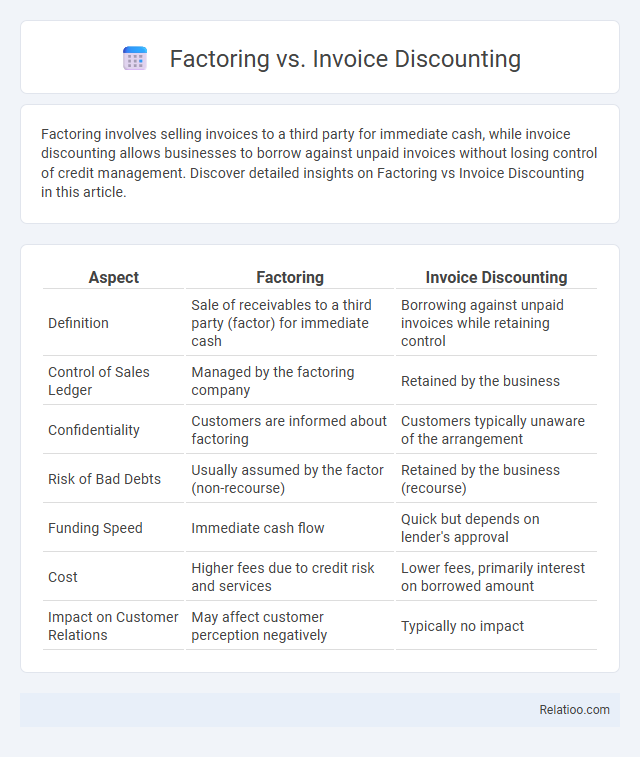

Factoring involves selling invoices to a third party for immediate cash, while invoice discounting allows businesses to borrow against unpaid invoices without losing control of credit management. Discover detailed insights on Factoring vs Invoice Discounting in this article.

Table of Comparison

| Aspect | Factoring | Invoice Discounting |

|---|---|---|

| Definition | Sale of receivables to a third party (factor) for immediate cash | Borrowing against unpaid invoices while retaining control |

| Control of Sales Ledger | Managed by the factoring company | Retained by the business |

| Confidentiality | Customers are informed about factoring | Customers typically unaware of the arrangement |

| Risk of Bad Debts | Usually assumed by the factor (non-recourse) | Retained by the business (recourse) |

| Funding Speed | Immediate cash flow | Quick but depends on lender's approval |

| Cost | Higher fees due to credit risk and services | Lower fees, primarily interest on borrowed amount |

| Impact on Customer Relations | May affect customer perception negatively | Typically no impact |

Introduction to Factoring and Invoice Discounting

Factoring and invoice discounting are financial solutions used by businesses to improve cash flow by unlocking the value of outstanding invoices. Factoring involves selling invoices to a third party, known as a factor, who then manages credit control and debt collection, while invoice discounting allows businesses to borrow against unpaid invoices without transferring control of the sales ledger. Both methods provide immediate working capital but differ in terms of control, confidentiality, and the involvement of external parties in the collection process.

What is Factoring?

Factoring is a financial transaction where a business sells its accounts receivable to a third party, called a factor, at a discount in exchange for immediate cash flow. This service includes credit control and debt collection, reducing the risk and administrative burden for the business. Factoring improves working capital management and supports business growth by converting outstanding invoices into liquid assets.

What is Invoice Discounting?

Invoice discounting is a financing solution that allows businesses to borrow money against their unpaid invoices without transferring ownership of the sales ledger. Unlike factoring, your company retains control over the collection process, ensuring customer relationships remain direct and confidential. This method improves cash flow by converting outstanding invoices into immediate working capital while maintaining operational independence.

Key Differences Between Factoring and Invoice Discounting

Factoring involves selling accounts receivable to a third party (factor) who manages collections and assumes credit risk, whereas invoice discounting allows businesses to borrow against unpaid invoices while retaining control over collections and customer relationships. In factoring, the factor typically handles debtor communication and credit control, providing immediate cash flow but reducing direct customer interaction. Invoice discounting maintains confidentiality and customer contact, with businesses responsible for collecting payments while accessing short-term financing based on invoice values.

Benefits of Factoring

Factoring improves cash flow by providing immediate funds against outstanding invoices, reducing the risk of bad debt through credit management services, and outsourcing credit control to save time and administrative costs. Unlike invoice discounting, factoring offers a more comprehensive solution by including debtor management and credit protection, enhancing financial stability. Its benefits include faster access to working capital, improved business liquidity, and strengthened credit risk mitigation.

Benefits of Invoice Discounting

Invoice discounting offers your business quick access to working capital by unlocking funds tied up in unpaid invoices without transferring control over your sales ledger. Unlike factoring, this method maintains confidentiality with customers unaware of the arrangement, preserving your company's professional relationships. Collection processes are managed internally, allowing you to maintain full control while enjoying improved cash flow and financial flexibility.

Potential Risks and Drawbacks

Factoring exposes your business to risks such as loss of control over customer relationships and potential higher costs due to fees and interest rates. Invoice discounting may lead to cash flow uncertainties if debtors delay payments, and it requires maintaining strict credit control internally. Collection processes can strain client relationships and incur additional administrative expenses, potentially damaging your brand reputation.

How to Choose the Right Financing Solution

Choosing the right financing solution between factoring, invoice discounting, and collection depends on your business's cash flow needs, control over customer relationships, and confidentiality preferences. Factoring offers immediate cash flow by selling invoices to a financier who manages collections, ideal for businesses seeking outsourced receivables management. Invoice discounting provides confidential funding with retained control over collections, while collection services focus solely on recovering overdue debts without upfront financing.

Industries Best Suited for Each Option

Factoring benefits industries with high-volume, small-value receivables such as retail, manufacturing, and transportation by providing immediate cash flow through the sale of invoices. Invoice discounting suits businesses like wholesale, import-export, and large-scale distribution that prefer confidentiality and maintain control over collections while leveraging outstanding invoices for working capital. Collection services are ideal for sectors with sporadic late payments and complex customer accounts such as professional services, healthcare, and utilities, focusing on recovering overdue debts without impacting customer relationships.

Conclusion: Making the Right Decision

Choosing between factoring, invoice discounting, and collection depends on a company's cash flow needs, control preferences, and cost considerations. Factoring offers immediate cash flow with external credit control, invoice discounting provides confidential financing while retaining customer relationships, and collection services focus on recovering overdue payments without funding. Evaluating business priorities and financial structure ensures selecting the most effective working capital solution.

Infographic: Factoring vs Invoice Discounting

relatioo.com

relatioo.com