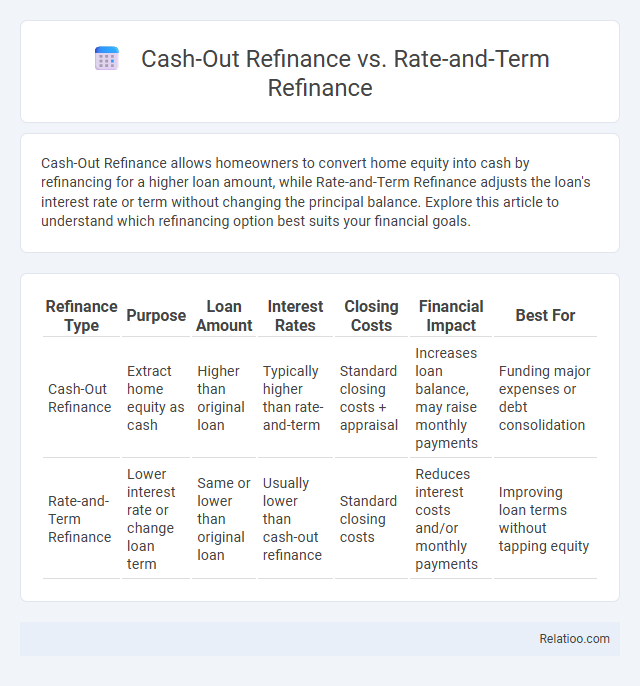

Cash-Out Refinance allows homeowners to convert home equity into cash by refinancing for a higher loan amount, while Rate-and-Term Refinance adjusts the loan's interest rate or term without changing the principal balance. Explore this article to understand which refinancing option best suits your financial goals.

Table of Comparison

| Refinance Type | Purpose | Loan Amount | Interest Rates | Closing Costs | Financial Impact | Best For |

|---|---|---|---|---|---|---|

| Cash-Out Refinance | Extract home equity as cash | Higher than original loan | Typically higher than rate-and-term | Standard closing costs + appraisal | Increases loan balance, may raise monthly payments | Funding major expenses or debt consolidation |

| Rate-and-Term Refinance | Lower interest rate or change loan term | Same or lower than original loan | Usually lower than cash-out refinance | Standard closing costs | Reduces interest costs and/or monthly payments | Improving loan terms without tapping equity |

Understanding Cash-Out Refinance

Cash-Out Refinance allows You to replace your existing mortgage with a new loan for more than you owe, providing extra funds which can be used for home improvements, debt consolidation, or other expenses. Unlike Rate-and-Term Refinance, which adjusts only the interest rate or loan term without increasing loan balance, Cash-Out Refinance increases your mortgage principal and may affect your equity position. Understanding these options helps in making strategic decisions to optimize your financial goals when refinancing your home.

What is Rate-and-Term Refinance?

Rate-and-term refinance involves replacing your existing mortgage with a new loan to change the interest rate, loan term, or both, without taking out extra cash. Unlike cash-out refinance, it doesn't increase your loan balance beyond what you owe, helping you save money on interest or shorten your repayment period. Understanding rate-and-term refinance enables you to optimize your mortgage payments and financial strategy effectively.

Key Differences Between Cash-Out and Rate-and-Term Refinance

Cash-out refinance allows homeowners to replace their existing mortgage with a new loan for more than the current balance, providing access to the difference in cash, while rate-and-term refinance focuses solely on changing the interest rate or loan term without increasing the principal balance. Key differences include that cash-out refinance increases debt and may have higher interest rates due to the added risk, whereas rate-and-term refinance aims to lower monthly payments or shorten loan terms without cash withdrawal. Understanding these differences is crucial for homeowners to choose whether to tap home equity or optimize loan conditions without additional borrowing.

Benefits of Cash-Out Refinance

Cash-out refinance allows you to tap into your home's equity to access lump-sum cash for renovations, debt consolidation, or other financial needs, often with lower interest rates compared to personal loans. Unlike rate-and-term refinancing, which primarily adjusts your mortgage rate or loan term without increasing loan balance, cash-out refinance provides immediate liquidity while potentially enhancing your financial flexibility. This option can help optimize your loan structure while leveraging your property's value to support your financial goals.

Advantages of Rate-and-Term Refinance

Rate-and-term refinance offers the advantage of lowering your interest rate or adjusting the loan term without increasing your loan balance, which can reduce monthly payments and overall interest costs. Unlike cash-out refinance, it helps build equity faster by preventing additional debt accumulation. Choosing a rate-and-term refinance allows you to customize your mortgage to better fit your financial goals while potentially saving thousands in interest over the life of the loan.

Potential Risks of Cash-Out Refinance

Cash-out refinance allows you to tap into your home's equity by borrowing more than your current mortgage balance, but it carries potential risks such as higher monthly payments and increased debt that can strain your finances. Unlike rate-and-term refinance, which simply adjusts the interest rate and loan duration without increasing debt, cash-out refinance can reduce your home equity and increase vulnerability to market fluctuations. Understanding these risks is crucial to ensure your refinancing strategy aligns with your long-term financial goals.

When to Choose Rate-and-Term Refinance

Choose rate-and-term refinance when the primary goal is to lower the interest rate or adjust the loan term without increasing the loan balance, offering savings on monthly payments or faster loan payoff. This type of refinancing is ideal for homeowners seeking better loan terms due to improved credit scores or market rate drops, while avoiding the higher costs associated with cash-out refinance options. Rate-and-term refinance is most beneficial when home equity is stable, and no additional funds are required for other expenses or investments.

Eligibility Requirements for Both Refinance Options

Cash-Out Refinance typically requires borrowers to have a minimum credit score of 620, sufficient home equity (usually at least 20%), and a debt-to-income ratio below 45%. Rate-and-Term Refinance demands similar credit qualifications but often has stricter limits on loan-to-value (LTV) ratios, generally capped at 80%-85% LTV. Both refinance options mandate proof of stable income, current employment, and a property appraisal to determine eligibility and loan terms.

Impact on Monthly Payments and Loan Terms

Cash-out refinance increases loan balance by tapping home equity, typically raising monthly payments but providing cash for expenses or investments. Rate-and-term refinance lowers interest rates or adjusts loan duration without increasing the principal, often reducing monthly payments and potentially shortening or extending loan terms. Both methods affect monthly costs and loan structure differently, with cash-out impacting debt size and rate-and-term focusing on optimizing interest and repayment periods.

How to Decide Which Refinance Option is Right for You

Understanding the differences between cash-out refinance, rate-and-term refinance, and general refinancing is crucial for making the best financial decision. Cash-out refinance allows you to tap into your home's equity for cash, while rate-and-term refinance adjusts your mortgage interest rate or loan term to reduce monthly payments or overall interest. You should evaluate your current financial goals, credit score, home equity, and market interest rates to determine which refinance option aligns with your long-term objectives and maximizes your savings.

Infographic: Cash-Out Refinance vs Rate-and-Term Refinance

relatioo.com

relatioo.com