. | Monthly account maintenance fee. |

| Regulation | Subject to financial disclosure laws (e.g., APR rules). | Often specified in service agreements, less regulated. |

Understanding Finance Charges and Service Fees

Finance charges represent the total cost of borrowing, including interest and any related fees, while service fees are specific charges for processing or maintaining an account unrelated to the interest cost. Understanding finance charges helps you evaluate the true expense of a loan or credit, as it encompasses all costs you incur over time. Differentiating these fees ensures you make informed decisions about borrowing and managing your finances effectively.

Defining Finance Charge: What It Means

Finance charge refers to the total cost of borrowing, including interest, fees, and other charges imposed by lenders. It encompasses interest on loans, credit cards, and other forms of credit, representing the amount paid over the principal. Distinct from a service fee, which covers specific administrative or processing costs, the finance charge reflects the comprehensive expense of credit use.

What Is a Service Fee? Explained

A service fee is a charge imposed for specific services rendered, often covering administrative costs or operational expenses not included in the base price. It differs from a finance charge, which primarily represents the cost of borrowing money and includes interest and fees related to credit. Understanding the distinction helps you manage your expenses more effectively and avoid unexpected charges on bills or loans.

Key Differences Between Finance Charge and Service Fee

Finance charges represent the total cost of borrowing, including interest, loan origination fees, and any other charges expressed as an annual percentage rate (APR), while service fees are specific, often fixed, fees for administrative or maintenance services unrelated to interest. Finance charges directly affect the overall cost of credit and are disclosed under the Truth in Lending Act (TILA), whereas service fees typically cover account handling or transaction processing without impacting the loan's interest rate. Understanding the distinction is crucial for accurate cost comparison, as finance charges reflect the true expense of borrowing, whereas service fees are additional charges not tied to credit usage.

Common Examples in Real-World Transactions

Finance charges often include interest accrued on credit card balances or loans, such as the monthly interest rate applied to unpaid credit card debt. Service fees commonly appear in banking transactions like ATM usage fees, wire transfer fees, or account maintenance charges. Finance charges typically represent the cost of borrowing money, whereas service fees compensate for specific services provided by financial institutions in real-world transactions.

How Finance Charges Impact Consumers

Finance charges directly affect your overall borrowing cost by including interest and related fees, increasing the total amount you repay over time. Service fees are fixed charges for specific services and typically do not vary with your loan balance, impacting your finances differently than finance charges. Understanding the difference helps you manage expenses and avoid unexpected increases in loan repayments.

Service Fees in Everyday Financial Products

Service fees in everyday financial products typically cover administrative costs, such as account maintenance, transaction processing, or customer support, and are often fixed or flat rates. Finance charges represent the total cost of borrowing, including interest and any additional fees applied over time, primarily impacting loans and credit card balances. Understanding service fees helps consumers manage recurring expenses on bank accounts, credit cards, and payment services, whereas finance charges affect the overall borrowings and repayment amounts.

Legal and Regulatory Considerations

Finance charges are legally defined costs of borrowing under the Truth in Lending Act (TILA), requiring clear disclosure of interest rates and associated fees to protect consumers from hidden charges. Service fees, which cover administrative expenses, are subject to state-specific regulations and may not always fall under TILA's disclosure requirements, creating variability in consumer protection. Failure to comply with these legal standards can result in enforcement actions by regulatory bodies such as the Consumer Financial Protection Bureau (CFPB) and state attorneys general.

Tips to Minimize Finance Charges and Service Fees

Finance charges and service fees can significantly increase the cost of borrowing and using financial services, so it's crucial to monitor account statements regularly to identify and dispute any unnecessary fees. Opt for credit cards with no annual fees, pay off balances in full each month to avoid interest charges, and choose financial institutions that offer transparent fee structures. Setting up automatic payments and negotiating lower fees with service providers can further reduce finance charges and service fees, ultimately saving money.

Choosing Financial Products: What to Watch For

Understanding the differences between finance charges and service fees is crucial when choosing financial products to avoid unexpected costs. Finance charges typically include interest and other costs associated with borrowing, such as loan origination fees, while service fees often cover administrative expenses like account maintenance or transaction processing. Carefully reviewing the total cost components on loan offers, credit cards, or investment accounts can help consumers make informed decisions and select the most cost-effective financial products.

Infographic: Finance Charge vs Service Fee

relatioo.com

relatioo.com